According to experts from VinaCapital, while a second Trump presidency may not bring as many benefits to Vietnam as the first, the risk of Trump’s tariff policies disrupting the country’s economic growth is very low.

Trump has chosen Scott Bessent, regarded as an ideal Treasury Secretary for Vietnam. Bessent has repeatedly stated that Trump’s tariff proposals are extreme and likely to be mitigated during negotiations. Trump’s recent announcement of his intention to impose a 25% tariff on Canada and Mexico should be interpreted in this light.

More importantly for Vietnam, Bessent supports considering America’s geopolitical goals when determining tariffs for individual countries. Details of how this strategy might work, as well as other aspects of Trump’s tariff strategy, are outlined in a report titled “Guide to Global Trade System Reform.”

This 40-page report, authored by a senior economic policy advisor during Trump’s first term, was widely circulated after Trump’s election victory. The author is believed to have a close relationship with Bessent.

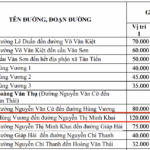

Source: VinaCapital

|

According to Michael Kokalari, the report mentions considering geopolitical factors in determining tariffs for individual countries over 20 times. This indicates that the bipartisan belief in the US about Vietnam’s useful role in helping America achieve its geopolitical goals will ensure that Vietnam is not heavily targeted by Trump’s tariff measures.

Prior to President Joe Biden taking office, there were concerns that Vietnam would not be as “lucky” as before, especially compared to the US-China trade war initiated by Trump. However, the Atlantic Council’s “The Longer Telegram” report in January 2021 allayed these fears and affirmed that US-Vietnam relations would continue to strengthen under Biden’s administration. This has indeed been the case.

On the other hand, the “Guide to Global Trade System Reform” report from 2024 suggests that Vietnam-US relations under the upcoming Trump administration will be “from neutral to positive,” according to VinaCapital.

The report also details how tariffs can be used to encourage the reshoring of manufacturing jobs to the US, similar to the 1985 Plaza Accord, which aimed to weaken the US dollar while reinforcing its role as the world’s reserve currency.

Contrary to warnings that Korean businesses may delay or reduce their investments in Vietnam, Kokalari holds the opposite belief. He asserts that investments from large Korean companies will continue flowing into Vietnam because wages in Korean factories are nearly ten times higher than in Vietnam, and Korea is aging faster than Japan did at the peak of its demographic decline.

These companies are unlikely to change their production plans in Vietnam if exports from Korea and Vietnam to the US face similar tariff burdens. In fact, Vietnam may even enjoy more favorable tariff treatment than other Asian exporting countries under Trump.

Kokalari highlights the importance of geopolitical factors in shaping America’s economic relationships with countries worldwide. This bodes well for Vietnam due to its skillful “bamboo diplomacy” strategy with major powers.

Previously, VinaCapital also stated that a Donald Trump presidency would not significantly impact Vietnam’s economy. They noted that Vietnam could help the US reduce its reliance on Chinese-made goods, which have become too expensive to produce in the US.

However, markets, including Vietnam’s stock market, may be affected by Trump’s unpredictable statements and social media posts.

The most immediate risk to Vietnam’s stock market is the potential continued appreciation of the US dollar. Additionally, Vietnam’s trade surplus with the US (approximately $100 billion) is the third-largest, after Mexico and Canada.

VinaCapital recommends that Vietnam quickly take measures to reduce its trade surplus with the US by increasing purchases of American products, such as liquefied natural gas (LNG) and aircraft engines.

Tung Phong

The Taxman Cometh: The Second Home Edition

The Ministry of Finance proposes studying the implementation of taxation on personal income from real estate transfers based on holding periods, drawing from the experiences of several countries. This progressive approach aims to create a fair and efficient tax system, ensuring that individuals contribute proportionally to their gains from real estate investments.

The Power of AI Marketing: BWF Ventures Leads the Way in 2024’s Strategic Revolution

“On the 6th and 7th of November 2024, BWF Ventures was proud to be a part of an event that marked the company’s strong presence in the development and investment in the AI technology market in Vietnam.”