Illustrative image

Chinese cars are creating an unbelievably strong wave and outcompeting Japanese automakers, who are struggling to keep up in China.

As the world’s largest auto market, China is seeing a surge in domestic brands, especially with the rise of electric vehicles. According to Nikkei, Chinese companies are also expanding into Southeast Asia, challenging the long-standing dominance of brands like Toyota, Honda, and Mitsubishi.

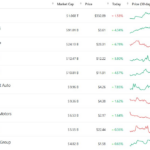

Analyzing sales and registration data, Japanese automakers experienced the biggest market share decline from 2019 to 2024 in China, Singapore, Thailand, Malaysia, and Indonesia.

The Japanese are losing ground across Asia, with all six of the biggest carmakers on the watchlist declining in China. Even Toyota, the world leader in car sales, is seeing stagnant sales. In Southeast Asia, the traditional stronghold of Japanese brands, their market share has significantly dropped.

In Thailand and Singapore, Japanese automakers now control only 35% of the market share, down from over 50% in 2019. Meanwhile, streets once dominated by Nissan and Mazda are now filled with Chinese brands. Toyota’s slow transition to fully electric vehicles risks falling behind in a market driven by advanced battery technology and smart software.

Despite facing high tariffs in Europe and the US, the decline of Japanese dominance in Asia could signal bigger challenges ahead.

Toyota’s stronghold in Southeast Asia remains intact with the production of gasoline-powered cars with larger engines in the region. In 2023, Thailand and Indonesia accounted for nearly 10% of Toyota’s global output of 11 million vehicles. However, other Japanese brands like Nissan are struggling.

Nissan’s outdated product line and lack of hybrid offerings have contributed to declining profits and production cuts, causing their presence in Jakarta to fade. In contrast, Chinese automaker BYD has quickly gained traction in Indonesia, becoming the sixth best-selling brand just months after delivering its first cars, with the BYD Seal, priced at $40,000, gaining popularity.

Japan’s global auto market share has dropped from over 20% two decades ago to 11%, while China has surged to dominate, now accounting for nearly 40% of worldwide car production.

Chinese automakers are leveraging their expertise in affordable batteries and flexible supply chains to expand into Southeast Asia, the Middle East, and Africa, further challenging Japanese dominance in these markets.

According to Reuters

The Korean Car Conundrum: Why Japanese Rivals Are Winning the Race

The Korean auto giants have lost their stronghold in the Vietnamese market due to a variety of factors, including a perceived lack of durability when compared to other automotive brands, and a significant depreciation in resale value.

VinFast Unveils Smaller, More Affordable Model than VF3: Stock Surges as $10 Billion Valuation Nears Top 5 Global EV Makers

This product is designed for service-based businesses, such as taxi companies and ride-sharing platforms. With its cutting-edge features and intuitive design, it revolutionizes the way these businesses operate, helping them streamline their services and elevate the customer experience to new heights.

![[On Seat 47] ‘EC40 Wants to Win, Volvo Vietnam Needs to Educate Customers: Using Electric Cars Without Public Charging Stations is Normal’](https://xe.today/wp-content/uploads/2024/12/v-quote-te-150x150.jpg)