Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 388 million shares, equivalent to a value of more than 9.5 trillion VND; HNX-Index reached over 33.6 million shares, equivalent to a value of more than 610 billion VND.

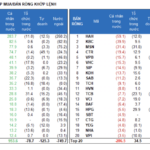

VN-Index continued to fluctuate around the reference level at the beginning of the afternoon session but closed in the green. In terms of impact, VCB, LPB, BVH, and HPG were the most positive influences on the VN-Index, contributing over 2.3 points. On the other hand, FPT, BID, GAS, and MSN had the most negative impact, taking away 1.1 points from the index.

| Top 10 stocks with the most significant impact on the VN-Index on 02/12/2024 |

Similarly, the HNX-Index also showed positive momentum, with a positive impact from stocks such as DHT (+9.94%), PVI (+1.62%), HGM (+8.67%), and MBS (+1.07%)…

|

Source: VietstockFinance

|

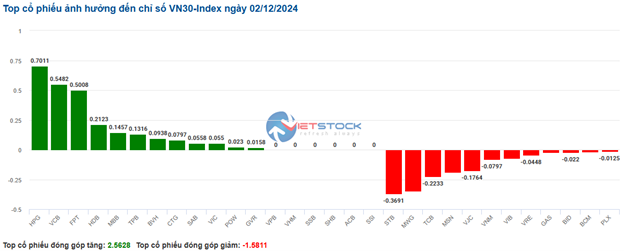

The telecommunications sector was the group with the strongest gain, up 2.25%, mainly driven by stocks such as VGI (+2.87%), YEG (+1.36%), FOX (+0.36%), and ELC (+0.95%). This was followed by the healthcare and materials sectors, with increases of 1.6% and 0.44%, respectively. On the other hand, the industrial sector saw the most significant decline in the market, falling by 0.87%, mainly due to ACV (-2.61%), VJC (-0.1%), MVN (-1.36%), and VEF (-0.86%).

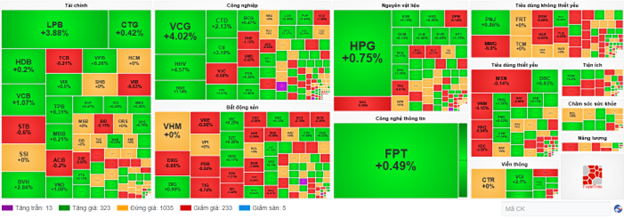

In terms of foreign investors’ activities, they net sold over 421 billion VND on the HOSE exchange, focusing on stocks such as FPT (164.07 billion VND), VRE (67.66 billion VND), HPG (58.99 billion VND), and KDH (58.07 billion VND). On the HNX exchange, foreign investors net sold 410 million VND, mainly offloading PVS (9.32 billion VND), LAS (1.84 billion VND), BVS (1.83 billion VND), and DTD (980 million VND).

| Foreign investors’ buying and selling activities |

Morning session: Returning to a divided scenario

The market was divided, and trading slowed down towards the end of the morning session. At the midday break, the VN-Index trimmed its gains from over 7 points earlier to just 1.72 points, standing at 1,252.2 points; the HNX-Index also inched up 0.26% to 225.24 points. The market breadth was relatively balanced, with 296 gainers, 277 losers, and 1,012 stocks ending unchanged.

The matching volume of the VN-Index in the morning remained low, reaching over 200 million units, equivalent to a value of more than 4.8 trillion VND. The HNX-Index recorded a matching volume of nearly 17 million units, with a value of over 294 billion VND.

In terms of impact, VCB and LPB were the two main pillars supporting the indices in the morning, with these two stocks alone contributing 2 points to the VN-Index. Meanwhile, no names had a particularly notable negative impact.

The sectors that attracted good buying interest last week continued their positive momentum this morning, including healthcare, telecommunications, and insurance. However, money flows became more selective, focusing on standout stocks such as DHT and TTD, which hit the daily limit, DHG (+1.29%), IMP (+0.78%), DBD (+1.95%); VGI (+1.44%), FOX (+0.82%), YEG (+1.36%); BVH (+2.74%), PVI (+1.01%), MIG (+1.93%), and BLI (+3.09%).

It is worth noting that stocks related to public investment are making a comeback after a long period of inactivity, following the National Assembly’s passage of the amended Public Investment Law last week. Many stocks witnessed strong breakouts, such as HHV (+4.11%), PLC (+3.9%), VCG (+3.45%), C4G (+3.95%), KSB (+2.87%), FCN (+2.44%), etc. Most other sectors were divided, with stocks fluctuating slightly around the reference level.

Foreign investors net sold nearly 278 billion VND on the HOSE exchange this morning, with FPT being the most sold stock after a previous buying streak. On the HNX exchange, foreign investors net sold over 17 billion VND, focusing their sales on PVS.

10:40 am: The early morning rally narrowed, and net selling by foreign investors prevailed.

Selling pressure re-emerged, narrowing the early morning gains. Currently, the main indices are fluctuating around the reference level. As of 10:30 am, the VN-Index rose slightly by 2.12 points, trading around 1,252 points. The HNX-Index gained 0.88 points, trading around 225 points.

Stocks in the VN30 basket were divided, with 14 gainers, 13 losers, and 3 unchanged. Specifically, HPG, VCB, FPT, and HDB contributed 0.7 points, 0.54 points, 0.5 points, and 0.21 points to the index, respectively. Conversely, STB, MWG, TCB, and MSN had the most significant negative impact, taking away more than 1.1 points from the VN30-Index.

Source: VietstockFinance

|

Telecommunications stocks led the market’s advance, rebounding by 1.65%. However, the sector’s breadth was somewhat divided. Buying interest concentrated on large-cap stocks such as CTR, which rose by 0.25%, VGI by 1.99%, FOX by 1.13%, and ELC by 0.57%…

On the other hand, a section of small-cap stocks remained stagnant, including VTK, ONE, ABC, and SED… Meanwhile, selling pressure persisted in some stocks, including MFS, which fell by 0.83%, TTN by 1.62%, ICT by 1.13%, and VNZ by 1.31%…

Currently, the telecommunications sector has the highest return on the market since the beginning of the year, with a gain of over 300%. It is on a recovery path, returning to its previous long-term uptrend after a sharp decline in July-August 2024.

Source: VietstockFinance

|

Following closely, healthcare stocks also posted a solid gain, and the sector’s breadth was divided, with most stocks ending unchanged. Buying interest focused on several large-cap stocks, including DHT, which rose by 9.83%, DHG by 1.78%, IMP by 0.33%, and DVM by 1.27%. Meanwhile, other stocks remained slightly in the red, such as FIT, which fell by 0.24%, DVN by 0.39%, and AGP by 0.26%.

Compared to the opening, buyers and sellers were locked in a tight battle, with over 1,000 stocks ending unchanged, and buyers slightly gaining the upper hand, with 323 stocks advancing (including 13 at the ceiling) against 223 declining (including 5 at the floor).

Source: VietstockFinance

|

Additionally, as of 10:30 am, foreign investors net sold over 109 billion VND. Notably, selling pressure was seen in FPT (36.01 billion VND), HPG (21.59 billion VND), VRE (21.45 billion VND), and VCB (13.52 billion VND). Conversely, PNJ, LPB, and CTG were the most net bought stocks, with a total net buying value of over 85 billion VND.

Source: VietstockFinance

|

Opening: Positive start

At the opening of the trading session on December 2, 2024, the VN-Index started in the green, reaching 1,256.48 points. Meanwhile, the HNX-Index edged slightly higher, staying at 225.97 points.

The basket of VN30 stocks was mostly positive, with 3 decliners, 23 gainers, and 4 unchanged stocks. Specifically, VJC, VIB, and VHM were the top losers, while BVH, VCB, and HPG were the best performers.

Telecommunications services stocks were among the most prominent sectors at the opening. Many stocks in this sector advanced from the beginning of the session, such as VGI, which rose by 2.87%, CTR by 1.26%, MFS by 0.55%, ELC by 1.15%, and YEG by 0.45%…

Along with this, healthcare stocks also contributed positively to the market’s performance this morning. Notably, stocks like DHT surged by 9.39%, TNH by 0.49%, DVM by 1.27%, and IMP by 0.33% saw gains, while the remaining stocks remained unchanged.

Market Beat: VN-Index Surges Past Challenges, Up Over 6 Points

The VN-Index faced significant pressure in the first half of the morning session, even briefly dipping below the 1,240-point mark. However, a swift turnaround saw the index overcome these challenges and close 6.41 points higher at 1,246.82.

Market Beat: VN-Index Retreats to 1,240-Point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.

The King of Stocks is Snubbed in November

The lackluster trading environment has dampened the price performance of bank stocks in the past month.