Selling pressure to lower prices increased slightly in the afternoon session, pushing the VN-Index below the reference level at times with a dominant red breadth. However, once again, extremely low liquidity indicated that the buyers were mostly holding back, and when bottom-fishing money appeared, the recovery was easy.

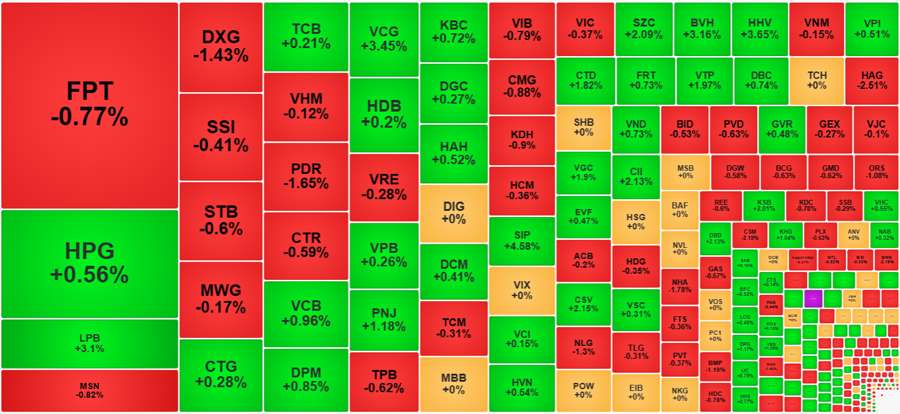

The VN-Index turned red around 1:50 PM and fell to its daily low at 2:20 PM. The index lost up to 2.7 points, reaching 1247.74 points. At the bottom, the breadth was recorded at 107 gainers and 256 losers. In the last 10 minutes and the ATC session, the index rebounded and closed with a gain of 0.75 points (0.06%) with 147 gainers and 221 losers.

Compared to the morning session’s close (151 gainers and 183 losers), the breadth in the afternoon was worse but not too bad. Among the 221 losing stocks, only 60 fell by more than 1%, higher than the morning session (46 stocks), but basically, they were stocks that had been weak since the morning. Very few stocks were sold off further. Moreover, the HoSE floor’s liquidity in the afternoon was relatively low, reaching nearly VND 4,676 billion in value, a decrease of 3.5% compared to the morning session and the lowest in the last 20 sessions.

Low liquidity and slight price declines continue to suggest that price movements are elastic from the buying side. Depending on the timing, the money pulled the bid price down and the sellers dominated, making the trading situation more negative, but not too bad. When the small selling wave ended, supply and demand balanced again, and stocks rebounded, maintaining a narrow fluctuation range. This state of small, gradual selling has persisted for the fourth consecutive session. In the last six trading sessions, the HoSE floor has had four sessions with a matching value below the 10,000 billion VND threshold.

The ability to maintain differentiation among stocks is quite favorable, as the selling pressure is not insignificant. For stocks with targeted cash flow, it is not difficult to balance or even push prices higher. For example, today, among the real estate group, DXG, PDR, HAG, and NLG were among those with the highest liquidity and deepest price drops. In contrast, VCG, SZC, HHV, VGC, CII, KHG, LCG, LHG, and KBC continued to rise. It was a similar story with banks, where the number of gainers, losers, and references was almost equal. Securities stocks also fluctuated…

Overall, the vast majority of stocks, despite ending in the red today, experienced only minor losses. The 60 stocks that fell by more than 1% accounted for only about 16.4% of the stocks in the VN-Index and 7.3% of the total trading value on the HoSE floor. The small price movements and low liquidity suggest that supply and demand remain balanced, and neither side is willing to act more aggressively.

Foreign investors also shifted to a balanced trading state in the afternoon, different from the morning session. Specifically, they sold an additional VND 736 billion but also bought VND 726 billion, resulting in a net sell value of only VND 10 billion. In the morning session, they had net sold VND 294.8 billion. However, this was still a strong net sell session after six consecutive net buy sessions, with a value of about VND 1,011 billion, just on the HoSE floor.

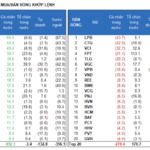

Their net selling was also concentrated in FPT – a stock that was strongly net bought last week. FPT was net sold by about VND 89 billion in the afternoon, bringing the total net sell value for the day to VND 164.1 billion. Other stocks were also net sold slightly, but basically, the scale remained from the morning session. Specifically, VRE -67.5 billion, KDH -49.9 billion, VCB -47.8 billion, STB -43.3 billion, HPG -42.8 billion, and NLG -22.3 billion. On the buying side, CTG +57.8 billion, PNJ +52.4 billion, TCB +48 billion, LPB +38.9 billion, VPB +32.3 billion, and TLG +20.1 billion.

The market has been rising almost continuously for the past nine sessions, causing investors who have not had a chance to buy to be in a state of waiting and doubting. As the VN-Index advances into a technical resistance zone, there is a probability of a pullback. However, the selling pressure is too weak, so prices have mostly fluctuated. The magnitude of the decline was not enough to attract buyers, so the waiting sentiment remained. The difference in prices has kept liquidity at a very low level, but there are still no signs that the market will “collapse.”

The Foreign Block Turns Net Sellers After 6 Consecutive Buying Sessions, Dumping Real Estate Across the Board

Liquidity on the three exchanges reached 13.4 trillion VND, with foreign investors selling a net of 310.2 billion VND after six consecutive sessions of net buying of over 424.5 billion VND.

Market Beat: A Tale of Diverging Fortunes, VN-Index Revisits 1,251 Points

The market ended the session on a positive note, with the VN-Index climbing 0.75 points (0.06%) to reach 1,251.21; the HNX-Index also rose, by 0.68 points (0.3%), closing at 225.32. The market breadth tilted towards decliners, with 373 tickers in the red and 319 in the green. The large-cap basket, VN30, witnessed a dominant performance, as evident in the 17 gainers, 9 losers, and 4 unchanged stocks.