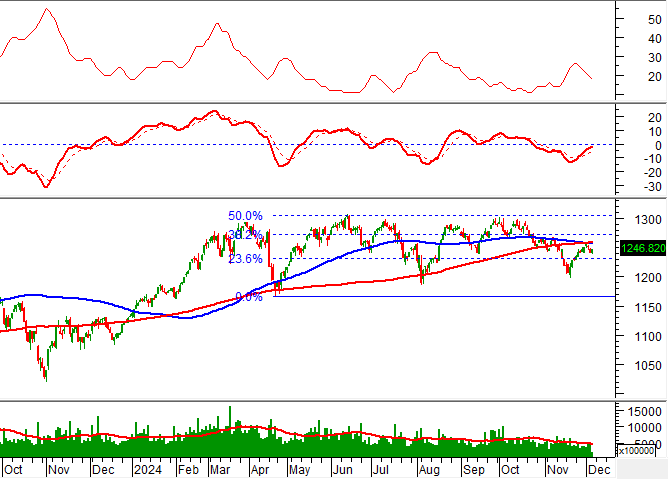

Technical Signals for the VN-Index

During the trading session on December 5, 2024, the VN-Index gained points, but the trading volume remained unchanged, indicating investors’ hesitation. The index is currently retesting the Fibonacci Projection 23.6% threshold (equivalent to the 1,225-1,240 point range) while the ADX indicator remains low and weak. This suggests that the back-and-forth sessions with alternating gains and losses may continue in the upcoming sessions.

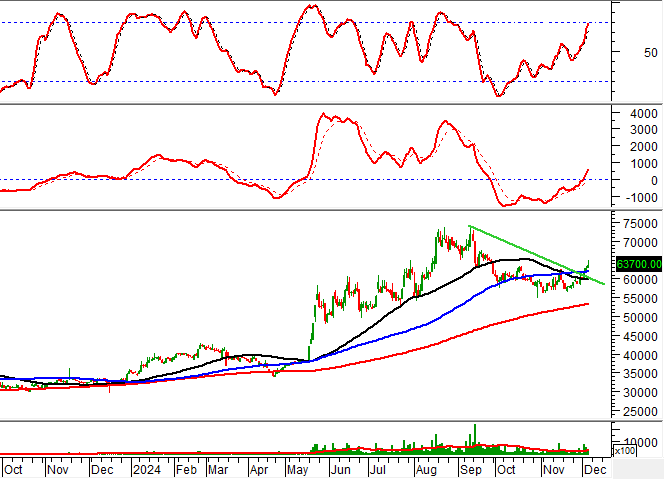

Technical Signals for the HNX-Index

On December 5, 2024, the HNX-Index rose and retested the Middle line of the Bollinger Bands, while liquidity fluctuated, indicating investors’ instability in recent sessions. The Stochastic Oscillator indicator continues to rise after a bullish divergence and gives a buy signal while the index retests the old bottom of April 2024 (equivalent to the 220-225 point range). If there is an improvement in cash flow in the next sessions, the outlook will be more optimistic.

NTP – Plastic Juvenile Pioneer JSC

In the morning session of December 5, 2024, NTP rose and formed a Three White Soldiers candlestick pattern with trading volume exceeding the 20-session average, indicating investors’ optimism. The stock price continues to rise after breaking out of the short-term downtrend line, while the Stochastic Oscillator indicator maintains the previous buy signal, further strengthening the stock’s current recovery trend.

VND – VNDIRECT Securities Corporation

On the morning of December 5, 2024, VND fell as trading volume surged in the morning session, exceeding the 20-session average and indicating investors’ pessimism. The stock price continues to hover near the lower band of the Bollinger Bands, while the MACD indicator keeps widening the gap with the signal line after previously giving a sell signal. This suggests that the short-term downward trend is likely to continue in the next sessions. In addition, the stock price is below the 50-day and 200-day SMA lines, indicating a less optimistic mid- and long-term outlook.

Technical Analysis Department, Vietstock Consulting

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.

Market Beat: VN-Index Surges Past Challenges, Up Over 6 Points

The VN-Index faced significant pressure in the first half of the morning session, even briefly dipping below the 1,240-point mark. However, a swift turnaround saw the index overcome these challenges and close 6.41 points higher at 1,246.82.

Market Beat: VN-Index Retreats to 1,240-Point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.

The King of Stocks is Snubbed in November

The lackluster trading environment has dampened the price performance of bank stocks in the past month.