After a long wait, investors who were sitting on the sidelines finally witnessed a significant market correction. Selling pressure intensified during the afternoon session, resulting in a broad-based decline across stocks, with the VN-Index shedding 9.42 points and the number of losing stocks more than doubling the number of gainers.

The VN-Index closed at its intraday low, indicating a substantial increase in selling pressure during the afternoon. Moreover, trading volume on the two main exchanges surged by nearly 38% in the afternoon compared to the morning session. HoSE, in particular, witnessed a 39% surge in trading value, reaching 6,952 billion VND. This was also the highest matched order value in the past nine sessions on this exchange.

The weakness in the blue-chip group remained the primary factor driving the VN-Index into a clear correction. The VN30-Index closed 0.87% lower, with only five gainers out of 25 losing stocks. While the breadth didn’t change much from the morning session’s close (six gainers and 22 losers), statistics showed that 21 stocks fell to lower prices in the afternoon compared to the morning.

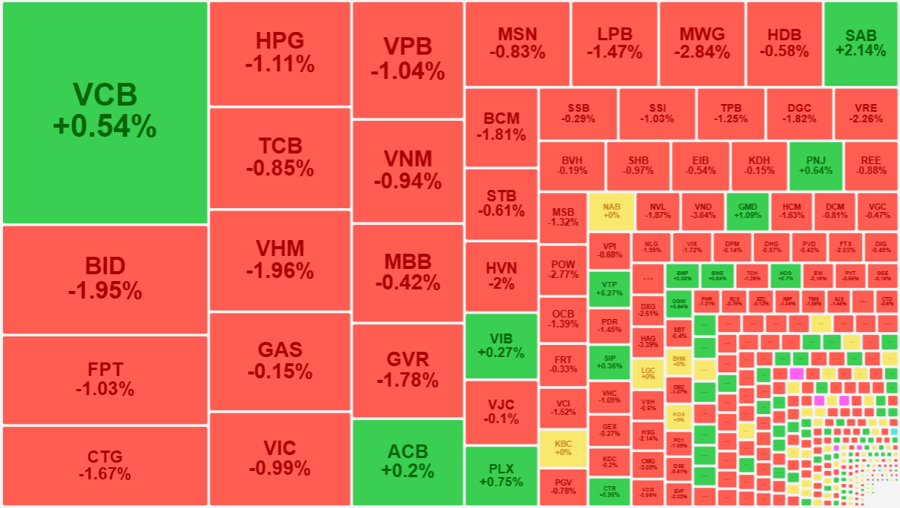

Several large-cap stocks witnessed sharp declines: VHM, which was down only 0.37% in the morning, fell another 1.6% in the afternoon. BID extended its losses from a 0.65% drop in the morning to close at -1.95%. FPT, which was still marginally up 0.28% at noon, tumbled continuously in the afternoon and ended the day 1.03% lower… Twelve stocks in the VN30 basket fell more than 1%, compared to five in the morning session. The group of worst performers included large-cap stocks from the Top 10 by market capitalization: BID, FPT, CTG, HPG, VHM, and VPB. Fortunately, VCB managed to stay in positive territory, rising 0.54%, while SAB gained 2.14%, partially offsetting the losses.

The banking and securities sectors experienced significant selling pressure during this session, with many stocks witnessing sharp declines. Out of the 27 banking stocks, only six managed to stay in positive territory, while the rest fell into the red, with nine stocks dropping more than 1%. In the securities sector, only two stocks, BMS and EVS, remained in the green, while about 20 stocks fell by over 1%. Additionally, many other stocks across different sectors witnessed high trading volume. At the close of the session, HoSE had 41 stocks with trading values of 100 billion VND or more, out of which only eight managed to stay in positive territory, while the rest declined.

The breadth of the VN-Index deteriorated significantly in the afternoon, with only 109 gainers versus 281 losers. Among these, 107 stocks fell by more than 1% and accounted for 53.6% of the total matched order value on the exchange. This reflects the increase in selling pressure, with some stocks even witnessing panic selling. MWG, VND, DXG, VRE, CMG, and HSG were among the stocks that experienced sharp declines amid high trading volume.

On the upside, there weren’t many changes compared to the morning session, as the gainers remained mostly low-volume stocks. HAH, with a trading value of 236.6 billion VND, increased by 4.49%; VTP rose 6.27% with a trading value of 153.5 billion VND; HDC gained 1.58% with a trading value of 99.9 billion VND; SAB climbed 2.14% with a trading value of 79.1 billion VND; and YEG, with a trading value of 78.2 billion VND, advanced by 6.69%. The group of stocks that hit the daily limit-up included AGG, APH, HTN, and VCA. Mid-cap stocks with relatively small trading volumes that also witnessed gains included VOS, BMP, AAA, GMD, NHA, DCL, and TTA.

The phenomenon of stock price divergence that had been observed in previous sessions was less evident today. The presence of sellers offloading large volumes put significant downward pressure on stock prices, resulting in a broader decline. The possibility of divergence now relies on the strength of bottom-fishing funds and the ability to limit the downside. Notably, 107 stocks witnessed sharp declines of more than 1%, accounting for approximately 28.9% of the total number of stocks traded on the VN-Index.

Foreign investors continued to offload their positions in the afternoon session, although the net selling position decreased in size. Specifically, they sold 884.4 billion VND worth of stocks while buying 671.8 billion VND worth of stocks, resulting in a net sell position of 212.6 billion VND. In the morning session, they had already sold a net of 438.1 billion VND. Combined across all three exchanges today, foreign investors withdrew a net of 690 billion VND, with HoSE accounting for 650.7 billion VND of this amount. The stocks that witnessed the largest net selling by foreign investors were MWG (-260 billion VND), FPT (-134.3 billion VND), VRE (-82.7 billion VND), VNM (-75.2 billion VND), NLG (-46.7 billion VND), VCB (-45.1 billion VND), CMG (-34.3 billion VND), HSG (-33 billion VND), HDB (-29.9 billion VND), VHM (-24.4 billion VND), and BID (-23.1 billion VND). On the buying side, the stocks that witnessed net buying were HAH (+72.4 billion VND), MSN (+66 billion VND), TCB (+43.6 billion VND), KBC (+30.4 billion VND), VPB (+27.1 billion VND), and SIP (+22.5 billion VND).

Today’s loss of 9.42 points on the VN-Index marks the first clear corrective session within the ongoing recovery trend. The index managed to hold above the 1240-point level, and the matched order volume increased by 4.2% compared to the previous session. This was the highest matched order volume in the past ten sessions on HoSE, indicating the presence of bottom-fishing funds entering the market.

The Stock Market Blog: Late-Stage Money Flow Opportunities

The market witnessed the first significant drop in what has been a recovery rally from the 1200-point lows. After several choppy sessions and intraday pullbacks, the sellers stepped up their game and exerted notable pressure…

The VN-Index Struggles Around 1260 Points, Selling Pressure Remains Subdued

The market witnessed another downward slide during the morning session, with selling pressure mounting but not yet overwhelming. Trading liquidity on the HoSE fell by 10% compared to the previous session, reaching only VND 4,843 billion, with the large-cap stocks bearing the brunt of the impact.

Drip Feed Selling, VN-Index Turns Green at the Last Minute, Foreigners Dump Again

Selling pressure mounted slightly in the afternoon session, pushing the VN-Index briefly into negative territory with a sea of red on the screen. However, the extremely low trading volume indicated that buyers were mostly sitting on the sidelines, and the market was quick to rebound as bottom-fishers jumped in.