Market liquidity increased compared to the previous trading session, with the matching trading volume of the VN-Index reaching more than 505 million shares, equivalent to a value of more than 11.9 trillion VND; HNX-Index reached more than 48.1 million shares, equivalent to a value of more than 865 billion VND.

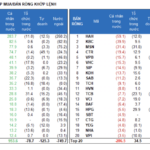

VN-Index opened the afternoon session with a continued lackluster performance as selling pressure increased, causing the index to plunge and close in the red. In terms of impact, BID, VHM, CTG, and MWG were the most negative stocks, taking away more than 3.3 points from the index. On the other hand, VCB, SAB, VTP, and PLX were the most positive stocks, contributing more than 1.4 points to the overall index.

| Top 10 stocks impacting the VN-Index on December 4, 2024 (in points) |

Similarly, the HNX-Index also witnessed a lackluster performance, with negative impacts from stocks such as IDC (-1.82%), DHT (-3.23%), MBS (-1.79%), and SHS (-1.53%)…

|

Source: VietstockFinance

|

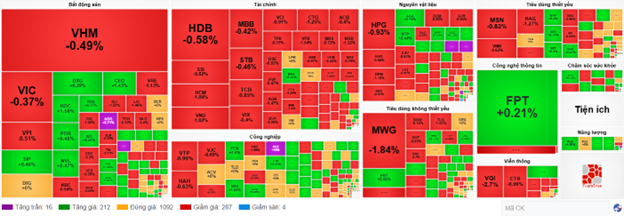

The information technology sector witnessed a sharp decline of 1.13%, mainly due to losses in stocks such as FPT (-1.03%), CMG (-3.09%), ITD (-1.53%), and CMT (-0.72%). This was followed by the real estate and telecommunications sectors, which decreased by 1% and 0.93%, respectively. On the other hand, the energy sector witnessed the strongest recovery in the market, gaining 0.46% with green signals from BSR (+1.04%), PSB (+1.85%), HLC (+1.67%), THT (+0.81%), and MGC (+3.64%). The utilities sector also witnessed a recovery, gaining 0.17%.

In terms of foreign trading, foreign investors continued to net sell more than 682 billion VND on the HOSE exchange, focusing on stocks such as MWG (250.38 billion), FPT (134.51 billion), VRE (82.24 billion), and VNM (71.14 billion). On the HNX exchange, foreign investors net sold more than 27 billion VND, focusing on IDC (26.12 billion), SHS (5.78 billion), PSW (1.69 billion), and NTP (1.2 billion).

| Foreign Trading Activity |

Morning Session: Large-cap Stocks and Foreign Selling Pressure Weigh on the Market

The strong selling pressure from large-cap stocks and foreign investors caused the VN-Index to remain in negative territory throughout the morning session, despite a notable recovery effort after touching the 1,240-point level. At the midday break, the VN-Index lost 2.3 points, closing at 1,247.53 points. Meanwhile, the HNX-Index fluctuated slightly above the reference level, reaching 225.57 points, a slight gain of 0.12%. The market breadth was tilted towards decliners, with 320 stocks decreasing and 245 stocks increasing.

CTG, BID, HPG, MWG, and VPB were the top losers and had a similar impact on the index, collectively causing the VN-Index to drop by approximately 2 points. On the other hand, VCB, SAB, and GAS contributed the most to narrowing the morning losses, recovering nearly 1.5 points for the VN-Index.

No sector stood out during the morning session, as most sectors exhibited mixed performances with narrow ranges. The telecommunications group witnessed the sharpest decline, pressured by stocks such as VGI (-0.76%), FOX (-2.03%), CTR (-0.64%), and SGT (-0.67%). However, VNZ (+1.91%) and YEG (+4.18%) managed to buck the trend and posted impressive gains.

Similarly, the real estate sector also witnessed bright spots, with AGG and L14 hitting the daily limit-up, while NTC (+3.23%), HDC (+2.57%), HDG (+1.75%), CEO (+1.43%), and SIP (+1.43%) also posted notable gains. However, the sector’s overall performance was dragged down by losses in large-cap stocks such as VHM, VRE, VIC, BCM, IDC, KDH, and NLG. The financial sector also exerted significant pressure on the VN-Index, with red signals across banking, securities, and insurance stocks, although most declines were mild. A few notable exceptions included BVH, VPB, VBB, VND, and VCI, which fell by more than 1%.

The energy, utilities, and information technology sectors managed to stay in positive territory by the end of the morning session. However, the gains were mostly driven by small-cap stocks, such as APP (+4.65%), AAH (+2.86%), PSB (+1.85%), MGC (+1.82%); TTA (+3.21%), KHP (+2.71%), and TDM (+1%). The remaining stocks in these sectors witnessed only minor fluctuations below 1%.

Foreign investors continued to net sell nearly 422 billion VND on the HOSE exchange, focusing their selling pressure on MWG (111.93 billion), VRE (59.59 billion), and FPT (52.70 billion). On the HNX exchange, foreign investors also net sold nearly 29 billion VND, mainly offloading IDC (17.9 billion).

10:30 AM: Selling Pressure in the Financial Sector; VN-Index Tests the 1,240-Point Level

The main indices exhibited mixed performances and fluctuated around the reference levels, reflecting investors’ cautious sentiment. As of 10:30 AM, the VN-Index decreased by 7.12 points, hovering around 1,242 points. Meanwhile, the HNX-Index gained 0.25 points, trading around 225 points.

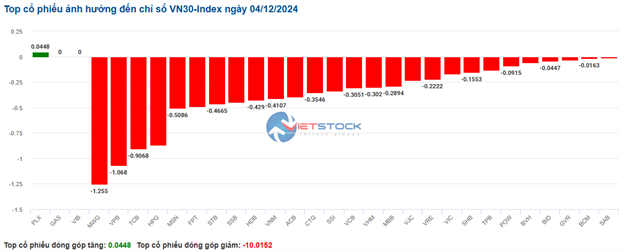

The majority of stocks in the VN30 basket traded in negative territory, with MWG, VPB, TCB, and HPG being the top losers, deducting 1.25 points, 1.06 points, 0.9 points, and 0.86 points from the VN30-Index, respectively. Conversely, PLX was the only stock in the basket that managed to stay in positive territory, but its impact on the index was not significant.

Source: VietstockFinance

|

Selling pressure persisted in the telecommunications sector, causing it to be the worst-performing sector in the market with a decline of 1.8%. Large-cap stocks in the sector, such as CTR, VGI, TTN, and ELC, witnessed notable losses, decreasing by 0.48%, 2.27%, 2.16%, and 0.75%, respectively.

Additionally, the financial sector faced significant headwinds, with most stocks trading in negative territory. Specifically, HDB declined by 0.58%, SSI decreased by 0.62%, VND fell by 1.82%, and HCM dropped by 0.73%… On the other hand, a few stocks managed to recover slightly, including LPB, which increased by 0.15%, FTS, up by 0.12%, and NAB, gaining 0.31%.

The real estate sector exhibited mixed performances, with selling pressure slightly outweighing buying interest. Specifically, stocks such as VRE decreased by 0.28%, KBC fell by 0.36%, VIC dropped by 0.35%, and VHM slipped by 0.24%… Conversely, buying interest remained robust in some stocks, including SIP, which rose by 0.6%, DIG, up by 0.49%, DXG, gaining 0.29%, and CEO, increasing by 2.14%…

Compared to the opening, the number of declining stocks outnumbered advancing stocks. There were 287 declining stocks and 212 advancing stocks.

Source: VietstockFinance

|

Market Open: Cautious Start to the Session

At the opening bell on December 4, as of 9:30 AM, the VN-Index edged slightly lower, hovering around the reference level, near the 1,247-point mark. Meanwhile, the HNX-Index posted a mild gain, maintaining the 225.6-point level.

The S&P 500 index edged slightly higher on Tuesday (December 3), setting a new record. Specifically, the S&P 500 index gained 0.05% to close at 6,049.88 points. The Nasdaq Composite rose 0.40% to 19,480.91 points, hitting a new intra-day record high as Apple shares surged to a new 52-week high. Both the S&P 500 and Nasdaq Composite indices reached new all-time closing highs. In contrast, the Dow Jones index lost 76.47 points (equivalent to 0.17%) to close at 44,705.53 points.

The VN30 basket witnessed a majority of stocks trading in negative territory, with 22 decliners, 5 gainers, and 3 stocks trading unchanged. Among the losers, SSB, MWG, and CTG were the top losers. Conversely, GVR, PLX, and GAS were the top gainers.

As of 9:30 AM, the telecommunications services sector was the top loser, negatively impacting the market performance. Specifically, stocks such as VGI decreased by 2.27%, CTR fell by 0.8%, FOX dropped by 0.2%, and ELC slipped by 1.12%…

The Foreign and Proprietary Blocks: Strong Bottom-Fishing by Individual Cash Flow

Foreign investors net sold VND 711.5 billion today, with a net sell of VND 649.9 billion in matched orders. Meanwhile, individual investors net bought VND 917.1 billion…