Business Targets of Trung Nam Group in 2023

|

Trung Nam Group’s Business Targets for 2023

Source: HNX

|

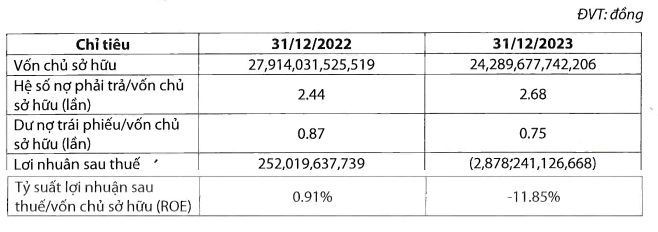

According to the financial report submitted to the Hanoi Stock Exchange (HNX), Trung Nam Group incurred a loss of nearly VND 2.9 trillion in 2023. This is a significant loss for the company, as it had recorded a profit of VND 252 billion in the previous year and even higher profits of over VND 1.6 trillion in 2021.

Owner’s equity decreased by 13% to over VND 24 trillion. The debt-to-equity ratio increased from 2.44 to 2.68, equivalent to a total debt of nearly VND 65.1 trillion. Of this, over VND 18 trillion was in bond debt. However, as of now, the company has cleared all its bond debt.

Established in November 2004, Trung Nam Group primarily engages in the construction of civil engineering works and is founded by brothers Nguyen Tam Thinh (born in 1973) and Nguyen Tam Tien (born in 1967). Mr. Thinh currently serves as the Chairman of the Board and legal representative of the company.

Over its 20 years of operation and transformation, Trung Nam Group has diversified into a conglomerate with five core business areas: energy, infrastructure and construction, real estate, and industrial information electronics. Notably, its energy segment stands out with 9 power projects totaling over 1.4 GW in capacity and nearly 4 billion kWh in annual output.

Some of Trung Nam Group’s most prominent projects include the Trung Nam Thuan Nam Solar Power Plant (450 MW, 1.2 billion kWh/year), Ea Nam Dak Lak Wind Power Plant (1.1 billion kWh/year), and several hydropower plants.

Trung Nam’s Renewable Energy Arm Posts Heavy Losses in 2023

Trung Nam Solar Power Plant Records Profit of VND 220 Billion and Adjusts Bond Interest Rates

Trung Nam Bondholders Agree to Transfer of Collateral for VND 2.1 Trillion Bond Package

The Future of Electricity Pricing: A Market-Driven Approach

According to the Ministry of Industry and Trade and industry experts, the newly amended Power Law, passed by the National Assembly, will bring about significant changes in legal regulations. This will untie the knots hindering the development of the electricity industry, particularly in terms of capital mechanisms and investment incentives to attract resources for electricity development and operation.

The NTP Fund Management: Disciplinary Action Taken

The State Securities Commission’s (SSC) Inspection and Examination Department has imposed an administrative penalty on NTP Fund Management Corporation. The decision will come into effect from November 28, 2024.