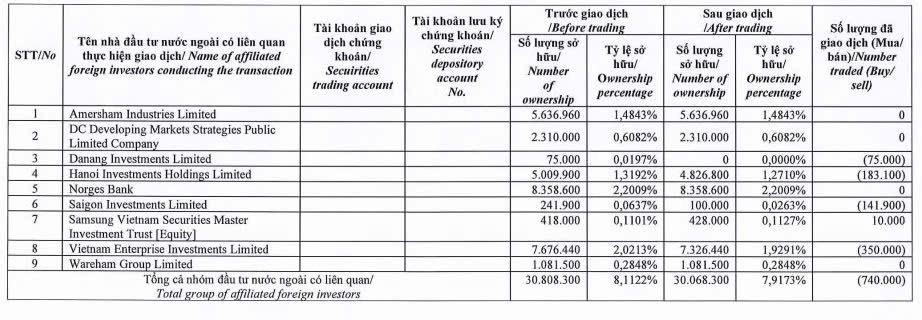

The foreign investment fund Dragon Capital, represented by Ms. Truong Ngoc Phuong, has just disclosed information about the ownership of the group of related foreign investors holding more than 5% of the shares at Duc Giang Chemical Group Joint Stock Company (Ticker: DGC, HoSE).

On November 26, 2024, Dragon Capital sold 740,000 DGC shares through four member funds and purchased 10,000 shares through another member fund.

Source: Duc Giang Chemicals

In particular, the Danang Investments Limited fund sold 75,000 DGC shares, Hanoi Investments Holdings Limited sold 183,100 shares, Saigon Investments Limited sold 141,900 shares, and Vietnam Enterprise Investments Limited sold 350,000 shares.

On the other side, the Samsung Vietnam Securities Master Investment Trust (Equity) fund purchased 10,000 DGC shares.

Following these successful transactions, Dragon Capital reduced its holding of DGC shares from nearly 30.81 million to nearly 30.07 million, equivalent to a decrease in ownership ratio from 8.1122% to over 7.9173% of Duc Giang Chemical’s capital. The date of change in the ownership ratio was November 28, 2024.

In terms of business results, according to the consolidated financial statements for Q3 2024, Duc Giang Chemical recorded net revenue of VND 2,558 billion, up nearly 4% over the same period last year. As the cost of goods sold increased less, gross profit increased by 5% over the same period to more than VND 881 billion.

In this period, financial revenue decreased by 26% to VND 150.5 billion, and financial expenses slightly increased by 1.5% to VND 22 billion. Total selling and management expenses increased by 33% to VND 208 billion.

As a result, after-tax profit for the period reached VND 738 billion, down 8.1% over the same period. It can be seen that the main reason for the decline in Duc Giang Chemical’s profit during this period was the decline in financial revenue and high-cost pressure.

For the nine months ended September 30, 2024, Duc Giang Chemical recorded revenue of VND 7,447 billion, up 1.2% over the same period, and after-tax profit of VND 2,322 billion, down 7.3% over the same period last year.

As of September 30, 2024, Duc Giang Chemical’s total assets increased slightly by 3.8% from the beginning of the year to VND 16,197 billion, and total liabilities were nearly VND 2,056 billion, a decrease of over VND 1,500 billion.

The Power of Foreign Capital: VN-Index Soars to 1250

The morning shake-up was quickly resolved as buying pressure forced prices higher and sellers jumped on board. The market didn’t correct, but instead continued its upward trajectory with extremely low liquidity. The VN-Index closed at a staggering 1250 points, with strong net buying of nearly VND 334 billion by foreign investors. FPT excelled, reaching a new historic peak, also fueled by foreign capital support.