I. MARKET ANALYSIS OF THE STOCK MARKET FOR BASIC DAY 12/03/2024

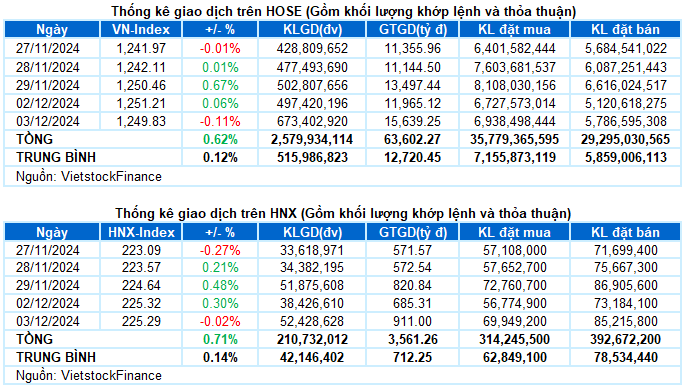

– The main indices edged lower on December 03. The VN-Index closed down 0.11% to 1,249.83 points; HNX-Index fell 0.02% from the previous session to 225.29 points.

– Matching volume on HOSE exceeded 477 million units, up 22.8% over the previous session. Matching volume on HNX increased 32.9% to nearly 45 million units.

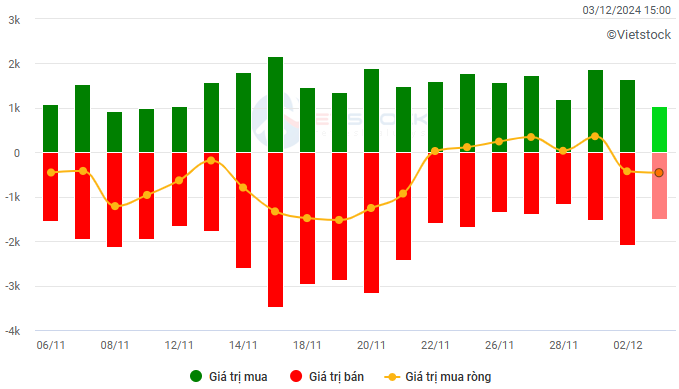

– Foreigners net sold on HOSE with a value of more than VND 385 billion and net sold nearly VND 50 billion on HNX.

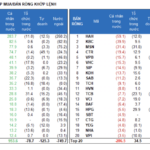

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

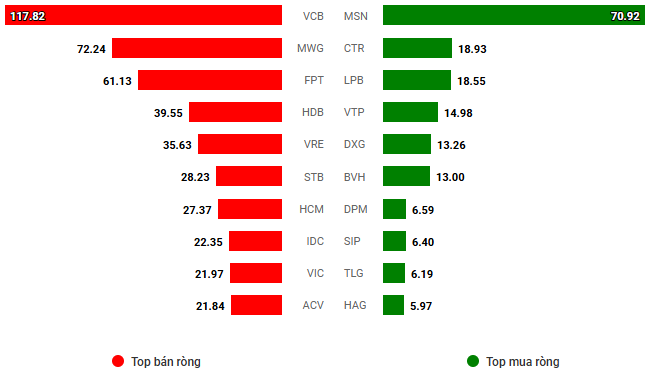

Net trading value by stock code. Unit: VND billion

– The market continued to have another volatile session with increased liquidity. Starting with quite negative selling pressure at the beginning of the session, the VN-Index fell more than 6 points and dropped below the 1,250 threshold. However, bottom-fishing demand quickly appeared, helping the index to recover almost to the reference level at the end of the morning session. Then the index fluctuated within a narrow range until the end of the trading day. At the close on December 03, the VN-Index stood at 1,249.83 points, down slightly by 0.11%.

– In terms of impact, VCB was dominated by sellers, especially strong selling pressure from foreigners, making this stock the most negative factor today, taking away 1.6 points from the VN-Index. Following were BID, GVR and VNM, which also caused the index to fall by nearly 1.5 points. In contrast, FPT, BVH, HDB and LPB tried to prevent the market from falling deeply, contributing more than 2.5 points to the VN-Index.

– The VN30-Index ended slightly higher by 0.03%, reaching 1,309.18 points. The breadth of the basket was balanced with 15 losers, 11 gainers and 4 stocks standing at the reference price. Notably, BVH continued its impressive breakout streak with a superior gain of 6.3%. Stocks of HDB, FPT and POW also attracted positive demand, rising by more than 2%. In contrast, the “bottom” of the VN30 basket today were stocks of GVR, STB and VCB with a decrease of more than 1%.

Industry groups were mixed. On the negative side, telecom stocks ranked at the bottom when they returned to a drop of more than 1%, due to the large impact from VGI (-1.4%), FOX (-0.81%) and VNZ (-1.49%). However, a few stocks in this industry still made a dramatic comeback, notably YEG hitting the ceiling price, CTR (+5.22%) and ELC (+1.32%). Next was the energy group, which was also dominated by sellers, with leading stocks in the industry all drowning in red such as BSR (-0.51%), PVS (-1.46%) and PVD (-1.27%).

On the positive side, insurance, healthcare and information technology groups maintained their impressive uptrend. Notably, stocks such as BVH (+6.33%), MIG (+3.76%), BMI (+3.12%); IMP hitting the ceiling price, DHT (+8.84%), DHG (+1.97%), DVN (+2.34%), DBD (+2.43%), PMC (+7.34%), DMC (+1.56%); FPT (+1.97%) and CMG (+3.55%). The remaining industry groups only fluctuated slightly around the reference price.

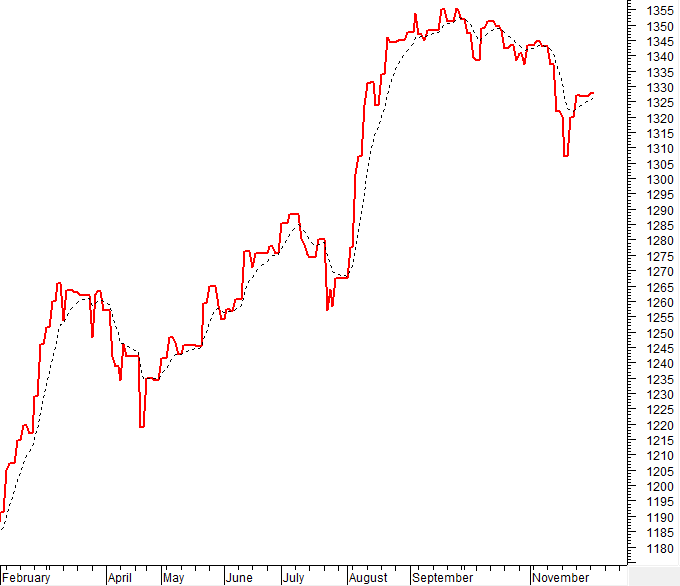

The VN-Index slowed its uptrend with a slight loss in the context of trading volume continuing to fall below the 20-day average. This shows that the cash flow participating in the market is still very limited. However, the MACD indicator is still maintaining a buy signal and is likely to cut above the 0 threshold. If the indicator cuts above this threshold in the coming time, the situation will not be too pessimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD indicator is likely to cut above the 0 threshold

The VN-Index slowed its uptrend with a slight loss in the context of trading volume continuing to fall below the 20-day average. This shows that the cash flow participating in the market is still very limited.

However, the MACD indicator is still maintaining a buy signal and is likely to cut above the 0 threshold. If the indicator cuts above this threshold in the coming time, the situation will not be too pessimistic.

HNX-Index – Trading volume fluctuates erratically

The HNX-Index edged down while staying above the Middle line of the Bollinger Bands. If, in the coming sessions, the index stays above this threshold along with trading volume holding firmly above the 20-day average, the outlook will not be too pessimistic.

Currently, the Stochastic Oscillator and MACD indicators continue to head up after giving buy signals. If this state continues, short-term risks will be reduced.

Money Flow Analysis

Fluctuations in smart money flow: The Negative Volume Index indicator of the VN-Index broke above the EMA 20 day line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuations in foreign capital flow: Foreigners continued to net sell in the trading session on December 03, 2024. If foreign investors maintain this action in the coming sessions, the situation will be more pessimistic.

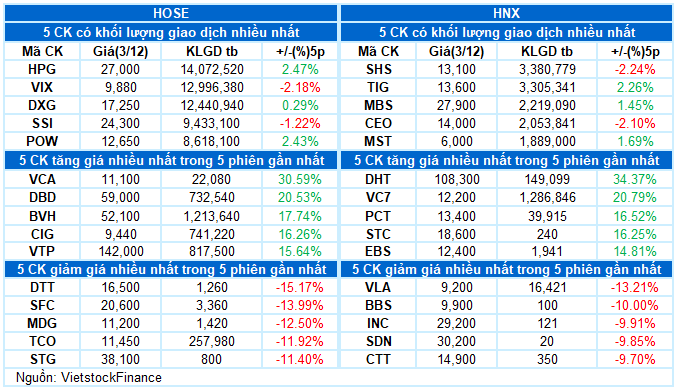

III. MARKET STATISTICS FOR DAY 12/03/2024

Economic Analysis & Market Strategy Department, Vietstock Consulting

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.

Market Beat: VN-Index Retreats to 1,240-Point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.

The Foreign and Proprietary Blocks: Strong Bottom-Fishing by Individual Cash Flow

Foreign investors net sold VND 711.5 billion today, with a net sell of VND 649.9 billion in matched orders. Meanwhile, individual investors net bought VND 917.1 billion…