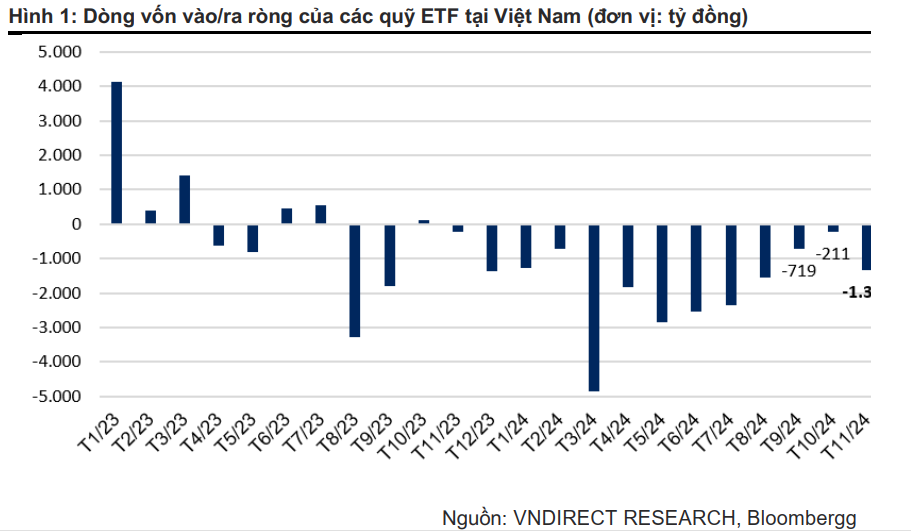

Widespread Decline in ETF Capital

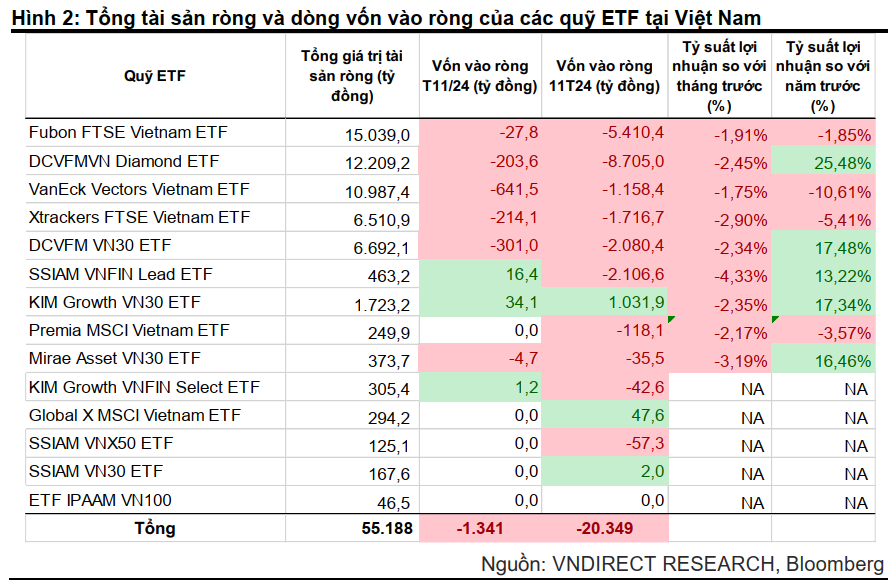

According to the latest report by VNDIRECT Research, ETFs in Vietnam experienced a net capital outflow of 1,341 billion VND in November, bringing the total net outflow for the first 11 months to 20,300 billion VND.

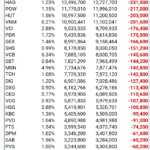

VanEck Vector Vietnam ETF (VNM ETF) faced the strongest capital outflow pressure with 641 billion VND, followed by DCVFM VN30 ETF (300 billion VND), Xtrackers FTSE Vietnam ETF (214 billion VND), and DCVFM VN Diamond ETF (203 billion VND).

Only two smaller funds recorded net inflows: KIM Growth VN30 ETF (34 billion VND) and SSIAM VNFIN Lead ETF (16 billion VND). In terms of size, the three largest funds in the market remain Fubon FTSE Vietnam ETF (15,039 billion VND), DCVFM VN Diamond ETF (12,209 billion VND), and VanEck Vectors Vietnam ETF (10,987 billion VND).

Foreigners Intensify Selling

In parallel with ETF capital, foreigners also increased their net selling to 11,800 billion VND in November, of which ETFs accounted for 11.3%. Cumulatively for the first 11 months, the net selling value of foreigners has reached nearly 89,800 billion VND.

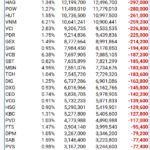

Specifically, they net sold 12,004 billion VND on HOSE and 342 billion VND on HNX, while net buying lightly 460 billion VND on UPCoM. The codes that were sold off the most included VHM, SSI, MSN, HDB, and VCB. On the other hand, CTG, MCH, HDG, TCB, and DPM were the codes that were net bought the most.

According to VNDIRECT Research, the widespread capital withdrawal trend is believed to be due to the strengthening of the US dollar index after Donald Trump’s victory in the US presidential election. The market is concerned that policies to increase tariffs on imports could push up US inflation, limiting the Fed’s monetary easing ability.

However, positive signals emerged at the end of November with the expected appointment of Scott Bessent as US Treasury Secretary. The market expects him to take a more flexible approach on tariffs, easing pressure on the US dollar and US bond yields, thereby potentially attracting foreign capital back to the Vietnamese market.

Vu Hao

When Will the $100 Million ETF Stop Selling?

The period from November 18-25 marked yet another week of net selling for the VanEck Vectors Vietnam ETF (VNM ETF), as the fund offloaded Vietnamese stocks for the fifth consecutive week amidst robust foreign net selling. However, with foreign investors showing signs of returning to the market, is the fund’s selling spree finally coming to an end?

The Foreign Block: A 28-Session Sell-Off Streak and the Continued Unwinding of the Million-Dollar ETF

The week of November 11–18, 2024, marks yet another significant period of aggressive selling by the VanEck Vectors Vietnam ETF (VNM ETF). This is the fourth consecutive week of net selling by the fund, coinciding with a prolonged period of foreign investor selling spanning dozens of sessions.