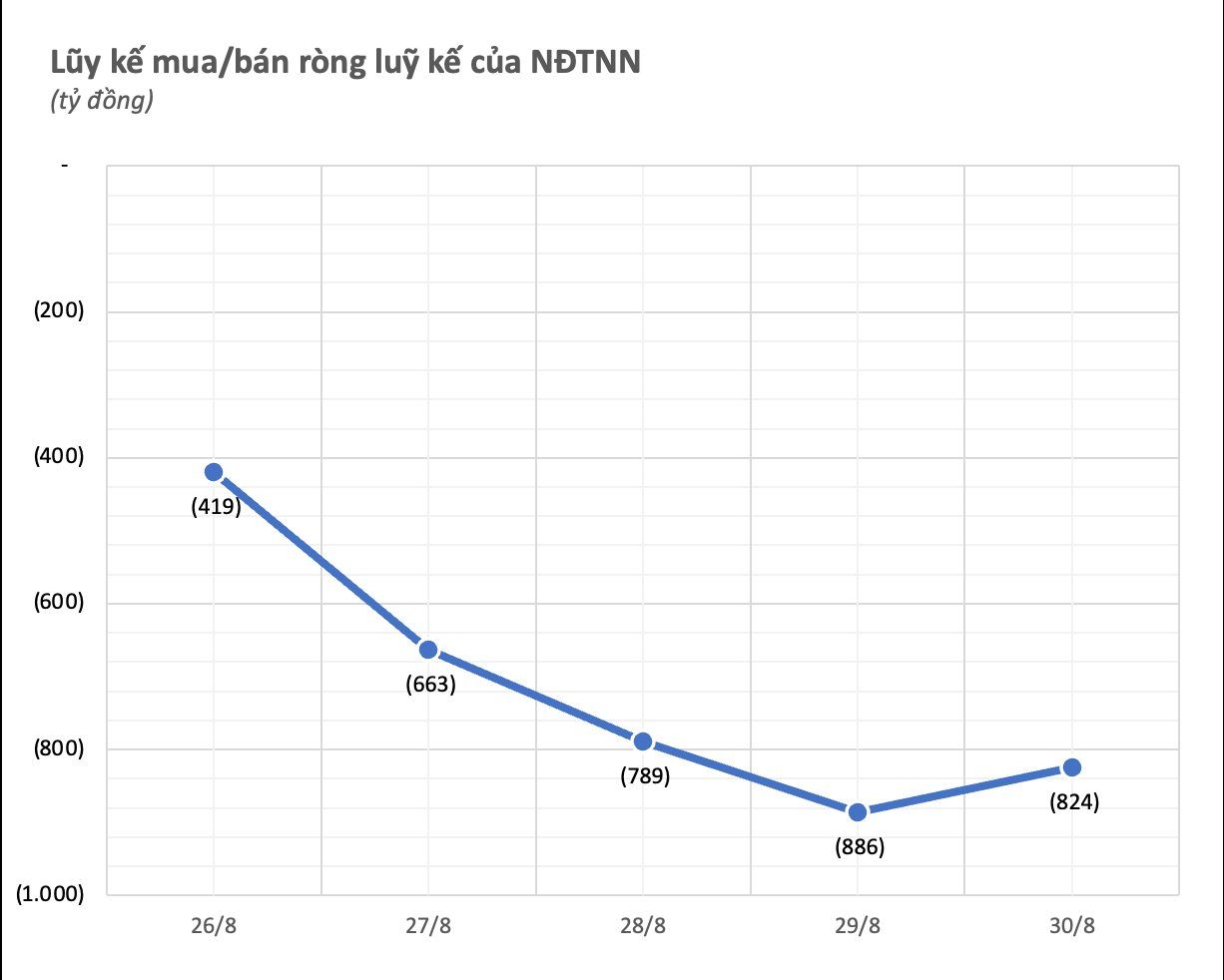

The market witnessed its first significant drop in what has been a recovery rally from the 1200-point trough. After a period of sideways trading and intraday adjustments, sellers have begun to exert noticeable pressure.

Today’s trading volume on the HSX floor increased by 4% in value and 6% in volume (excluding matched trades). Ideally, as prices fall, trading volume should increase, indicating that there is a significant amount of capital on the sidelines waiting to enter the market at more attractive levels.

On the other hand, the high trading volume during a downward session suggests that investors are offloading a large number of accumulated stocks. This will facilitate a shift in expectations and reduce speculative volume. It’s evident that investors have been holding onto their stocks for around five sessions, and a substantial force is required to unlock these holdings. Long-term investors will also take this opportunity to restructure their portfolios or engage in price-reducing trading.

Overall, a corrective phase, if it occurs, is not out of the ordinary. The most tense decline was halted around the 1200-point mark, sending a clear message. The factors influencing the market are not new at this point and are even less severe. This downward phase will be a time to assess the genuine shift in market perspective, moving away from the skepticism of the past ten sessions.

The wide range of stock price declines and high trading volume indicate that sellers are firmly in control of the market’s oscillations. The influential stocks have been particularly affected. The more pronounced drop in the VNI is contributing to a consensus among those looking to sell. Therefore, if the pace of decline slows in the coming sessions and stocks return to differentiation, it will be a strong signal.

I maintain the view that the market is behaving normally and that stocks will experience varying degrees of adjustment due to the highly selective nature of capital flows. Instead of relying solely on the VNI to determine entry points, investors should monitor the supportive capacity of capital flows for specific stocks. The next few sessions could present a favorable opportunity to gradually increase stock exposure.

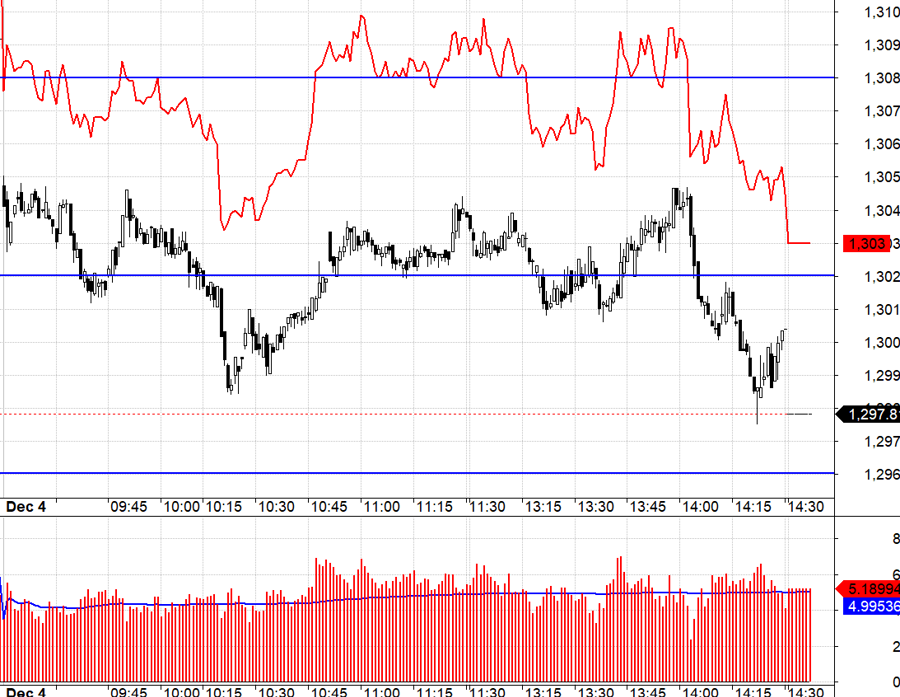

Today’s derivatives market provided a positive basis cushion for short positions, but its practical effectiveness was limited. This was partly due to the sensitive reaction of F1, while VN30’s oscillations did not reach the required amplitude, hovering around 1302.xx. Short positions taken when VN30 breached the 1302.xx level benefited from positive basis, but the index failed to decline further to the next threshold of around 1296.xx.

Accepting such a wide basis differential at a time when VN30 was susceptible to a downward adjustment and given the sensitive reactions of F1 during the session indicates strong expectations. Nonetheless, the likelihood of a decline remains higher, as the market needs to exert pressure to offload short-term stocks. There is a possibility that the basis will start to narrow in the next session. The recommended strategy is to buy back stocks and employ a flexible long/short approach with derivatives.

VN30 closed today at 1297.81. The nearest resistances for tomorrow are 1303, 1314, 1321, and 1326. Supports are at 1296, 1290, 1285, 1277, and 1267.

Disclaimer: This “Stock Market Blog” reflects the personal views and opinions of the author and does not represent the views of VnEconomy. The opinions and views expressed are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives presented in this blog.

The VN-Index Struggles Around 1260 Points, Selling Pressure Remains Subdued

The market witnessed another downward slide during the morning session, with selling pressure mounting but not yet overwhelming. Trading liquidity on the HoSE fell by 10% compared to the previous session, reaching only VND 4,843 billion, with the large-cap stocks bearing the brunt of the impact.

The Power Player: VNDirect’s Chairwoman Pham Minh Huong to Feature on The Investors Talk Show on December 3rd

The Investors is an insightful talk show series that offers a unique perspective on the world of investing. Each episode features seasoned business leaders, fund managers, securities experts, and influential investors who share their wisdom and insights on the Vietnamese stock market and the latest investment trends. With their extensive experience and knowledge, these experts provide valuable insights that go beyond the surface, giving viewers a deeper understanding of the market and empowering them to make informed investment decisions.

The Stock Market’s Silver Lining: Opportunities for Latecomers

“As the year draws to a close, the market is receiving a plethora of positive support, providing ample opportunities for the VN-Index to extend its upward trajectory,” MBS stated.