Yang Trung Wind Power Buys Back Bonds, Raising Concerns About Related Projects

Source: HNX

|

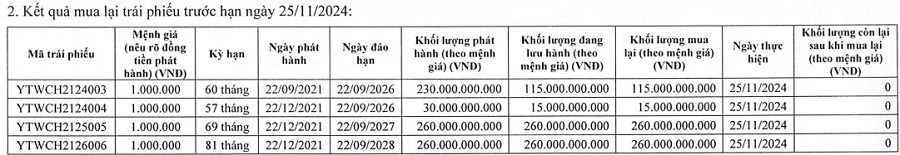

Yang Trung Wind Power has repurchased four bond issues with codes YTWCH2124003, YTWCH2124004, YTWCH2125005, and YTWCH2126006, raising concerns about the company and its related projects. The two largest issues, 2125005 and 2126006, were each worth VND 260 billion, totaling VND 520 billion. The other two issues, 2124003 and 2124004, had outstanding bonds of 115,000 and 15,000, respectively, worth VND 115 billion and VND 15 billion. With a face value of VND 1 million per bond, the issues raised a total of VND 780 billion when launched in 2021, maturing between September 2026 and September 2028.

The funds raised were intended for investment in the Yang Trung Wind Power Plant project, with a capacity of 145 MW. However, the company and its legal representative, Mr. Nguyen Nam Chung, have come under scrutiny for violations related to another wind power project in the same district. Mr. Chung was previously disciplined by the Hoa Binh People’s Committee in 2020 for misuse of land but was still granted an investment license by the Gia Lai provincial authorities in August 2020, indicating a lack of due diligence.

Moreover, Mr. Chung’s involvement in the Chơ Long Wind Power Project in Kông Chro district has also raised concerns. The project ran into legal trouble as the company commenced construction on forest-planned land without first converting the land use purpose, violating the 2013 Land Law.

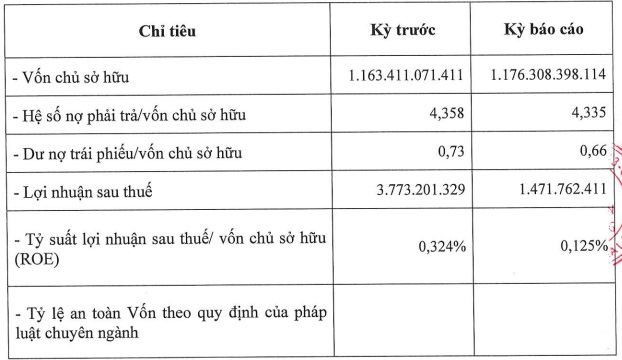

As for Yang Trung Wind Power’s financial performance, the company reported a modest profit of nearly VND 1.5 billion in the first half of 2024, a 61% decrease year-on-year. Its equity slightly increased to nearly VND 1,180 billion, while its debt-to-equity ratio stood at 4.34, translating to total liabilities of nearly VND 5,100 billion. The company’s ROE also declined from 0.3% to 0.1% during this period.

|

Yang Trung Wind Power’s business indicators for the first half of 2024

Source: HNX

|

[Châu An]

The Soaring Success of Bidiphar Stock (DBD): Trading Prices Soar Over 30% Higher Than the Start of the Year

DBD stock of Binh Dinh Pharmaceutical – Medical Equipment Joint Stock Company hit its second consecutive ceiling, setting a new all-time high since its listing. Moreover, the share price of this pharmaceutical stock has surged over 30% since the beginning of the year, marking a significant milestone for the company.