FPT AI Factory: Powering Digital Transformation and Innovation in Japan and Vietnam

November 2024 marked a significant step forward for FPT with the official launch of FPT AI Factory in Vietnam and Japan. This launch was accompanied by the announcement of a strategic partnership ecosystem with industry leaders, including NVIDIA, SCSK, ASUS, Hewlett Packard Enterprise, VAST Data, and DDN, to accelerate the development and operations of the project.

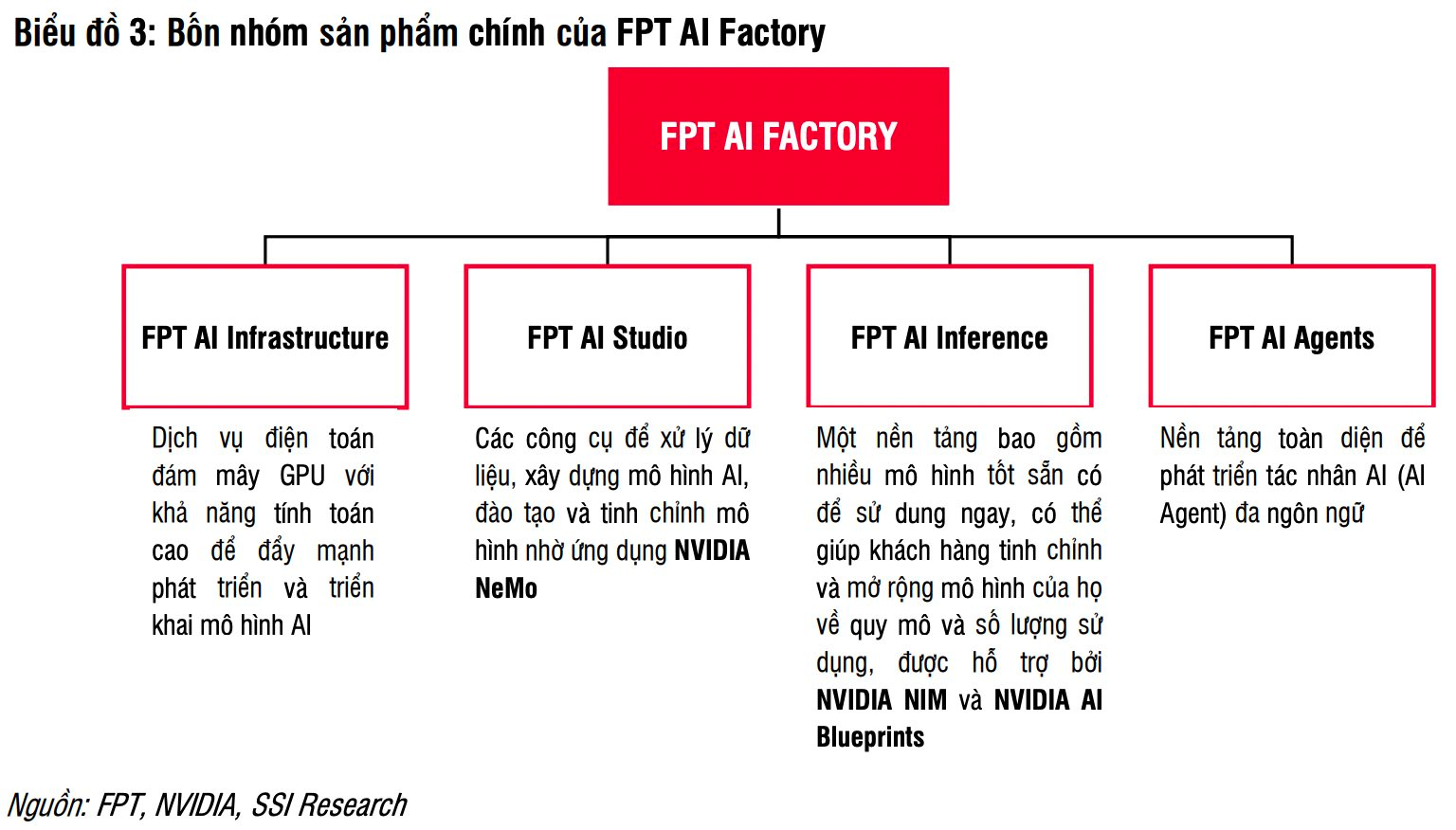

In a recently published report, SSI Securities assesses FPT AI Factory as a comprehensive solution for end-to-end AI development compared to the AI infrastructure offered by competitors in Japan. FPT AI Factory encompasses four main product groups: FPT AI Infrastructure, FPT AI Studio, FPT AI Inference, and FPT AI Agents. Regarding pricing strategy, FPT aims to offer competitive rates similar to those of Japanese companies in the same industry rather than matching the high prices of global cloud service providers like Google and Microsoft.

FPT AI Factory: A Comprehensive Approach to AI Development

One of the key strengths of FPT AI Factory lies in its ability to address the urgent need for digital transformation and the IT workforce shortage in Japan. Despite efforts made, Japan’s digital transformation journey lags behind that of the US, several European countries, and even some APAC nations like Singapore, South Korea, China, and Australia. According to Japan’s Ministry of Internal Affairs and Communications (MIC), the shortage of IT professionals, particularly in areas such as AI/data analysis and UI/UX design, is a significant factor contributing to the slow pace of digitalization. These factors bode well for the growth prospects of FPT AI Factory.

According to FPT, the company is already taking pre-orders and aims to generate revenue from the project starting in 2025. The revenue target is set at approximately $100 million (at 90% operational capacity), with a projected EBITA margin of around 50% and an internal rate of return of about 25%. This revenue is likely to be classified under the domestic IT segment under FPT Smart Cloud. Meanwhile, SSI Research estimates that this revenue accounts for about 5% of the estimated 2024 IT segment revenue.

Overseas IT Segment to Drive Growth in 2025-2026

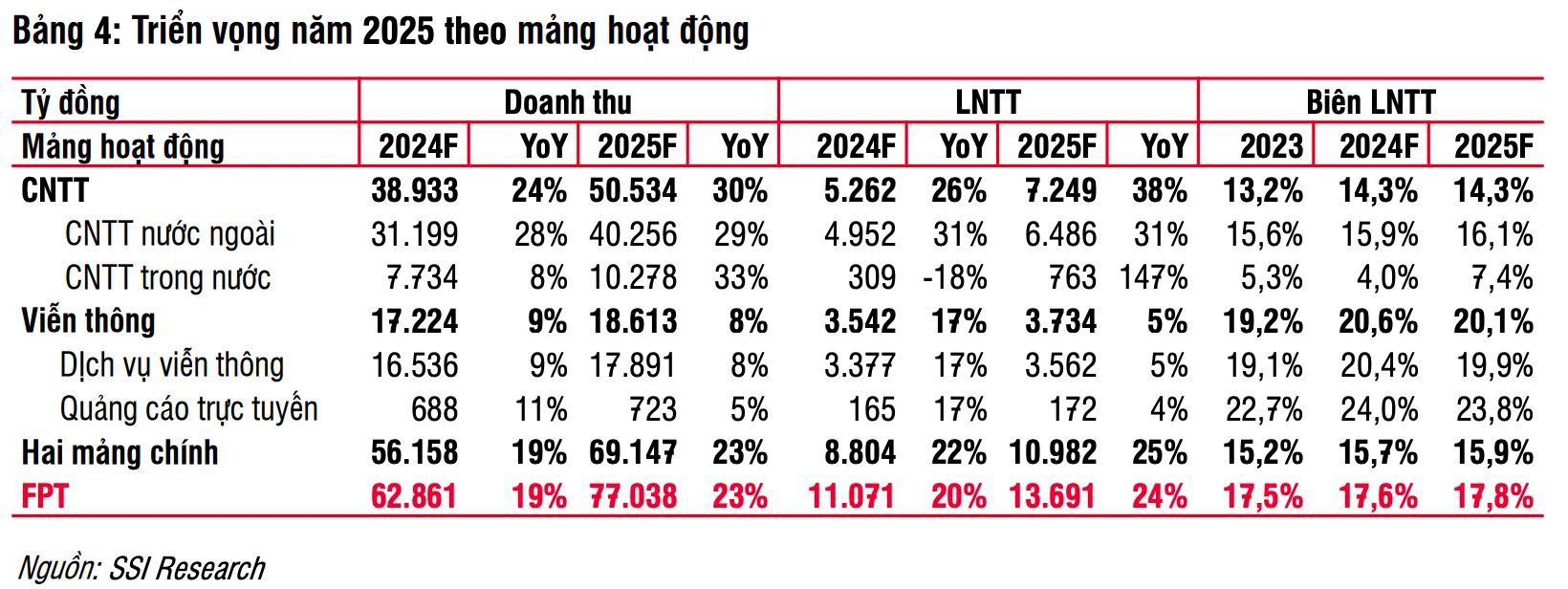

For 2025, SSI Research forecasts net profit growth of up to VND 13,700 billion, primarily driven by the continued expansion of the overseas IT segment and revenue from FPT AI Factory.

Specifically, in the IT segment, overseas IT revenue and net profit are expected to grow by 29% and 31%, respectively. For the domestic IT segment, SSI predicts a 33% revenue increase thanks to the introduction of FPT AI Factory, contributing 20%-25% of domestic IT revenue, and a significant improvement in the net profit margin to 7% (up from 4% in 2024) due to the relatively high net profit margin of FPT AI Factory (around 20%).

In the telecommunications segment, SSI anticipates continued single-digit growth in both revenue and profit. Specifically, fixed broadband and Pay TV are expected to gain market share due to enhanced service quality. FPT is also investing in new licenses for Pay TV. Regarding the data center segment, the upcoming data center in District 9, Ho Chi Minh City, is facing some delays due to logistical issues related to equipment. The project is now expected to be operational by the end of 2025, but this delay will only have a minor impact on profit forecasts as the data center segment accounts for only about 3% of the telecommunications segment’s revenue. Additionally, online advertising will receive a boost from the ongoing economic recovery.

In the education, investment, and other segments, FPT expects higher growth in 2025 as the company plans to focus more on brand-building activities for the FPT Education Organization. For a conservative estimate, SSI predicts a similar growth rate as in 2024, approximately 17%. In November 2024, FPT announced plans to open a representative education office in Japan to expand training programs, promote student exchange, and facilitate cultural interactions, indicating a new growth driver for this segment in the long term.

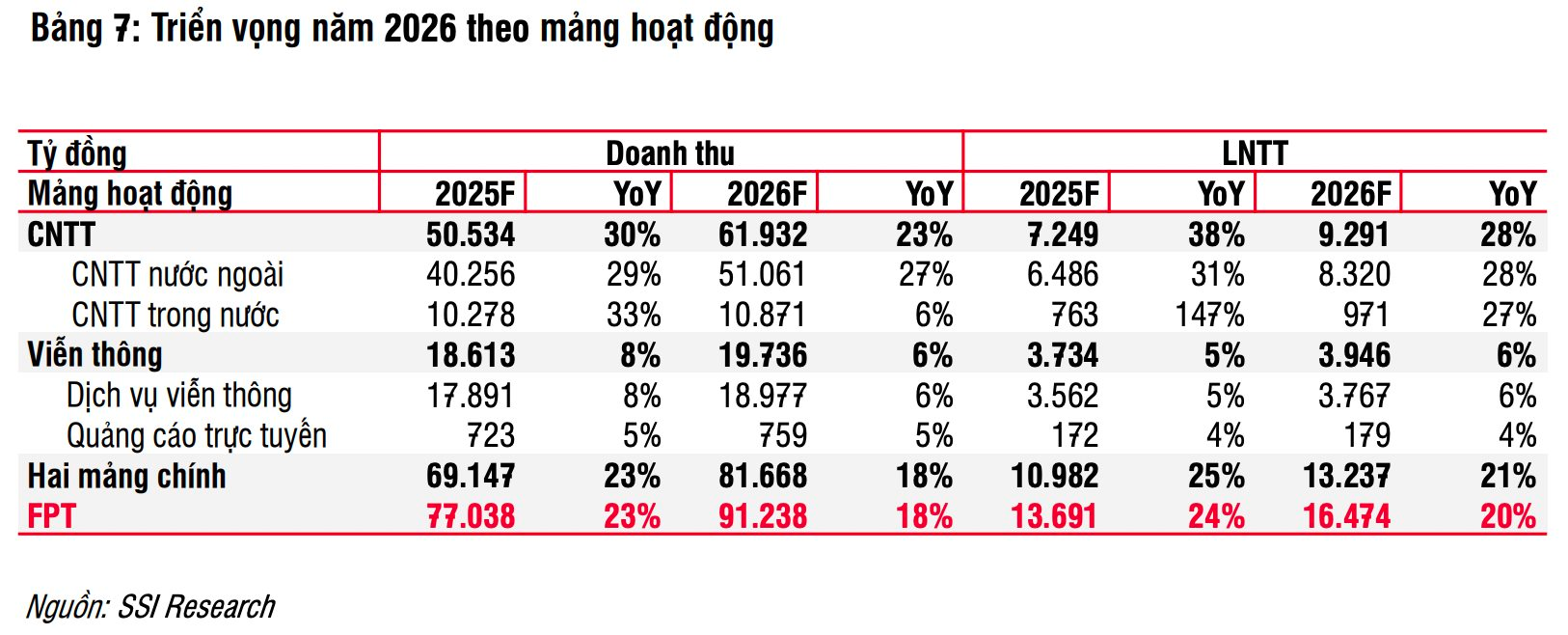

Moving into 2026, SSI forecasts FPT’s revenue and net profit to reach VND 91,200 billion (up 18%) and VND 12,400 billion (up 23%), respectively. The overseas IT segment is expected to continue its strong performance and become the main growth driver in the long term.