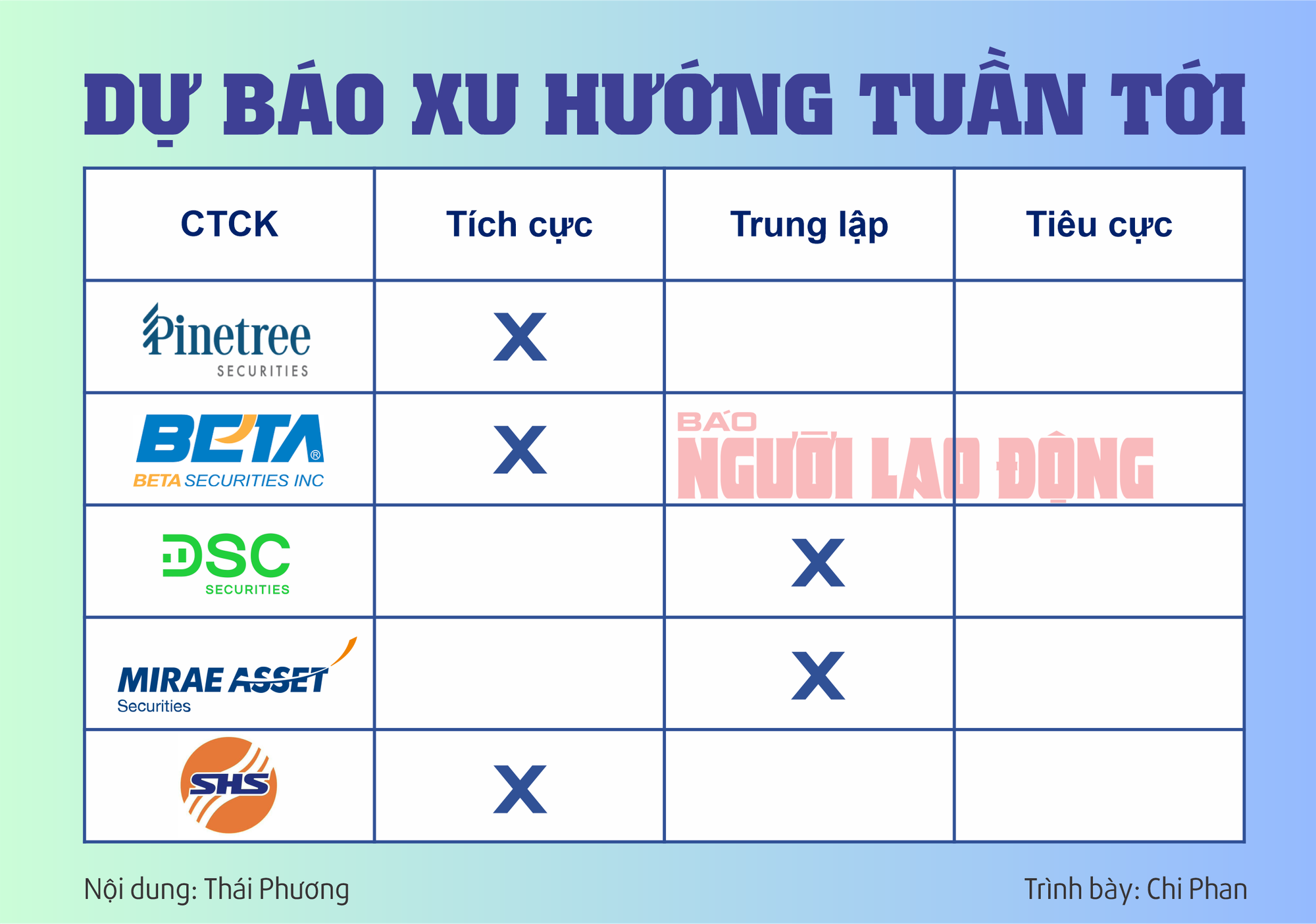

The VN-Index witnessed a strong recovery last week, closing the week’s trading at 1,250 points, a significant increase of 22.36 points from the previous week. The HNX-Index also rose, ending at 224.64 points, up by 3.35 points.

The banking sector was a notable contributor to the market’s gains. The robust recovery of pillar stocks, particularly those with large market capitalization, played a crucial role in driving the upward trend. Analysts attribute this to the enduring appeal of blue-chip stocks, which has fostered a sense of optimism among investors.

While liquidity has not fully recovered, a bright spot for the market is the return of foreign capital after a series of strong net selling days. Foreign investors net bought over VND 1,040 billion, focusing on FPT, MSN, CTG, and others.

Many investors expressed surprise at the market’s V-shaped recovery, raising hopes for a more vibrant VN-Index in the final stretch of the year.

Market Beat: A Tale of Diverging Fortunes, VN-Index Revisits 1,251 Points

The market ended the session on a positive note, with the VN-Index climbing 0.75 points (0.06%) to reach 1,251.21; the HNX-Index also rose, by 0.68 points (0.3%), closing at 225.32. The market breadth tilted towards decliners, with 373 tickers in the red and 319 in the green. The large-cap basket, VN30, witnessed a dominant performance, as evident in the 17 gainers, 9 losers, and 4 unchanged stocks.

The Power of Persuasive Writing: Crafting Compelling Headlines

A good headline should be like a powerful magnet, attracting readers’ attention and leaving them intrigued. It should be a delicate balance of creativity and clarity, enticing readers to want to learn more.

The VN-Index has been on a consistent upward trajectory since surging above the Middle Bollinger Band. If, in upcoming sessions, the index remains above the 200-day SMA, coupled with improved trading volume, this bullish trend will be further reinforced. Currently, the Stochastic Oscillator and MACD indicators continue to ascend, having already signaled a buy. Should this status quo persist, the positive short-term outlook is here to stay.