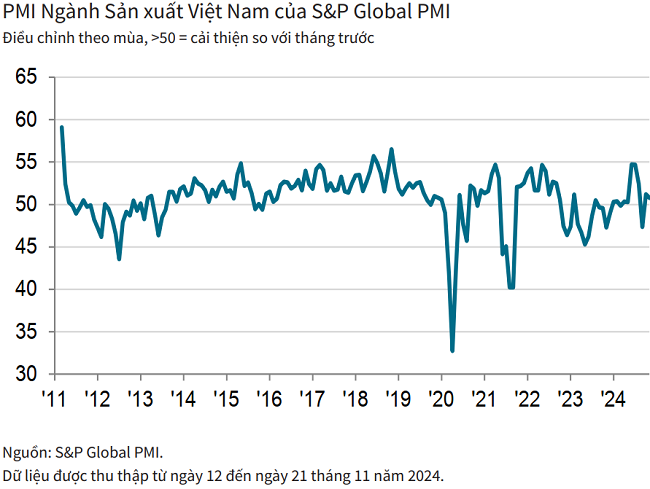

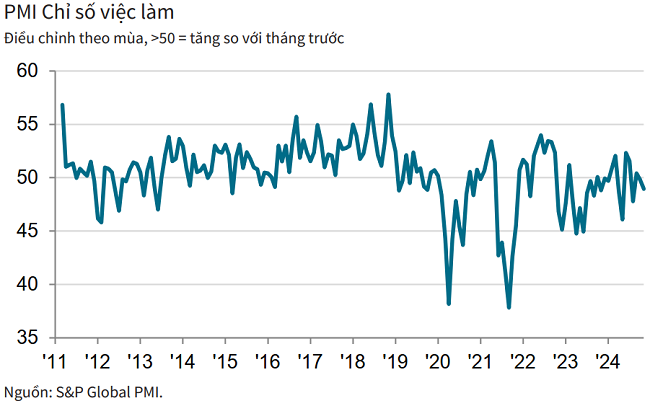

On December 2, S&P Global published the Purchasing Managers’ Index (PMI) for Vietnam’s manufacturing sector for November 2024. The report highlighted three key points: a slowdown in new orders as exports declined, employment decreased for the second consecutive month, and suppliers’ delivery times continued to lengthen.

OUTPUT AND NEW ORDERS GROWTH SOFTEN

According to S&P Global’s report, Vietnam’s manufacturing sector continued to expand in November, but the overall business conditions improved at a slower pace compared to October. Output and new orders growth softened, impacted by weakening export performance. Meanwhile, employment decreased as companies continued their cost-cutting efforts, leading to a further increase in backlogged work.

Input costs rose but only modestly, resulting in a slight increase in output prices.

The PMI for Vietnam’s manufacturing sector remained above the 50-point threshold in November, indicating business conditions improved for the second straight month after disruptions caused by Typhoon Yagi in September. However, the index dropped slightly to 50.8 from 51.2 in October, suggesting only a modest strengthening of the sector.

Similar to the overall business conditions, manufacturing output increased for the second consecutive month but at a slower pace compared to October.

The report from S&P Global stated that while some companies raised their output to meet rising new orders, others reported relatively weak demand, leading to an overall slowdown in production. Although total new orders increased amid improving domestic demand and new clients, the weakness in international demand weighed on the overall growth.

In fact, new export orders declined after a slight increase in the previous month, and export activity contracted at the sharpest rate since July 2023.

While output and new orders continued to rise, albeit at a weaker pace, employment decreased for the second month in a row in November. In some cases, companies reduced their workforce to lower costs.

With a reduced workforce, companies continued to struggle to complete orders on time, leading to a further increase in backlogs, although the rate of accumulation was the slowest since June.

MANUFACTURERS REMAIN OPTIMISTIC ABOUT FUTURE OUTPUT

The report from S&P Global showed that companies’ efforts to control costs resulted in a slightly slower rise in input prices in November, and this increase was milder than the average for 2024 so far. Where input costs rose, survey respondents attributed this to supply shortages and a weak currency.

Similarly, output charges rose only marginally in November, and the rate of inflation was almost unchanged from the previous month. Manufacturers continued to face lengthening delivery times from suppliers in the final quarter of the year.

Delivery times lengthened for the third month in a row, and the extent of the deterioration was greater than in October. Survey respondents cited transportation issues and difficulties in sourcing raw materials as reasons for the delays.

Meanwhile, companies reduced their purchasing activity for the second time in three months, following a slight increase in October. The decrease in purchases of input goods and problems with the delivery of materials led to a renewed reduction in stocks of purchases, and the rate of decline was substantial. Stocks of finished goods also decreased as companies used these inventories to fulfill orders. The sharp drop this time was the most notable since July.

Business confidence eased for the second month in a row, and the decline was the steepest since January. However, manufacturers remained optimistic that output would increase over the next year, with expectations linked to plans for new product launches and business expansion, along with rising new orders.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, said, “While Vietnam’s manufacturing sector remained in growth territory in November, there was some disappointment as output and new orders growth softened instead of gaining further momentum following the disruptions caused by Typhoon Yagi in September. To some extent, the slowdown reflects weakening international demand, as exports contracted at the sharpest rate since July 2023.”

“Companies continued to focus on cost control, which contributed to lower employment and constrained their ability to complete orders on time,” Mr. Harker added. “Firms are hopeful that stronger demand in the coming months will enable them to boost capacity.”

The Evolving Landscape of Hanoi’s Aspiring District: A Narrative on the Apartment and Land Market Dynamics

The real estate market in Dong Anh district, Hanoi, has witnessed a significant surge in prices, not just for apartments but also for land plots, in the last quarter of 2024. Some areas have seen an astonishing rise of over 110% in just one year, indicating a booming market with high demand and limited supply.

What Does Donald Trump’s Senior Staff Appointments Mean for Vietnam?

Although Trump’s second term as US President may not benefit Vietnam as much as his first, VinaCapital believes there is a very low risk that tariff policies will disrupt the growth of the Vietnamese economy.