|

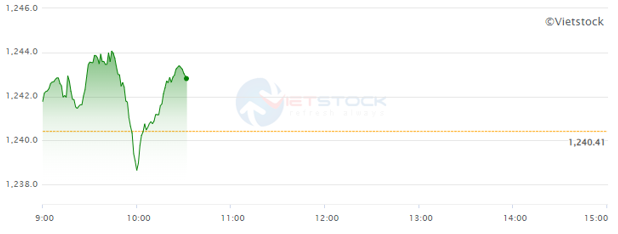

VN-Index Surges in the Latter Half of the Morning Session

Source: VietstockFinance

|

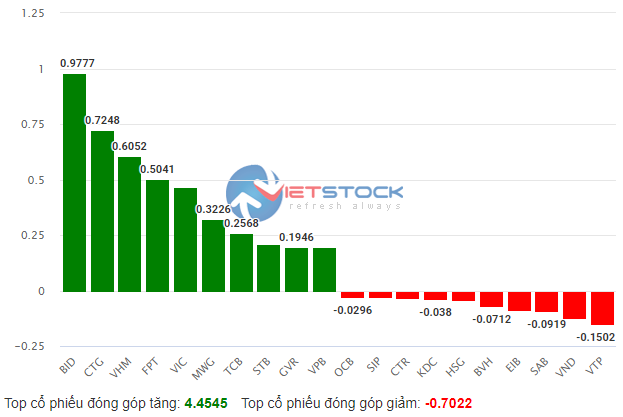

Major contributors to the index’s gain included BID with nearly 1 point, CTG with over 0.7 points, VHM with more than 0.6 points, and FPT with over 0.5 points. The top 10 stocks with the most positive impact on the VN-Index brought in nearly 4.5 points.

|

Top Stocks Influencing the VN-Index

Source: VietstockFinance

|

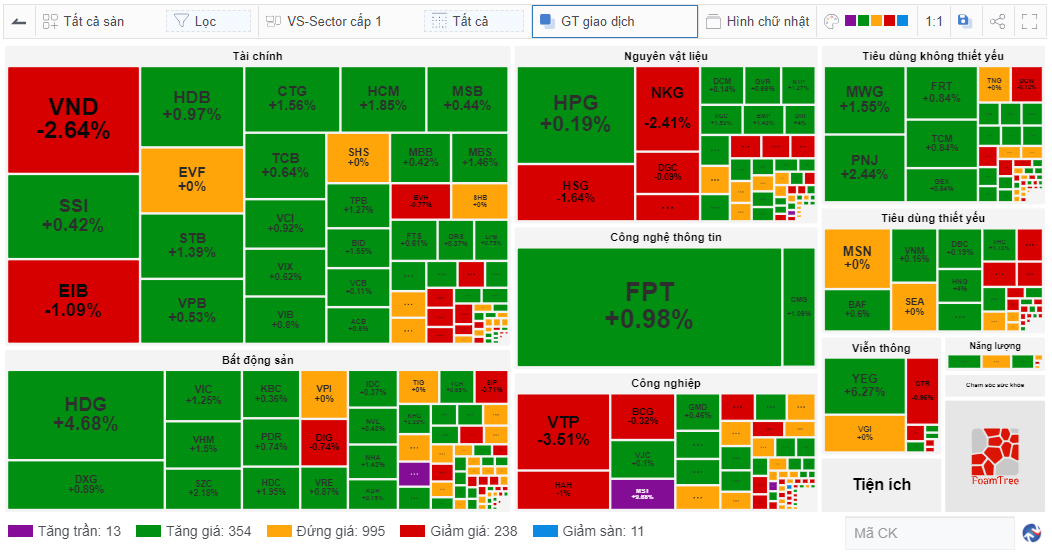

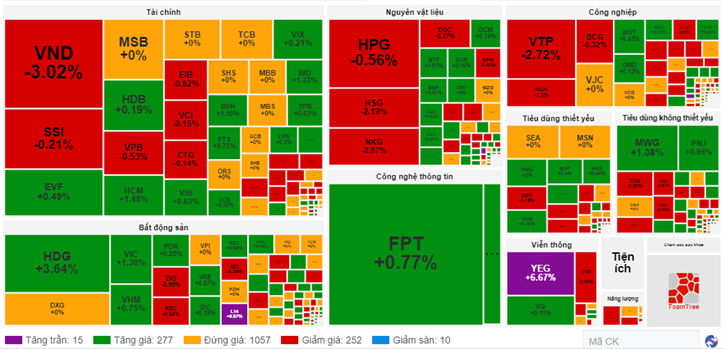

Banking and securities stocks continued to closely follow the index’s movement, with most stocks ending in positive territory. Notable gainers included CTG, up 1.56%, HCM, up 1.85%, STB, up 1.39%, and SSI, up 0.42%. Rare decliners included VND, down 2.64%, and EIB, down 1.09%.

Real estate stocks showed more consensus, with HDG leading the gains at 4.68%, followed by VIC at 1.25%, VHM at 1.5%, SZC at 2.18%, HDC at 1.95%, and DXG at 0.89%.

Additionally, the non-essential consumer goods sector also witnessed positive momentum, with PNJ rising 2.44%, MWG up 1.55%, FRT gaining 0.84%, and TCM increasing by 0.84%. The information technology sector also saw gains, led by FPT, which rose by 0.98%.

Overall, the market recorded 367 stocks with price increases, including 13 stocks that hit the ceiling price, significantly outpacing the 249 declining stocks, of which 11 hit the floor price.

|

Market Map at the End of the Morning Session on December 5

Source: VietstockFinance

|

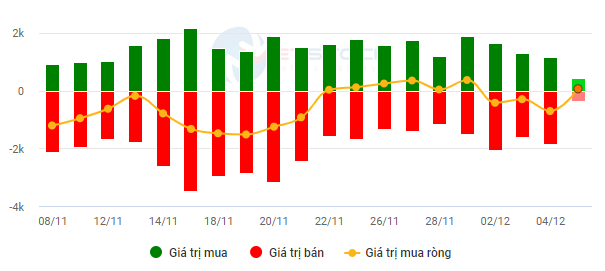

The market’s liquidity was not particularly remarkable, with over 300 million shares traded, equivalent to a value of nearly VND 6,518 billion, which was almost unchanged compared to the same period in previous sessions.

Foreign investors also significantly narrowed their trading scale, with net buying of just over VND 58 billion, as they bought over VND 420 billion and sold over VND 362 billion.

|

Foreign Investors Significantly Narrowed Their Trading Scale in the Morning Session of December 5

Source: VietstockFinance

|

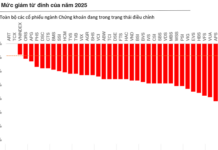

Opening: Mounting Pressure, Many Large-cap Stocks Turn Red

After a positive start, the market began to face increased pressure. As of 10:30 am, the VN-Index and HNX-Index managed to stay in positive territory, recording gains of 2.41 points and 0.2 points, respectively, reaching 1,242.82 and 224.82. Meanwhile, the UPCoM-Index turned red, losing 0.08 points to 92.36.

|

VN-Index Faces Mounting Pressure After Initial Enthusiasm

Source: VietstockFinance

|

The mounting pressure was evident as the number of declining stocks accelerated to 262, including 10 stocks hitting the floor price, while the number of advancing stocks stood at 292, including 15 stocks touching the ceiling price.

A glance at the market map revealed that many large-cap stocks were in the red, ranging from slight losses such as VCI (-0.15%), SSI (-0.21%), CTG (-0.14%), and VPB (-0.53%) to more substantial declines like HSG (-2.19%), NKG (-2.67%), VTP (-2.72%), and VND (-3.02%)…

On the upside, there weren’t many prominent names, but notable gainers included FPT, up 0.77%, MWG, up 1.38%, PNJ, up 0.96%, and HDG, up 3.64%…

|

Many Large-cap Stocks Turned Red

Source: VietstockFinance

|

In terms of contribution to the VN-Index, BID took the lead with a gain of 0.83 points, followed by VIC at 0.5 points and VCB at 0.4 points. On the flip side, HPG was the stock that took away the most points, but the impact was negligible, at just over 0.2 points.

Opening: Following Global Markets, VN-Index Edges Higher at the Start of the Session

In the first 30 minutes of December 5, the indices posted modest gains, with the VN-Index climbing 2.84 points (equivalent to a 0.23% increase) to 1,243.25, while the HNX-Index and UPCoM-Index also edged higher to reach 225.14 and 92.51, respectively.

Most stocks remained unchanged during the first 30 minutes, while 251 stocks advanced (including 10 stocks hitting the ceiling price, notably L14 and YEG) and 139 stocks declined (including 4 stocks touching the floor price). Overall, the market was painted in green.

The market’s liquidity at the opening was unremarkable, with nearly 34.6 million shares traded, corresponding to a value of over VND 777 billion.

In terms of sector performance, only 3 sectors declined and 3 sectors were unchanged, while 17 sectors posted gains. The specialized services and trading sectors led the advance with a 5% increase, driven by VEF‘s 6.19% jump. The insurance sector also rose sharply by 1.22% thanks to gains in BVH, BIC, PVI, VNR, MIG, and BMI, which all climbed between 1% and 2%. The media and entertainment sector also contributed significantly to the market’s performance, led by YEG.

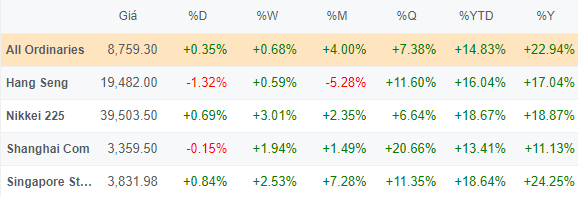

Asian markets, on average, were up 0.33% at the opening, but the picture was mixed. Notably, the Nikkei 225 rose 0.69% to 39,503.5, and the Singapore Straits Times climbed 0.84% to 3,831.98. In contrast, the Hang Seng dropped 1.32% to 19,482, and the Shanghai Composite slipped 0.15% to 3,359.5.

|

Asian Markets Opened with a Mixed Picture

Source: VietstockFinance

|

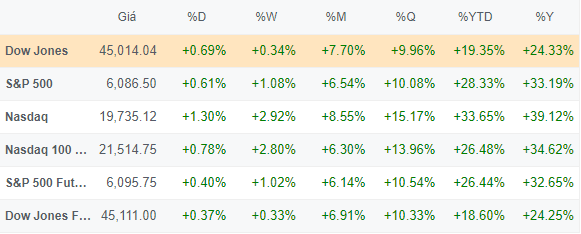

Wall Street closed on a positive note overnight, with technology stocks leading the rally following strong reports from Salesforce and Marvell Technology.

At the close of the trading session on December 4, the S&P 500 index rose 0.61% to 6,086.49, while the Nasdaq Composite gained 1.3% to 19,735.12. The Dow Jones index added 308.51 points (equivalent to a 0.69% increase) to close at 45,014.04, marking the first time the index crossed the 45,000 threshold.

|

Wall Street Closed with Enthusiasm

Source: VietstockFinance

|