Foreign Sell-Off Continues in November: A Comprehensive Overview

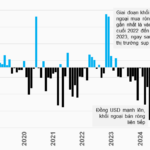

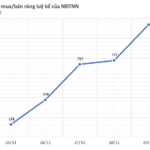

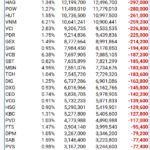

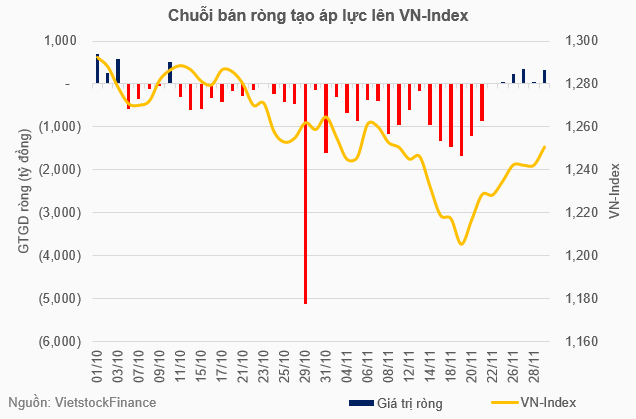

Following the net selling trend from October, foreign investors on the HOSE kicked off the new month with 15 consecutive net selling sessions, totaling more than VND 13 trillion. They only returned to net buying in the last 6 sessions. As a result, the HOSE experienced a net sell-off of over VND 12 trillion in November, a level not seen since July. This pushed the total net sell-off since the beginning of the year to over VND 90 trillion.

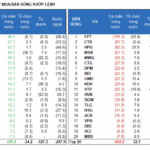

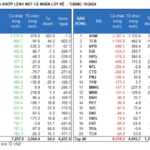

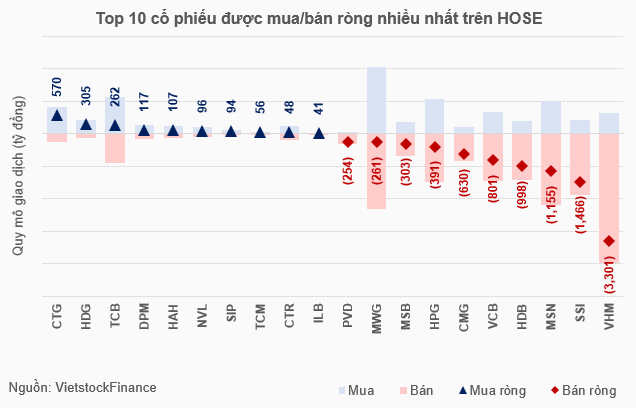

Notable stocks that were net sold in November included VHM, SSI, and MSN, with values of over VND 3.3 trillion, nearly VND 1.5 trillion, and almost VND 1.2 trillion, respectively. HDB followed closely with a net sell-off of nearly VND 1,000 billion. VHM, MSN, and HDB frequently attracted attention with large-volume negotiated selling transactions.

On the net buying side, CTG, HDG, and TCB topped the list with net buying values of nearly VND 570 billion, over VND 305 billion, and nearly VND 262 billion, respectively. However, these figures paled in comparison to the net-sold group.

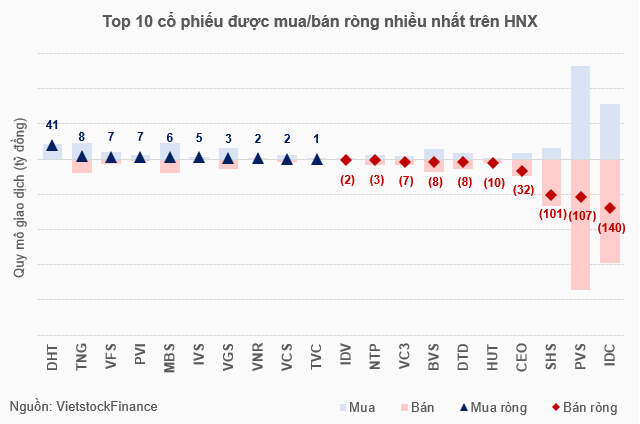

Similar to the HOSE, foreign investors aggressively net sold on the HNX in November, totaling nearly VND 343 billion. This marked the second consecutive month of net selling and pushed the cumulative net sell-off since the beginning of the year to over VND 915 billion.

Three stocks experienced net selling in the hundreds of billions of VND: IDC at nearly VND 140 billion, PVS at nearly VND 107 billion, and SHS at over VND 101 billion. On the opposite side, DHT was the most net bought stock, but only at nearly VND 41 billion.

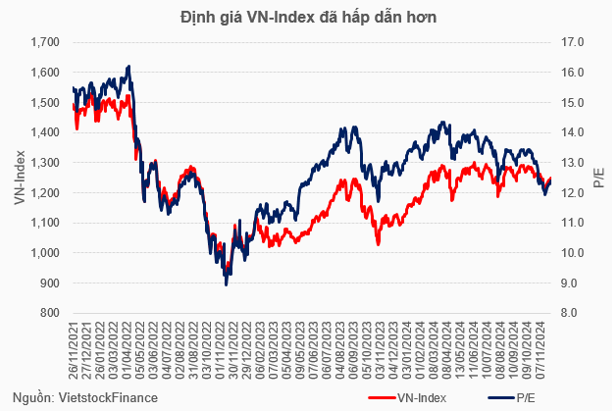

Thus, on both the HOSE and HNX, foreign investors withdrew a total of over VND 12 trillion in November and nearly VND 91 trillion in the first 11 months. In fact, the scenario of ending 2024 with a massive net sell-off had been predetermined months ago, and what most investors hoped for at this point was a reduction in the net selling pace, thereby reducing pressure on the indices.

Would there be a respite in December?

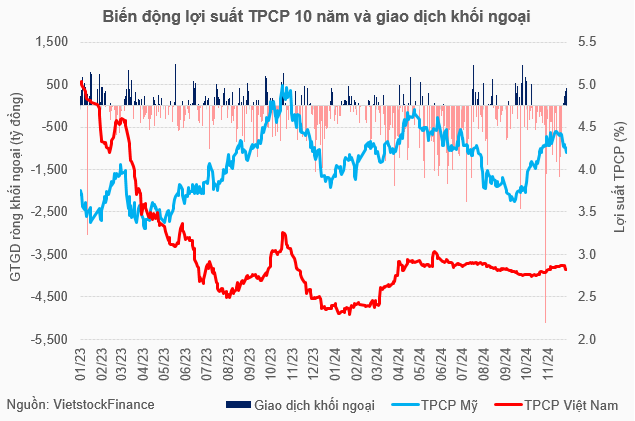

The recent streak of net selling by foreign investors coincided with a period when the yield on 10-year US Treasury bonds rose sharply from 4% to nearly 4.5%, widening the gap with the yield on 10-year Vietnamese government bonds. Looking back, similar scenarios and outcomes have occurred multiple times in the past, such as in the September – November 2023 and March – April 2024 periods.

In the last week of November 2024, after Mr. Donald Trump chose Mr. Scott Bessent as the expected new Secretary of the Treasury, the USD immediately showed signs of cooling down, and the yield on 10-year US Treasury bonds decreased, leading to a return of foreign capital flows to the Vietnamese market.

According to Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities Joint Stock Company (VPBankS), Mr. Donald Trump’s election as US President raised concerns about a potential increase in tariffs, which could lead to a return of inflation in 2025. This would limit the room for monetary policies to ease, causing the Fed’s interest rate cut roadmap to be more cautious.

When inflationary pressures return while economic growth remains weak, typically in the EU, a general picture emerges where defensive assets appreciate, the USD strengthens, and US government bond yields remain high. For Vietnam, these factors are essentially reflected through exchange rate pressures, becoming one of the reasons for the net sell-off by foreign investors.

However, the expert believed that these pressures had been reflected in the market and showed signs of cooling down. At the same time, the market’s discount level was sufficient for the net selling pace to slow down, thereby expecting the net selling pressure to ease in December.

Huy Khai

Is There Still Appeal in Vietnamese Stocks? A Deep Dive into the $3.8 Billion Foreign Sell-Off on HOSE.

The extent and trend of foreign investor retreat from the stock market is indeed surprising, given that Vietnam has consistently boasted of being a developing country with the fastest-growing economy in Asia and the world.

Foreign Investors Net Buy for the 6th Straight Session, Strong Demand for FPT Shares

The market continues to rally despite uncertain cash flows, with today’s liquidity not exceptionally high. The three exchanges witnessed a matching volume of nearly VND 15,000 billion, including net foreign buying of VND 359.7 billion. Specifically, in terms of matched orders, they were net buyers to the tune of VND 226.9 billion.

The Foreigners’ Sector: Week Five Buying Spree, Investing $1.3 Billion in a Blue-Chip Stock While Offloading Vietcombank Shares

After a prolonged period of offloading, foreign investors made a surprising comeback in the final week of November, ending the month with strong net buying.

When Will the $100 Million ETF Stop Selling?

The period from November 18-25 marked yet another week of net selling for the VanEck Vectors Vietnam ETF (VNM ETF), as the fund offloaded Vietnamese stocks for the fifth consecutive week amidst robust foreign net selling. However, with foreign investors showing signs of returning to the market, is the fund’s selling spree finally coming to an end?