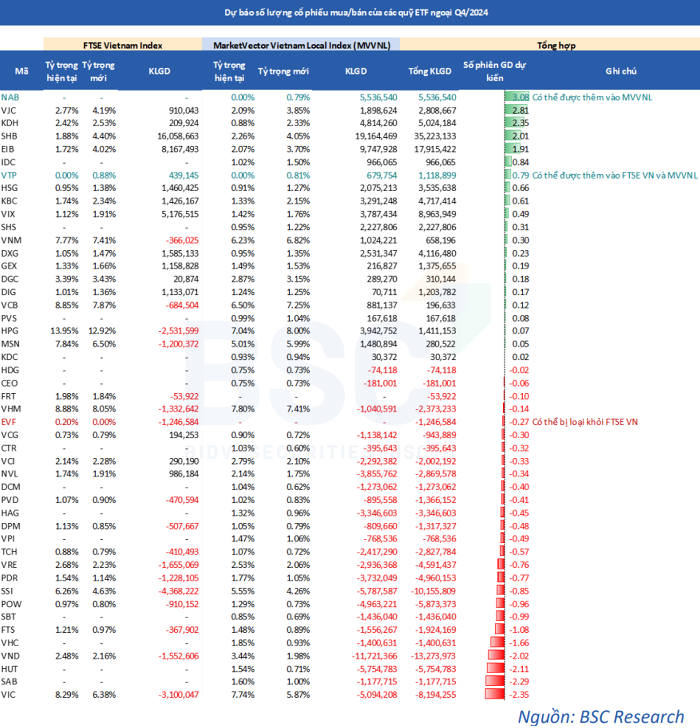

For the FTSE Vietnam Index (a reference for the FTSE ETF), VTP is expected to be added with a weight of 0.81% after meeting the full criteria for liquidity, free-float ratio, and foreign ownership ratio. On the other hand, EVF of EVN Finance may be removed from the portfolio for failing to meet the market cap weight requirement.

Regarding the MarketVector Vietnam Local Index (a reference for the VNM ETF), not only is VTP expected to be included, but NAB, belonging to Nam A Bank, is also forecasted to join with a weight of 0.79%. Conversely, BVH, a subsidiary of the Bao Viet Group, risks being eliminated as its market capitalization currently falls outside the threshold of 98% of the accumulated capitalization of eligible stocks.

In terms of expected trading volume, BSC Research estimates that FTSE ETF will purchase 439,145 shares of VTP and VNM ETF will buy an additional 1.1 million shares. Combining the two funds, the stocks with the highest purchase volume include SHB with 35.2 million shares, EIB with 17.9 million shares, and VIX with 9 million shares.

On the opposite end, selling pressure is concentrated on VND with 13.3 million shares, SSI with 10.2 million shares, and VIC with 8.2 million shares. This is followed by HUT with 5.8 million shares, PDR with 5 million shares, and VRE with 4.6 million shares.

The FTSE ETF has a scale of nearly VND 6,790 billion, while the VNM ETF has a scale of nearly VND 11,260 billion.

|

Forecasted transactions of VNM ETF and FTSE ETF

|

According to the schedule, FTSE will announce the constituent stock portfolio on December 6, while MarketVector will announce their portfolio on December 13. The entire restructuring process is expected to be completed by December 20, with the official data closing date for the two indexes being November 29.

Quarterly Review: Which Sector Will the 18,000 Billion NAV ETF Duopoly Heavily Invest In?

According to the latest report from BSC Research, the portfolios of two large ETFs are set for notable changes in the upcoming Q4 2024 reconstitution. Viettel Post’s VTP is predicted to feature in both ETF portfolios, while Nam A Bank’s NAB is likely to be added to the VNM ETF.

Market Beat: Telecoms Rebound, VN-Index Surges Over 8 Points

The market ended the session on a positive note, with the VN-Index climbing 8.35 points (0.67%) to reach 1,250.46, while the HNX-Index gained 1.07 points (0.48%), closing at 224.64. The market breadth tilted in favor of buyers, with 402 tickers advancing against 279 declining ticks. The VN30 basket painted a similar picture, as bulls dominated with 21 gainers, 6 losers, and 3 unchanged stocks, ending the day in the green.

Filling the Void: BVH Steps Up as Chairman, Ending a Two-Year Vacancy

The Chairman position at Bao Viet Holdings (HOSE: BVH) has been vacant since Dao Dinh Thi stepped down from the role on August 24, 2022, leaving a notable gap in the leadership of one of Vietnam’s prominent financial and insurance groups.