Today’s trading session lacked any significant catalysts to drive market activity. Neither the buyers nor the sellers showed strong conviction, resulting in low liquidity. The HoSE exchange recorded approximately 9,520 billion VND in matched transactions, with four out of the last six sessions falling below the 10,000 billion VND threshold. Stock prices mostly fluctuated within a narrow range, particularly the large-cap stocks, causing the Vn-Index to hover around 1,251 points. It briefly dipped into negative territory but managed to eke out a minor gain of 0.75 points by the closing bell.

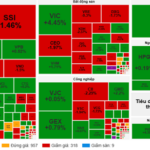

Despite the slight gain in the index, the market breadth leaned towards the negative side, with 221 declining stocks outweighing 147 advancers. The banking sector emerged as the main pillar of support for the index, with notable gains in stocks like VCB and LBP, contributing almost two points to the index. Other financial services stocks, including CTG, BVH, and PNJ, also lent a helping hand to the index, preventing it from slipping below the reference level.

The telecommunications sector garnered high praise today, witnessing a collective gain of 2.3%. Meanwhile, the materials sector mirrored this positive sentiment with a 0.44% increase. On the flip side, the real estate and securities sectors underwent mild corrections, with the former experiencing an average decline of over 1% in stocks like VHM, KDH, DXG, PDR, and NLG. In contrast, the industrial real estate group defied the downward trend, displaying robust resilience.

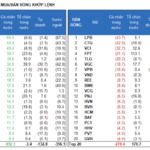

The food and beverage, energy, and information technology sectors also succumbed to selling pressure, weighing down the index. The top laggards included FPT, BID, GAS, MSN, and VIC, which dragged the index lower. Combined liquidity across the three exchanges reached 13,400 billion VND, with foreign investors registering strong net selling after six consecutive sessions of net buying. Their net selling value exceeded 424.5 billion VND, and specifically in matched transactions, they offloaded a net 310.2 billion VND.

Foreign investors focused their net buying on the banking, consumer goods, and household appliances sectors. The top stocks on their net buying list included CTG, TCB, VPB, LPB, PNJ, TLG, VND, MWG, FUEVFVND, and HVN. Conversely, they engaged in net selling in the real estate sector, with FPT, VRE, KDH, STB, HPG, NLG, VIC, MSN, and KDC being the top stocks on their net selling list.

Individual investors displayed net buying worth 442.4 billion VND, of which 339.9 billion VND was attributed to matched transactions. In terms of matched transactions, they bought a net in 11 out of 18 sectors, primarily focusing on the real estate sector. The top stocks on their net buying list were VRE, STB, VHM, SSI, KDH, HPG, MSN, VIC, NLG, and VCB. On the selling side, they offloaded a net in 7 out of 18 sectors, mainly offloading consumer goods, household appliances, construction, and building materials. The top stocks they sold included LPB, CTG, VCI, FPT, TLG, VGC, VND, REE, and BWE.

Proprietary trading accounted for net buying of 69.9 billion VND, while in matched transactions, they were net sellers at 147.0 billion VND. Focusing on matched transactions, proprietary trading showed net buying in 4 out of 18 sectors, with the information technology and chemicals sectors attracting the most interest. The top stocks on their net buying list were FPT, DCM, HAH, SBT, FRT, DBC, HCM, GVR, HT1, and SIP. Conversely, they offloaded a net in the banking sector, with the top sold stocks being VHM, HPG, VPB, TCB, MBB, VNM, MSN, ACB, PNJ, and TPB.

Domestic institutional investors recorded net selling of 208.1 billion VND, while in matched transactions, they were net buyers at 117.3 billion VND. Analyzing matched transactions, domestic institutions sold a net in 9 out of 18 sectors, with the chemicals sector witnessing the highest net selling value. The top stocks they offloaded included TCB, SSI, DCM, MWG, PNJ, CTG, SIP, FRT, VHM, and FUEVFVND. Conversely, they engaged in net buying in the information technology sector, with FPT, HPG, VCI, VCB, VGC, KDH, ACB, REE, MBB, and BWE being the top stocks on their net buying list.

Today’s trading volume in negotiated transactions reached 2,911.5 billion VND, marking a substantial increase of 42.7% compared to the previous Friday’s session. These transactions contributed 21.7% to the total trading value. Notably, a significant transaction occurred in VPB, with domestic institutions selling 12.5 million units worth 247.5 billion VND to proprietary trading. Additionally, there were negotiated transactions among foreign institutions in various stocks, including ACB, MBB, FPT, PNJ, and TNH.

Individual investors remained active in the banking sector stocks (EIB, MSB, LPB, HDB) and large-cap stocks (FPT, VHM, HPG, and KDH). The allocation of funds showed an increase in exposure to real estate, banking, construction, steel, oil and gas, warehousing, logistics, and maintenance sectors, while reducing positions in securities, agricultural and marine farming, food, retail, software, and textiles sectors.

Specifically, in terms of matched transactions, the allocation of funds favored mid-cap stocks (VNMID) while reducing exposure to large-cap (VN30) and small-cap (VNSML) stocks.

The Challenges Faced by Social Housing Developers: Navigating the Complexities of Mechanisms and Policies

At the 2024 Sustainable Real Estate Market Development Forum, social housing took center stage as a key area of focus for both regulators and businesses alike. This segment, aimed at addressing the housing needs of low-income individuals, has garnered attention due to the supportive policies in place. Despite this, businesses operating in the social housing sector continue to grapple with various challenges.

Danang’s Real Estate Market Soars with the Free Trade Zone

The Danang real estate market, particularly the Lien Chieu district, is experiencing a surge in development, fueled by a series of breakthrough growth catalysts. These catalysts include the next-generation free trade zone (FTZ), the Lien Chieu port, and a cluster of high-tech industrial parks. This perfect storm of economic drivers is transforming the area into a thriving hub of activity, attracting investors and businesses alike.