After a drop of over 100 points from the October peak to the psychological support level of 1,200, the domestic market found balance in November and is expected to gain momentum for a recovery in December.

Positive Tailwinds for the Stock Market in the Year-end Period

In a recent report, MBS Securities stated that some signals, which were bottlenecks for the market in October, have gradually been resolved.

Regarding the global market, US stocks continue to outperform the rest of the world. Notably, the Dollar Index (DXY) and the yield on 10-year US Treasury bonds have declined, thereby reducing pressure on the USD/VND exchange rate for the domestic market.

Domestically, as the year-end approaches, the market is receiving a lot of positive news, helping the VN-Index recover from the psychological threshold of 1,200 points and offering many opportunities to expand the uptrend.

Additionally, MBS stated that the exchange rate story is also cooling down as the SBV has been net injecting to support liquidity, and interbank interest rates are on a downward trend. On November 28, the State Bank of Vietnam (SBV) adjusted the credit growth target for 2024, creating favorable conditions for credit institutions to transparently and fairly expand their business activities.

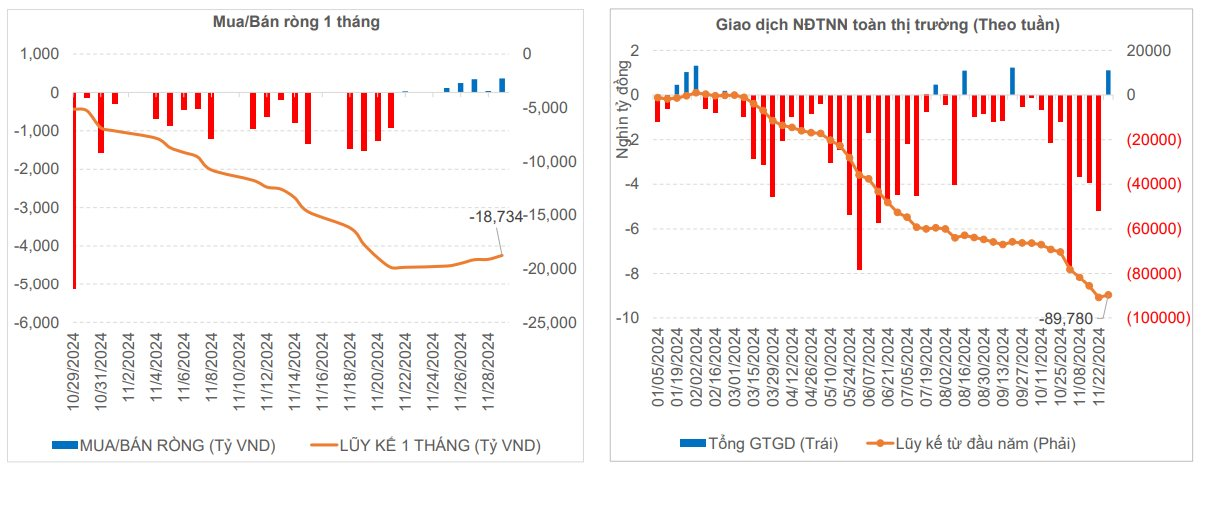

Notably, the clearest signal supporting the market from the cooling exchange rate story is that foreign investors have returned to net buying for six consecutive sessions after a record net selling streak of over $3.3 billion in the entire market since the beginning of the year.

As the year-end sprint approaches, the market is receiving even more positive news, such as Dispatch No. 122/CĐ-TTg, in which the Prime Minister requests the State Bank to implement eight groups of tasks to achieve the credit growth target of 15%, ensuring the smooth, safe, and efficient operation of the banking system.

In addition, the market also received some positive macroeconomic news: The Ministry of Finance has proposed to extend the 2% reduction in value-added tax (VAT) for some goods and services for another six months, i.e., until mid-2025. The goal is to stimulate consumption, thereby promoting production and business activities to recover and develop soon to contribute to the state budget and the economy.

Moreover, on November 26, 2024, the National Assembly passed the draft Law on Value Added Tax (VAT) amendment, according to which, from July 1, 2025, fertilizers will officially become output VAT-liable commodities with a tax rate of 5%. This could benefit domestic fertilizer companies next year.

Meanwhile, electricity companies are also looking forward to the amended Law on Electricity, expected to be passed by the National Assembly this week, with a privatization orientation for the electricity industry from 2025.

VN-Index Likely to Continue Uptrend

From a technical perspective, MBS analysts assessed that the VN-Index’s drop of over 100 points from the October peak to the psychological support level of 1,200 points, equivalent to a decline of more than 8%, is similar to the two sharp declines of over 9% in April and July this year when the market corrected to the lower bound of the 1,180-1,300 point range over the past seven months.

Although the recovery is doubtful as liquidity continues to decline, the possibility of the VN-Index extending its uptrend is supported by domestic positive news. The market may fluctuate at the notable resistance level of 1,260 points in the trading week of December 2-6, 2024. This is an opportunity for latecomers and investors to restructure their portfolios.

Some stock groups with attractive discounts, such as real estate, securities, and oil and gas, have seen bottom-fishing returns in the recent sharp decline.

Therefore, MBS recommends investment opportunities in stock groups such as real estate, industrial real estate, logistics, exports (garments, seafood, wood), Viettel, steel, and securities.

Market Beat: A Tale of Diverging Fortunes, VN-Index Revisits 1,251 Points

The market ended the session on a positive note, with the VN-Index climbing 0.75 points (0.06%) to reach 1,251.21; the HNX-Index also rose, by 0.68 points (0.3%), closing at 225.32. The market breadth tilted towards decliners, with 373 tickers in the red and 319 in the green. The large-cap basket, VN30, witnessed a dominant performance, as evident in the 17 gainers, 9 losers, and 4 unchanged stocks.

The Prime Minister Calls on US Businesses to Enhance Trade and Investment Ties with Vietnam

On November 27, the Vietnam-US Business Summit, themed “Policies and Approaches to Ensure Mutual Benefits in Trade Relations,” took place in Hanoi. This is the seventh time the Vietnam Chamber of Commerce and Industry (VCCI) has collaborated with the American Chamber of Commerce (AmCham) in Hanoi and the US Chamber of Commerce in Washington to organize this prestigious event.

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.

![[IR AWARDS] December 2024: A Month of Revealing Insights](https://xe.today/wp-content/uploads/2024/12/Screenshot_01-150x150.png)