Oil Prices Edge Higher

Oil prices edged higher on Thursday, with Brent crude futures settling up 34 cents, or 0.5%, at $73.17 a barrel. U.S. WTI crude also rose by 16 cents, or 0.2%, to $68.88. Trading activity was thin due to the U.S. Thanksgiving holiday.

OPEC+, which includes members of the Organization of the Petroleum Exporting Countries and allies such as Russia, postponed their next policy meeting from Dec. 1 to Dec. 5 to avoid clashing with an event.

Another factor supporting oil prices is the discussion within OPEC+ about potentially delaying the planned increase in oil output for January 2025. The group, which produces about half of the world’s oil, has maintained production cuts to support prices. While OPEC+ aims to gradually unwind these cuts, weak global demand has forced the group to postpone increasing output.

Oil prices also received a slight boost from U.S. gasoline inventories, which rose by 3.3 million barrels in the week ending Nov. 22, according to a report from the U.S. Energy Information Administration on Wednesday. This was contrary to expectations of a slight decline in fuel stocks during the Thanksgiving holiday travel season. The slowdown in fuel demand growth from both China and the U.S. has impacted oil prices this year.

Gold Prices Rise on Safe-Haven Demand and Thanksgiving Holiday

Gold prices climbed as political uncertainty and trade war concerns drove safe-haven demand, while trading volume was expected to be low due to the U.S. markets being closed for the Thanksgiving holiday.

Spot gold rose 0.2% to $2,641.79 per ounce at 1507 GMT, while U.S. gold futures held steady at $2,642.00.

President-elect Donald Trump’s commitment to impose tariffs on Canada and Mexico is also impacting the markets. This has raised concerns about potential repercussions from these countries, providing further support for gold prices.

Data released on Wednesday showed that the decline in U.S. inflation may have stalled in recent months, which could make the Fed more cautious about further interest rate cuts. Markets are currently predicting a 70% chance of a 0.25 percentage point cut in December 2024.

Silver spot prices rose 0.5% to $30.22 per ounce, platinum gained 0.9% to $935.25, and palladium climbed 0.6% to $978.12.

Copper Prices Slip on Stronger Dollar and Global Growth Concerns

Copper prices slipped as a stronger U.S. dollar, concerns about global growth, and demand from top consumer China weighed on the market.

Three-month copper on the London Metal Exchange (LME) closed down 0.2% at $9,002.50 a ton. The U.S. dollar index edged higher, making dollar-denominated metals more expensive for buyers using other currencies, amid thin trading due to the U.S. Thanksgiving holiday.

Investors are awaiting developments following President-elect Donald Trump’s commitment to impose a 25% tariff on all imports from Mexico and Canada and an additional 10% tariff on Chinese goods when he takes office in January 2025.

Iron Ore Prices Fluctuate Slightly

Iron ore prices fluctuated within a narrow range as traders weighed the strong performance of the Chinese steel market against weak economic data from the world’s top metal consumer.

The most-traded January 2025 iron ore contract on the Dalian Commodity Exchange (DCE) ended the daytime trading session unchanged at 786.5 yuan ($108.54) per ton, halting a three-day winning streak.

On the Singapore Exchange, December 2024 iron ore fell 0.34% to $103.45 a ton as of 07:08 GMT.

Meanwhile, on the Shanghai Futures Exchange, steel rebar, hot-rolled coil, and stainless steel all posted gains, rising 0.4%, 0.26%, and nearly 0.7%, respectively.

“The steel industry has shown signs of improvement in recent months,” ANZ analysts said in a note. “Strong exports and falling inventories, along with continued growth in steel production in November, have supported the market.”

Cumulative losses in China’s steel industry narrowed to 23 billion yuan in the first ten months of the year, down from 34 billion yuan in the first nine months, according to data from the National Bureau of Statistics.

However, China’s industrial profits continued to decline in October, falling 10% year-on-year, impacted by deflationary pressures and weak demand in the slowing economy.

The industry also faces new challenges from higher U.S. tariffs, which could threaten exports and reduce profits in the coming year.

Robusta Coffee Climbs to Two-Month High

Robusta coffee prices edged higher, closing slightly up after reaching their highest level in over two months. The January 2025 Robusta contract rose 0.6%, settling at $5,565 a ton, after hitting an intraday high of $5,613, the highest in more than two months.

Traders attributed the strength in the Robusta market to the rally in Arabica coffee, which surged to its highest level in nearly half a century on Wednesday.

The slow start to the harvest in Vietnam, the top Robusta producer, provided support to prices. A trader in the Vietnamese coffee belt said, “The volume of new beans purchased from farmers so far is much lower than before.”

Two Brazilian coffee traders, Atlantica and Cafebras, will negotiate with creditors in court due to debt issues related to a poor crop and currency fluctuations.

White Sugar Prices Decline

White sugar futures for March 2025 delivery fell 0.7% to close at $556.10 a ton.

Traders attributed the weak Brazilian cane crop to supporting sugar prices, with the number of mills closing exceeding the norm.

Brazil’s government agricultural agency Conab estimated the country’s sugar production for the 2024/25 season at 44 million tons, down from its previous forecast of 46 million tons.

Japanese Rubber Futures Slip

Japanese rubber futures fell slightly due to a stronger yen and weak export data from Toyota Motor, Japan’s largest listed company, which weighed on investor sentiment.

The May 2025 rubber contract on the Osaka Stock Exchange (OSE) fell by 0.8 yen, or 0.22%, closing at 367.1 yen ($2.42) per kg.

Meanwhile, rubber futures on the Shanghai Futures Exchange (SHFE) for January 2025 delivery rose by 405 yuan, or 2.29%, to 18,125 yuan ($2,500.28) per ton. Butadiene rubber futures for January 2025 on the SHFE also climbed by 90 yuan, or 0.7%, to 12,910 yuan ($1,780.89) per ton.

Toyota’s global production fell in October, marking the ninth consecutive month of decline, due to significant drops in output in the U.S. and China. As automobile production is closely linked to rubber usage in tires, vehicle sales data can impact the demand for rubber.

Rubber futures for December 2024 on the Singapore Exchange (SICOM) traded at $192 per kg, up 1.2%.

EU Wheat Prices Steady During U.S. Holiday

Euronext wheat futures were almost unchanged as the market lacked direction due to the U.S. holiday, while traders assessed news of an unfamiliar Egyptian agency seeking to buy wheat for the major importer.

The March 2025 contract, the most active on Paris-based Euronext, was unchanged at €222.50 ($234.76) a ton by 16:06 GMT, after falling to a near two-week low of €221.50.

Euronext prices have come under pressure this week due to the euro’s rebound, the rouble’s decline, and results from international tenders showing competition from Black Sea supplies.

Cheap Black Sea wheat continues to weigh on the European market, traders said. Russian 12.5% protein wheat for December delivery was offered around $225-$227 a ton FOB, while Ukrainian and Russian 11.5% protein wheat was offered at $218-$219 a ton. Romanian 11.5% protein wheat for December 2024 delivery was higher, offered around $225-$230 a ton FOB.

Traders are monitoring the potential for slower Black Sea exports as harvest supplies dwindle and Russia may look to curb shipments.

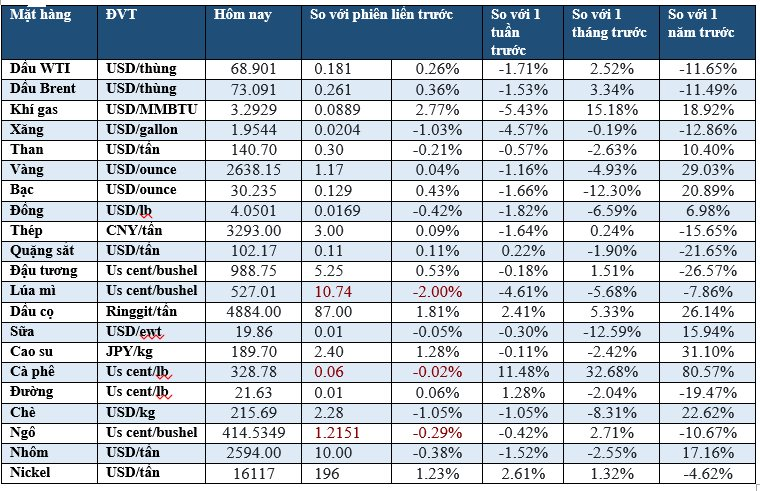

Key Commodity Prices as of Friday, November 29, 2024

The Market on Nov 30th: Oil Slides, Gold Gains, Iron Ore Hits 1-Month High

“Oil prices fell on Nov 29, 2022, as concerns over supply risks eased. Gold rallied on a weaker dollar and geopolitical tensions. Copper prices edged higher but were still on course for a second straight monthly loss. The price of iron ore on the Dalian exchange rose on a resilient Chinese economic outlook, posting a weekly gain. Robusta coffee prices fell back after reaching their highest level in over two months. Export prices for rice rose in India and Thailand. Japanese rubber prices declined amid demand concerns.”

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

On the morning of November 29, domestic gold prices surged by approximately 200,000 to 500,000 VND per tael compared to the previous day’s rates, marking a significant upward shift in the market.