A little-known metal called antimony has surged 300% this year, outperforming gold, silver, and even Bitcoin. With prices soaring from $11,000 to over $40,000 per ton, and a projected price of $50,000 per ton by 2025, antimony is making waves in the commodities market.

The recent spike in antimony prices can be attributed to China’s decision to cut off supply to the US this summer. As the US doesn’t produce any antimony domestically, Western governments are scrambling to secure alternative sources. This has led to a rush of funding towards companies with antimony assets, such as Australia’s Larvotto, which boasts the country’s largest antimony mine and the “golden” Hillgrove project. Larvotto’s stock has skyrocketed by almost 600% since the start of 2024.

Military Metals Corp is another company poised to benefit from the antimony rush. With the acquisition of two top-tier antimony projects globally, they are rapidly developing a new antimony mine. One of their key acquisitions is the Trojarova project in Slovakia, a Cold War-era mine estimated to contain nearly 70,000 tons of antimony, valued at approximately $2 billion at current prices.

Military Metals isn’t putting all its eggs in one basket, though. They are also making moves in North America, with the renowned West Gore antimony mine in Nova Scotia, Canada.

Despite its modest market valuation of $12 million, Military Metals’ new operations in Slovakia are valued at $2 billion in-ground resources at current antimony prices. This doesn’t even factor in the potential of the West Gore mine in Canada. With its strategic acquisitions and development efforts, Military Metals is well-positioned to capitalize on the surging demand for antimony.

As of September 15, China has tightened its control over the purchase, sale, and export of antimony and products made from this element. China holds 32% of the world’s antimony reserves and produces 48% of the global supply, far surpassing Tajikistan, the second-largest producer, at 25%.

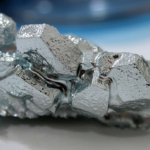

Antimony, a metalloid element, has long been utilized by humans for medicinal and cosmetic purposes. Today, antimony and its compounds serve as flame retardants, with half of the world’s antimony consumption in 2023 attributed to this use. Additionally, antimony enhances the efficiency of solar panels and batteries and is used in military applications such as night-vision goggles, armor-piercing bullets, infrared missiles, and even nuclear weapons.

The Race to 100,000: Can Huawei’s Homegrown OS Dream Compete?

Huawei has set an ambitious target for its proprietary operating system, aiming to reach 100,000 apps within the next six months to a year.