Trung Nam Investment and Construction Joint Stock Company (Trung Nam Group) has just announced periodic financial information for 2023 related to the offering and trading of corporate bonds.

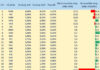

According to the separate financial statements, as of the end of 2023, Trung Nam Investment and Construction’s equity reached VND 21,440.5 billion, a 9% decrease compared to the end of 2022 (VND 23,651.4 billion). The debt-to-equity ratio stood at 0.77.

The bond debt-to-equity ratio at the end of 2023 was 0.14, corresponding to a bond debt of VND 3,001.6 billion.

Notably, the company reported a tax profit of VND 241.6 billion in 2022, but a tax loss of VND 2,120.5 billion in 2023. In 2021, the company also reported a profit of over VND 1,600 billion.

The consolidated financial statements as of the end of 2023 showed that Trung Nam Group’s equity reached VND 24,289.6 billion, a 12.9% decrease compared to the previous year (VND 27,914 billion). The debt-to-equity ratio was 2.68.

The bond debt-to-equity ratio was 0.75, corresponding to a bond debt of VND 18,217.2 billion.

The after-tax profit in 2023 was negative VND 2,878.2 billion, while it was VND 252 billion in the previous year.

As of the end of 2023, the after-tax profit margin (ROE) was -11.85%, compared to 0.91% in the same period last year.

Established in 2004, Trung Nam Group has a diverse ecosystem with five main business areas: Energy, Infrastructure, Construction, Real Estate, and Information Technology Industry.