Gold prices were largely unchanged during the December 3 trading session, hovering at $2,636.50 per ounce after a 1% decline on Monday. US gold futures held steady at $2,659.00.

A stronger US dollar made gold bullion priced in the greenback more expensive for overseas buyers.

This week’s critical US data includes the ADP employment report and the jobs report, culminating in the payrolls report at week’s end.

“Gold is treading water awaiting fresh catalysts… The next move could be dictated by Fed rate cut expectations. There is the possibility of another 25-basis-point cut this month. Investors are also awaiting data on 2025 rate easing,” said Ilya Spivak, head of Macro Strategy at Tastylive.

Global gold prices stagnate after a plunge.

On December 2, Fed Governor Christopher Waller signaled support for another rate cut later this month, stating that with inflation expected to remain below 2%, a further reduction is warranted. In contrast, New York Fed President John Williams suggested that a continued neutral policy stance is most appropriate.

These comments pushed investor expectations of a Fed rate cut at the December 17-18 meeting to nearly 75%. Gold tends to benefit from low-interest rates and periods of geopolitical uncertainty.

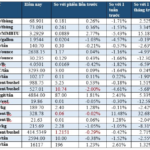

Spot silver prices edged up 0.1% to $30.51 per ounce, while platinum fell 0.3% to $944.35, and palladium dropped 0.2% to $979.72.

In the energy market, Brent crude futures rose 14 cents, or 0.19%, to $71.97 a barrel, after falling one cent in the previous session. US West Texas Intermediate crude increased by eight cents, or 0.12%, to $68.18, following a ten-cent gain on Monday’s close.

“Investors are in a wait-and-see mode ahead of the OPEC+ meeting. This is having a strong impact on gold prices,” ANZ analysts said.

According to Reuters

The Golden Opportunity: Unveiling the Power of Words in the Digital Age

On the morning of November 28, domestic gold prices reversed course and fell after a strong recovery in the previous session.

The Market on Nov 30th: Oil Slides, Gold Gains, Iron Ore Hits 1-Month High

“Oil prices fell on Nov 29, 2022, as concerns over supply risks eased. Gold rallied on a weaker dollar and geopolitical tensions. Copper prices edged higher but were still on course for a second straight monthly loss. The price of iron ore on the Dalian exchange rose on a resilient Chinese economic outlook, posting a weekly gain. Robusta coffee prices fell back after reaching their highest level in over two months. Export prices for rice rose in India and Thailand. Japanese rubber prices declined amid demand concerns.”