Speaking at the Khớp lệnh program on December 2, 2024, expert Tran Hoang Son, Market Strategy Director of VPBank Securities JSC, pointed out that the VN-Index had gained over 40 points from the 1,200 bottom, but liquidity showed no signs of recovery. Therefore, this is still a short-term rebound.

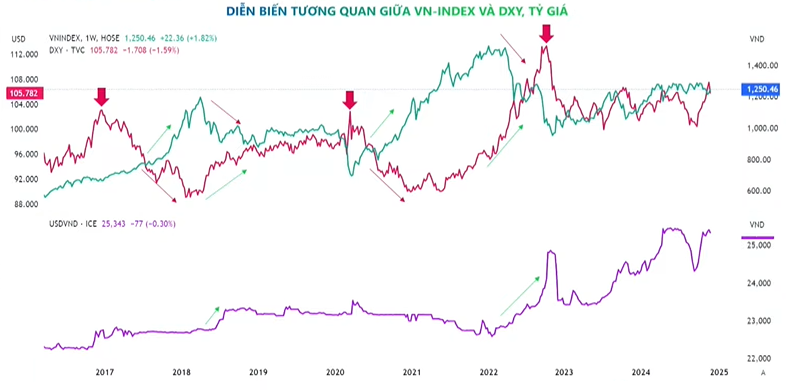

Looking back at the exchange rate story, the most positive development last week (November 25-29, 2024) was when Donald Trump chose Scott Bessent as his expected new Secretary of the Treasury. The US dollar immediately showed signs of cooling off, and the yield on 10-year US government bonds fell back, causing foreign capital flows to return to the Vietnamese market.

According to Mr. Son, foreign investors’ actions closely follow the trends in international financial markets, international capital flows, and the strength of the US dollar.

Specifically, international capital flows have returned to Vietnam relatively clearly, alongside India, in a region that is experiencing strong outflows. As for the US dollar, it fell more than 1% from its peak last week.

Looking back, every time the DXY index peaked and fell, the VN-Index often showed signs of bottoming out and rising.

Source: VTV Money

|

In the context of a recovering market, the VN-Index is touching strong resistance at 1,255-1,265 but is not accompanied by good liquidity. Mr. Son expects the market to find a more balanced pace in the short term as the exchange rate temporarily stabilizes and even cools down in the coming time.

The positive scenario is that the index retests the 1,250-1,255 area, builds a base, and accumulates with increasing liquidity, confirming a continued recovery signal by the end of 2024. However, breaking above the 1,300 threshold in the last month of the year remains challenging.

Foreign investors reduced their selling and returned to net buying last week, while domestic money remained relatively cautious. Therefore, when the DXY index cools down further and foreign investors’ net buying signal strengthens, liquidity will pick up again.

Looking ahead to 2025, Mr. Son believes that the Vietnamese market still has many positive stories, such as trading system changes, upgrades, and positive GDP growth. Therefore, corrective phases are opportunities to buy.

Source: VTV Money

|

Mr. Son assessed that not every time foreign investors sell heavily, the market goes down. A typical example is their net selling of over $2 billion during the cheap money phase from 2020 to 2021, but the market still climbed to new highs.

In terms of capital flow structure, there were many periods in 2023 and 2024 when foreigners net sold, and individuals in the country bought them. Last week, when foreigners returned to net buying, individuals and domestic organizations also net bought, indicating the market’s attraction at a reasonable discount.

Mr. Son expects domestic capital to be the driving force to support the market from falling too deeply in 2024 and possibly stabilizing and accumulating to move up in 2025.

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.

Market Beat: VN-Index Retreats to 1,240-Point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.

The Foreign and Proprietary Blocks: Strong Bottom-Fishing by Individual Cash Flow

Foreign investors net sold VND 711.5 billion today, with a net sell of VND 649.9 billion in matched orders. Meanwhile, individual investors net bought VND 917.1 billion…