Illustration photo.

Vietnam boasts a diverse range of agricultural, forestry, and aquatic products worth billions of dollars. Among these, wood and wood products are one of the country’s top six export commodities.

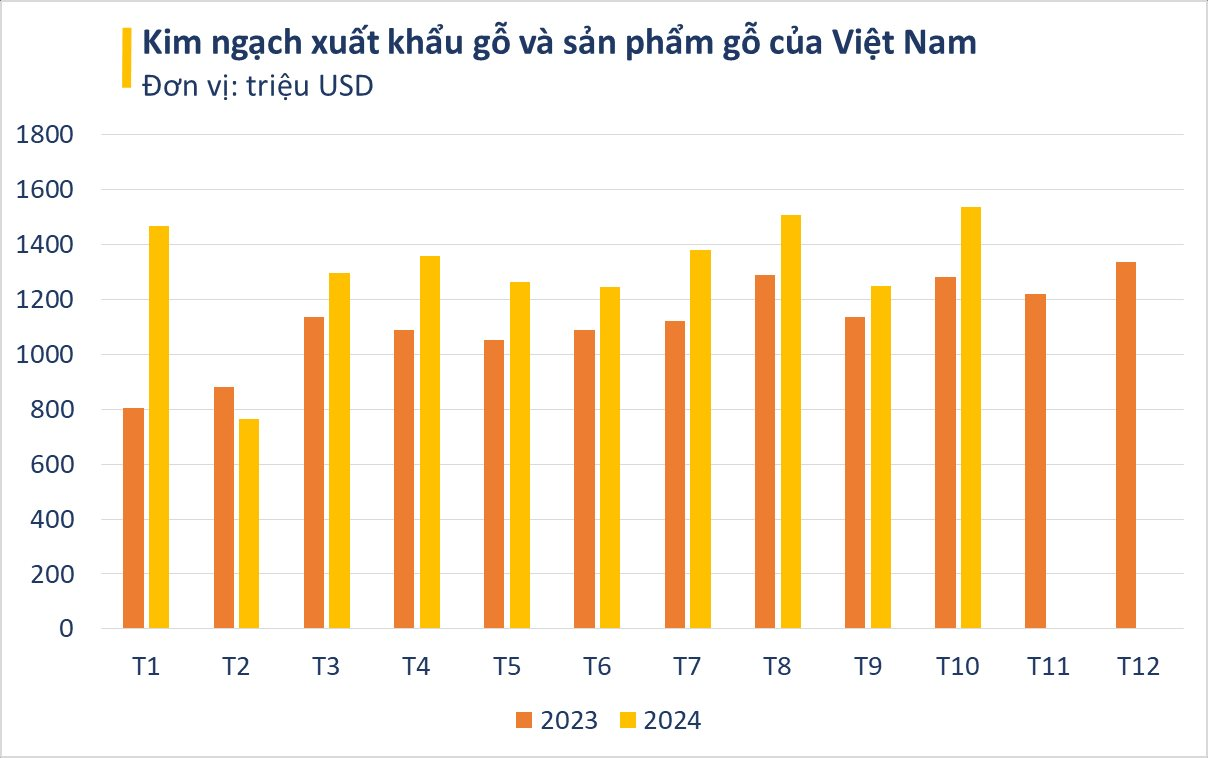

According to preliminary statistics from the General Department of Vietnam Customs, the export turnover of wood and wood products in October 2024 reached nearly $1.54 billion, a 22.9% increase compared to September 2024 and a 19.4% increase compared to October 2023. This marks the highest growth rate for the industry so far this year.

For the first ten months of 2024, the export turnover of wood and wood products reached nearly $13.22 billion, a 21.2% increase compared to the same period in 2023.

The main market for Vietnam’s wood and wood products is the United States, which accounts for 55.5% of the country’s total export turnover in this sector, reaching over $7.34 billion, a 25.2% increase compared to the previous year. The re-election of Donald Trump as President of the United States is expected to bring advantages to Vietnam.

The United States may impose taxes on imported wood products ranging from 10% to 60%. Products imported from China are expected to remain subject to high US tariffs, while Vietnamese enterprises hope to benefit from lower tax rates. With this tax rate differential, many US importers will continue to source their products from Vietnam. Therefore, wood exports to the United States are expected to continue growing in the coming time.

The second largest market is China, with a turnover of $1.72 billion, a 22.3% increase, and a market share of 13%. Japan ranked third, with a turnover of $1.42 billion, a 2.5% increase, and a market share of 10.8%.

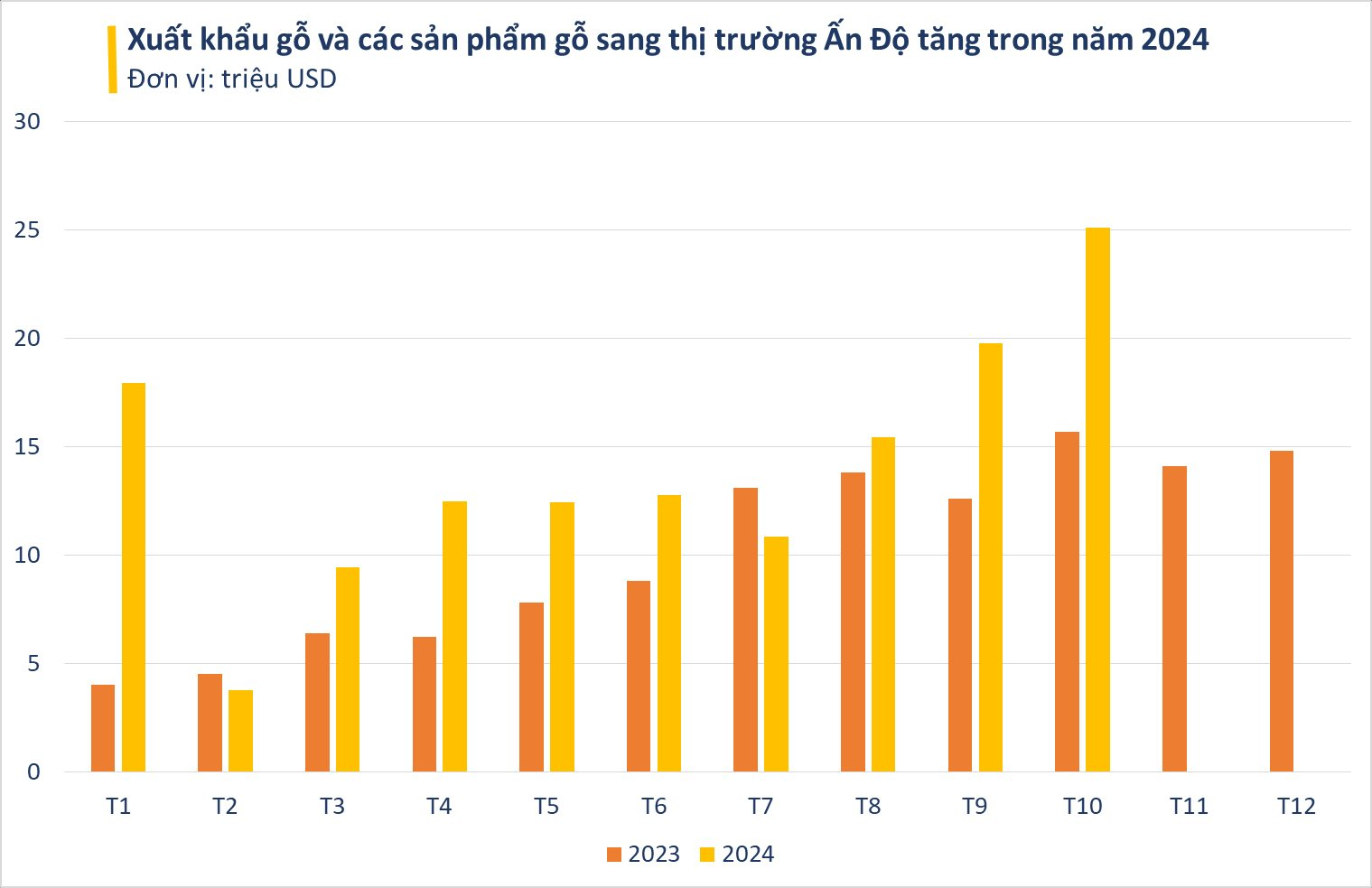

In addition to these major markets, exports to many potential markets are also growing well, especially India. In October, exports to this market reached $25.1 million, a 60.5% increase compared to the same period in 2023. This was also the month with the highest export turnover since the beginning of the year.

For the first ten months of the year, Vietnam’s exports to India exceeded $140 million, a 50.9% increase compared to the same period last year.

With a market size of over 1.4 billion people, India’s furniture and design industry is booming due to the growing real estate market, increasing population, and rising incomes. With a total market size of $41 billion, India is the fourth largest furniture consumer in the world.

Vietnam is currently the leading wood exporter in Southeast Asia and the fifth largest wood exporter in the world. It is also the second-largest exporter (after China) of high-value-added wood products such as indoor and outdoor furniture. Vietnamese wood products have reached 170 markets worldwide.

With the current growth rate, the export turnover of the wood industry for the whole of 2024 is expected to increase by 20% to 23% compared to 2023. The outlook for wood and wood product exports in 2025 is positive, thanks to the promising growth of demand from key markets. In addition, the trend of shifting production from China to Vietnam due to tariff impacts will continue to be strongly promoted.

“Positive Growth, Wood Industry Seizes Opportunity to Conquer $15.2 Billion Target”

The road to achieving the timber and forest product export target of $15.2 billion by 2024 will be challenging, according to experts. They believe that the industry will face numerous obstacles and require a concerted effort from businesses within the sector to overcome these hurdles.