Vietnam’s Seafood Exports Surge in the Last Two Months

According to a report by the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam’s seafood exports reached an impressive $1 billion in October and $924 million in November.

STRONG GROWTH IN THE SECOND HALF OF THE YEAR

In October alone, seafood exports surpassed $1 billion, marking a 28% increase compared to the same period last year. For the first time in over two years (since June 2022), monthly seafood exports have returned to the $1 billion mark.

As of the end of November, the cumulative seafood export turnover of Vietnam reached nearly $9.2 billion, an 11.5% increase compared to the previous year.

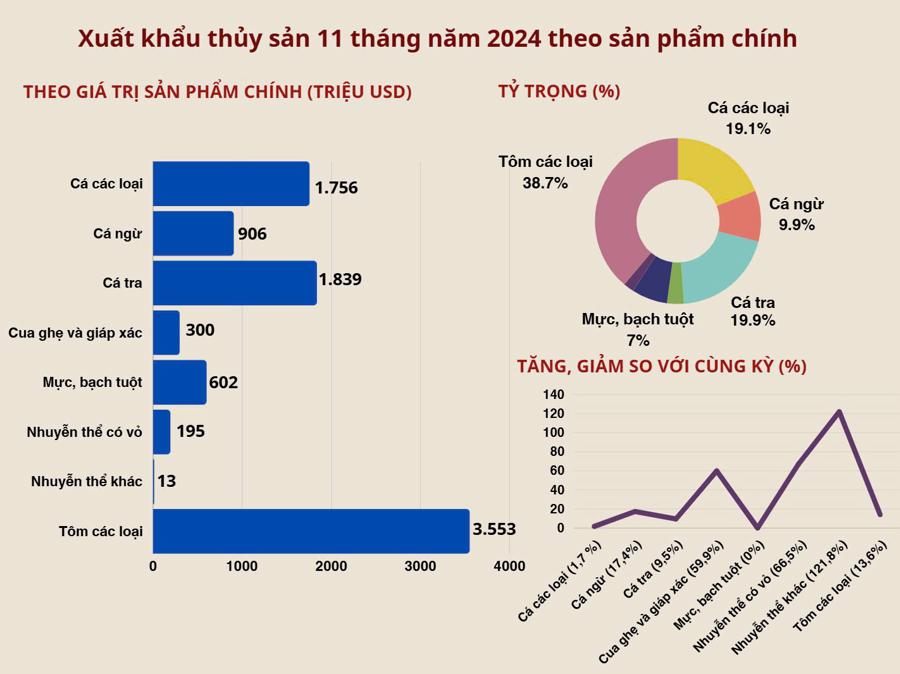

Shrimp exports continued their impressive growth trajectory, registering a 22% increase in November. It is predicted to reach the $4 billion mark by the end of the year. Other products, such as pangasius and tuna, also showed promising growth. Pangasius exports reached $1.84 billion in the first 11 months and are expected to hit the $2 billion mark by the end of 2024. Tuna exports, on the other hand, increased by 8% compared to November 2023 and are on track to match the record $1 billion achieved in the previous year.

Additionally, some products like crab, shellfish, and cephalopods also recorded high growth rates, with shellfish experiencing an astonishing 180% increase.

Not only are Vietnam’s key seafood products performing well, but the country is also developing its by-products, such as fishmeal. Specifically, in the first ten months of 2024, fishmeal exports reached $220.4 million, and it is projected that the whole year’s exports will reach $264.6 million, with the Chinese market accounting for nearly 90% of Vietnam’s fishmeal export turnover.

Commenting on the recent seafood export performance, Mr. Truong Dinh Hoe, VASEP’s Secretary-General, stated that after four years of disruptions caused by the COVID-19 pandemic, wars, and inflation, market trends are stabilizing. Vietnam’s seafood exports in 2024 have returned to their usual trajectory of accelerating in the second half of the year.

Both shrimp and pangasius exports have yielded positive results due to the recovery in demand and prices in the US and Chinese markets, coupled with the strength of value-added products in other markets like Japan and Australia. The recovery and breakthrough in these major importing markets, especially the US and China, have significantly boosted Vietnam’s seafood exports in recent months and will continue to do so in the remaining months of the year.

The Chinese market, including Hong Kong, has taken the lead in importing Vietnamese seafood, with a remarkable 61% growth in November, bringing the cumulative turnover to over $1.7 billion, a 19% increase compared to the same period last year.

The US market also recorded positive growth, with a 21% increase in November, reaching $1.67 billion in the first 11 months. This positive trend is expected to continue in the final month of the year before the US government implements new tax rates.

“Although the Japanese, EU, and Korean markets did not experience significant breakthroughs in November, they still contributed significantly to the total seafood export turnover,” VASEP stated.

FURTHER GROWTH POTENTIAL

Recently, the US Department of Commerce announced preliminary countervailing duty rates for shrimp imports from Ecuador, India, and Vietnam. Notably, the duty rate for Vietnamese shrimp is 2.84%, significantly lower than India’s 4.36% and Ecuador’s 7.55%. This gives Vietnamese shrimp a competitive advantage in the US market in the coming months.

Currently, Vietnamese seafood benefits significantly from the EU-Vietnam Free Trade Agreement (EVFTA). Most seafood products have enjoyed preferential treatment since the agreement came into force, resulting in impressive export growth.

For instance, taxes on most raw shrimp (fresh, frozen, or chilled) exported to the EU have been reduced to 0% immediately after the agreement took effect. In contrast, Thailand and India do not have an FTA, and Ecuador still faces a basic tax rate of 12%.

Apart from traditional and key export markets like the Netherlands, Germany, and France, there are still untapped opportunities and potential niche markets within the EU for Vietnamese seafood exports. It is anticipated that the EU’s demand for seafood imports and consumption will continue to rise in the coming months.

“Overall, 2024 is a promising year for Vietnam’s seafood industry, as exports continue to achieve remarkable achievements, not only in value but also in the diversity and stability of export markets and products,” VASEP concluded.

According to the General Department of Customs, seafood is currently ranked 8th among the top export earners, as of mid-November. The products with higher export values include computers and components, phones and parts, machinery and parts, textiles and garments, footwear, wood and wooden products.

Seafood Exports for the First Ten Months Reached $8.3 Billion, with Key Products Showing Strong Growth

The seafood industry is swimming towards success, with October’s achievements pushing the 10-month tally to a remarkable $8.33 billion in export turnover. This impressive figure marks a 12% increase compared to the same period last year, showcasing the sector’s resilience and growth. Key products such as shrimp, pangasius, and tuna have all witnessed positive growth trajectories, contributing to the industry’s overall triumph.

Vietnam Prepares for EU Inspection Delegation in Aquaculture

The European Union (EU) inspection team is set to visit Vietnam to audit its aquaculture industry. The team is expected to evaluate the country’s residue control program for products destined for the EU market and verify the reliability of ensuring that farmed seafood complies with residue regulations.