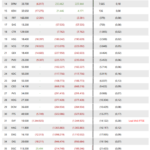

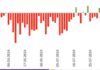

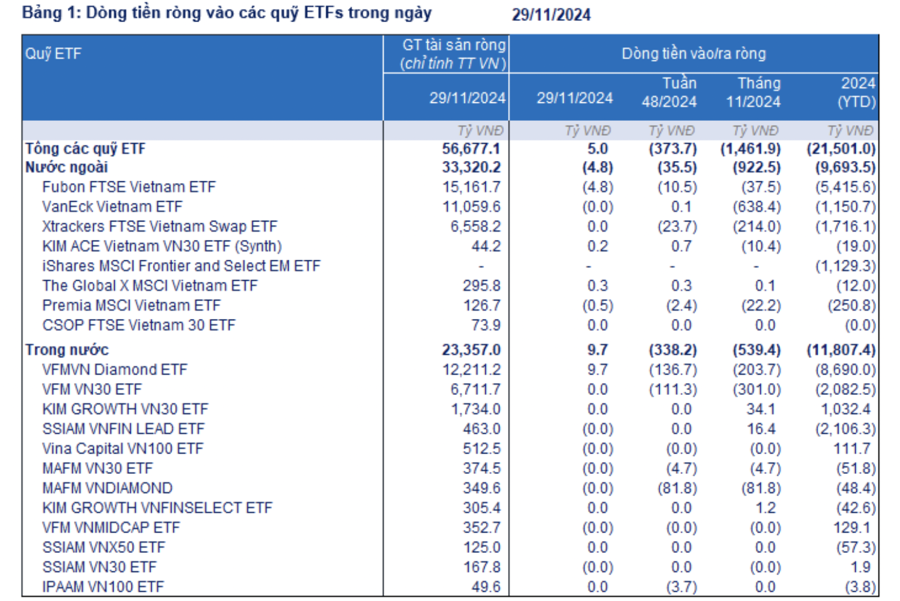

For the week of November 25–29, ETFs investing in Vietnamese stocks maintained a net withdrawal status with over VND 373 billion. This was the seventh consecutive week of capital outflows, with a cumulative value of over VND 2,200 billion. The main outflows occurred in the VFM VNDiamond ETF.

In November 2024, the total net withdrawal was recorded at over VND 1,400 billion.

Thus, the cumulative net withdrawal from ETFs since the beginning of 2024 is nearly VND 21,500 billion, 13.5 times higher than the total net withdrawal of VND 1,500 billion in 2023, and equivalent to 27.6% of the net selling by foreign investors since the beginning of 2024.

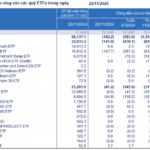

The total net asset value of ETFs, including foreign and domestic ones, reached VND 56,600 billion in the week of November 25–29, up 0.8% from the previous week. Note that this net asset value is only for the Vietnamese market.

Foreign ETFs recorded a net withdrawal of over VND 35 billion, mainly from the Xtrackers FTSE Vietnam ETF, which withdrew VND 23.7 billion. However, the withdrawal value decreased sharply by 92.6% compared to the previous week. Similarly, the Fubon FTSE Vietnam ETF also experienced a net withdrawal of over VND 10 billion.

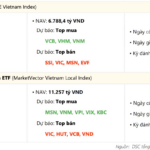

In contrast, net withdrawals from domestic ETFs increased significantly, reaching over VND 338 billion in the week of November 25–29. This was largely contributed by the VFM VNDiamond ETF (-VND 136.7 billion). The top sold-off stocks included PNJ, GMD, ACB, and TCB. The VFM VN30 ETF also experienced a net withdrawal of over VND 111 billion, with FPT, ACB, and TCB being the top sold-off stocks in its portfolio. Similarly, the MAFM VNDiamond ETF unexpectedly suffered a net withdrawal of nearly VND 82 billion.

In addition, there were net withdrawals in the capital flow of Thai investors through DRs in the fund managed by Dragon Capital. In the week of November 25–29, investors sold a net of 4.15 million depositary receipts (DRs) in the VFM VN30 ETF, equivalent to over VND 100 billion. Similarly, investors sold 700,000 DRs in the VFM VNDiamond ETF, equivalent to over VND 23 billion.

On December 2, 2024, the Fubon FTSE Vietnam ETF recorded a net inflow of over VND 10 billion and did not trade any stocks. Meanwhile, the VFM VNDiamond ETF attracted a net inflow of over VND 3 billion, while the VFM VN30 ETF remained unchanged in terms of capital flow.

The Hunt for the Top Stock Picks: Unveiling the Two Most Formidable “Sharks” in the Market

According to DSC Securities, a retail stock is set to be the focal point of foreign ETF fund inflows.

The Great ETF Snub: Vietnam Left Out in the Cold Despite Southeast Asia’s Allure

Week 04-08/11/2024 saw a significant wave of capital outflows across multiple Asian markets, with Vietnam recording a notable foreign net withdrawal of up to $144 million, equivalent to VND 3,600 billion. Among this, ETFs withdrew $9.2 million, contributing to the overall outflow. This period marked a notable shift in investment trends, highlighting the dynamic nature of global financial landscapes and the intricate interconnectedness of international markets.