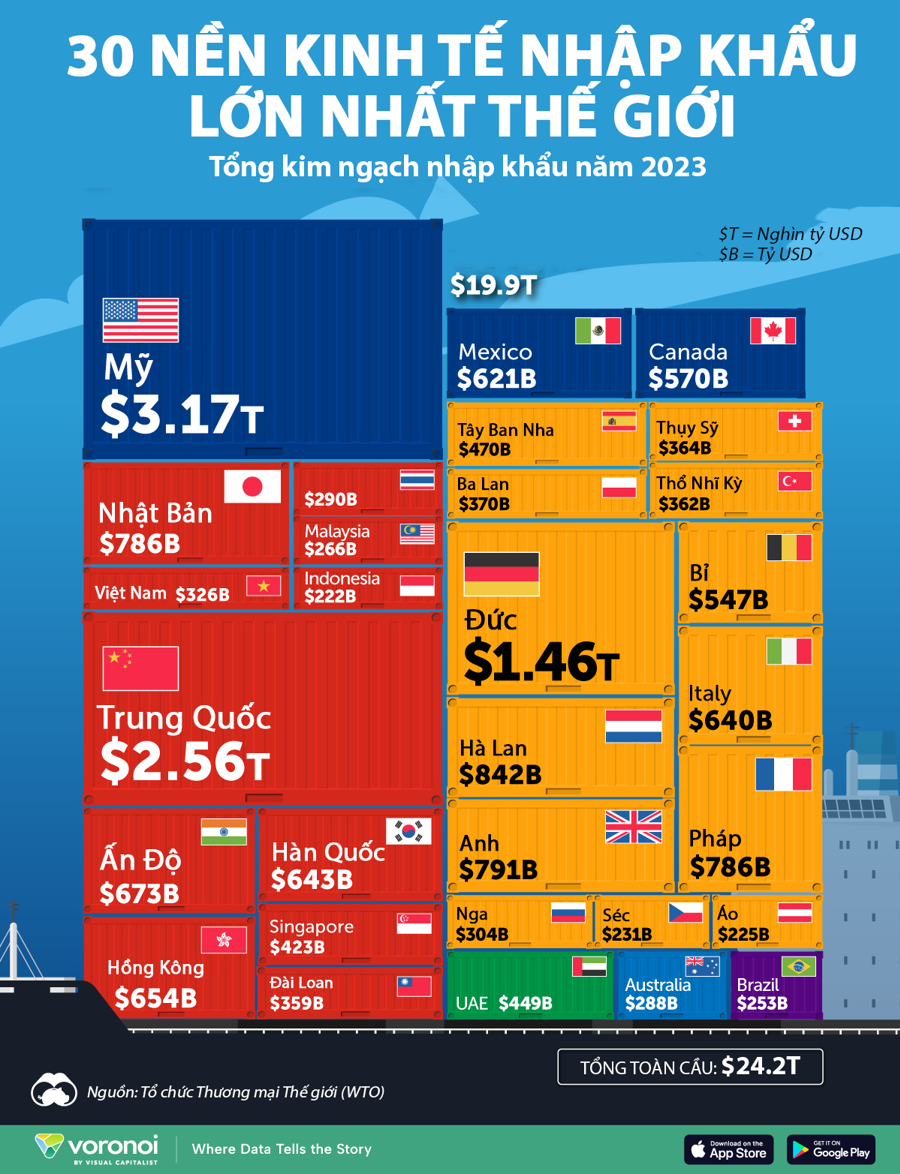

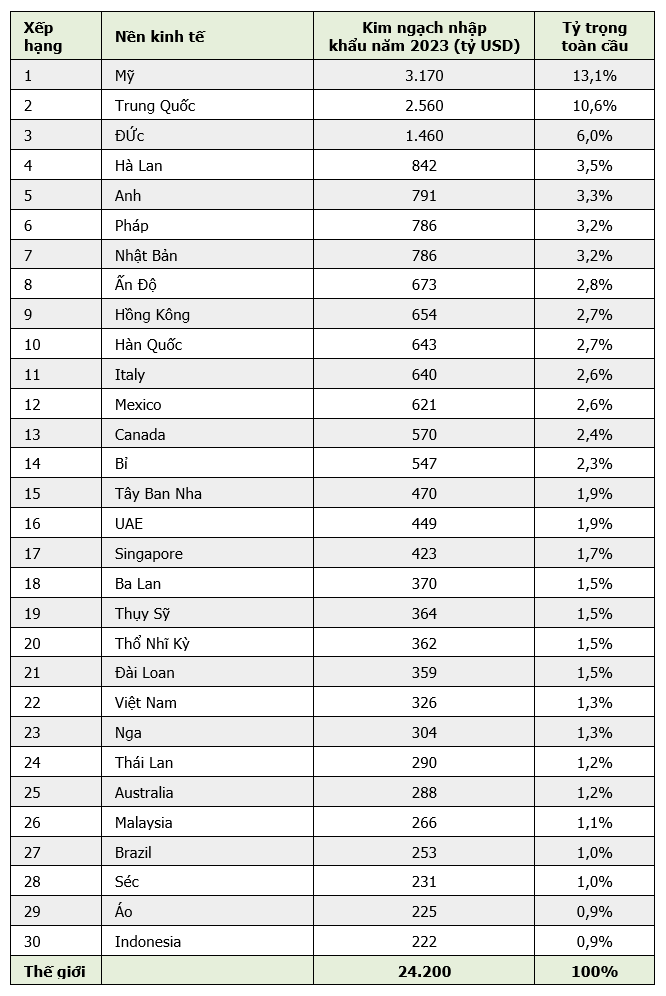

Global trade value has nearly quintupled since 1995. Today, the top 10 importing economies account for over 50% of global import value, amounting to a staggering $12.4 trillion.

From the United States to India, these are robustly growing economies with massive consumer markets. Factors such as business investment, disposable income, and exchange rates also play a significant role in shaping the import dynamics within these economies.

The infographic below depicts the top 30 importing economies based on data from the World Trade Organization (WTO) in 2023.

The United States tops this list with an import volume of $3.2 trillion last year. With its vast consumer market and developed economy, the US is the largest importer of goods such as automobiles, electronics, industrial machinery, and pharmaceuticals.

Mexico, the US’s top trading partner, supplies most of these goods. Meanwhile, Canada is a significant source of crude oil, natural gas, and other resources. Recently, President-elect Donald Trump announced plans to impose a 25% tariff on imports from Mexico and Canada from day one of his administration. If enacted, this policy could significantly increase costs for businesses and consumers in all three countries.

Following the US, China is the world’s second-largest importer. It is also the largest importer of crude oil, sourced primarily from Saudi Arabia, Russia, and Iraq. However, unlike the US, China maintains a substantial trade surplus, with exports exceeding imports by over $1.3 trillion in 2023.

Amid weak consumer demand and global supply chain disruptions, 27 out of the top 30 economies experienced a decline in import volume in 2023. Taiwan and Brazil saw the sharpest drops, with import volumes falling by 18% and 14%, respectively.

Saudi Aramco Seeks Investment Opportunities in Vietnam’s Petrochemical, Oil Refinery, and Distribution Sectors

Saudi Aramco’s President and CEO, Amin Al-Nasser, emphasized the company’s keen interest in the Asian market, including Vietnam.

The Energy and Commodity Markets Surge: US Crude Oil Climbs Over $2 a Barrel, Robusta Coffee at a Near 16-Year High

As of the market close on September 11th, crude oil prices surged by over $2 a barrel, with natural gas, nickel, copper, steel, and sugar also seeing notable gains. Robusta coffee prices hit a near 16-year high, while gold and rubber prices retreated.