|

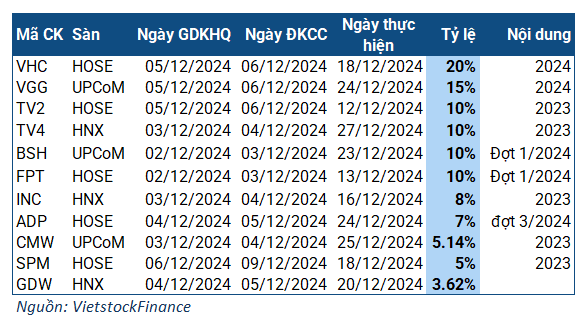

Companies Finalizing Dividend Payouts in Cash for the Week of 02-06/12/2024

|

The company with the highest dividend payout ratio for next week is Vinh Hoan (HOSE: VHC), which is an interim dividend for 2024. With over 224 million shares outstanding, VHC is estimated to pay out nearly VND 449 billion for this dividend. The ex-dividend date is 05/12, and the payment is expected to be made on 18/12/2024.

It is worth noting that VHC has maintained a 20% cash dividend payout ratio since 2020. The decision to pay an interim dividend comes as the company’s Q3/2024 financial results show positive improvements. For the first nine months of 2024, VHC’s net revenue and net profit reached VND 9.3 trillion (up 22%) and VND 808 billion (down 5%), respectively.

Ranking second is May Viet Tien (UPCoM: VGG) with a 15% ratio (1 share receives VND 1,500), requiring more than VND 66 billion in payment. The ex-dividend date is 05/12, and the payment is expected on 24/12/2024. VGG’s 2024 General Meeting of Shareholders approved a 20% dividend payout, so the company needs at least one more payout to meet this target.

Four companies will finalize dividends with a 10% ratio next week, but the most notable is FPT due to its over 1.46 billion shares outstanding. As a result, FPT’s payout amounts to nearly VND 1.5 trillion. The ex-dividend date is 02/12, and the payment is expected on 13/12/2024.

According to the resolutions of the General Meeting of Shareholders, the company plans to pay a 2024 dividend of 20% in cash, the same as in 2023. After this interim dividend, FPT shareholders can expect at least one more dividend payment for the remaining period of 2024, with a 10% ratio.

Four companies will finalize dividend payouts in shares next week: CTF, TNH, BIG, and VDG. The highest ratio belongs to TNH at 15% (100 shares receive 15 new shares), equivalent to issuing nearly 19 million new shares.

Market Beat: Telecoms Rebound, VN-Index Surges Over 8 Points

The market ended the session on a positive note, with the VN-Index climbing 8.35 points (0.67%) to reach 1,250.46, while the HNX-Index gained 1.07 points (0.48%), closing at 224.64. The market breadth tilted in favor of buyers, with 402 tickers advancing against 279 declining ticks. The VN30 basket painted a similar picture, as bulls dominated with 21 gainers, 6 losers, and 3 unchanged stocks, ending the day in the green.

Stock Market Week of Nov 25-29, 2024: Foreign Investors Maintain Net Buying

The market remains cautious despite a strong recovery in the VN-Index last week. Trading volume needs to improve in the coming period to sustain this upward momentum. Notably, consecutive net buying by foreign investors is a positive signal that bodes well for the VN-Index’s outlook.

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.

The Power of Foreign Capital: VN-Index Soars to 1250

The morning shake-up was quickly resolved as buying pressure forced prices higher and sellers jumped on board. The market didn’t correct, but instead continued its upward trajectory with extremely low liquidity. The VN-Index closed at a staggering 1250 points, with strong net buying of nearly VND 334 billion by foreign investors. FPT excelled, reaching a new historic peak, also fueled by foreign capital support.