I. MARKET ANALYSIS OF STOCKS ON 04/12/2024

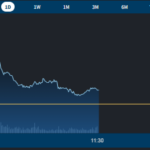

– The main indices continued to fall during the trading session on 04/12. VN-Index closed down 0.75%, to 1,240.41 points; HNX-Index decreased by 0.3% compared to the previous session, to 224.62 points.

– The matching volume on HOSE exceeded 505 million units, up 5.8% compared to the previous session. The matching volume on HNX increased by 7.7%, reaching more than 48 million units.

– Foreign investors continued to net sell on the HOSE with a value of nearly VND 683 billion and net sold more than VND 27 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The market experienced a turbulent trading session as strong selling pressure in large-cap stocks caused the VN-Index to sink into the red from the beginning of the session. The weak recovery efforts later helped the index narrow the loss towards the end of the morning session but could not last long. Sellers became more aggressive in the afternoon session, especially foreign investors, causing significant pressure on the index. The VN-Index closed down 9.42 points compared to the previous session, to 1,240.41 points.

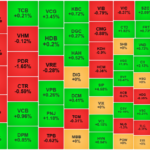

– In terms of impact, the 10 stocks with the most negative influence on the market belonged to the VN30 group, led by BID, VHM, and CTG, which took away nearly 3 points from the VN-Index. On the other hand, VCB, SAB, and VTP tried to hold on to nearly 1.5 points for the overall index.

– VN30-Index ended the session down 11.37 points, or 0.87%, to 1,297.81 points. Sellers dominated, with 25 codes decreasing and only 5 increasing. Among them, POW, MWG, and VRE were at the bottom of the table, plunging more than 2%. In contrast, out of the 5 positive codes, only SAB recorded an outstanding increase of 2.1%, while the rest, including PLX, VCB, VIB, and ACB, inched up slightly by less than 1%.

The red dominated the broad market. Information Technology had to “bottom” the market as the two giants FPT (-1.03%) and CMG (-3.09%) mainly influenced the sector’s index. The real estate group was not much more positive, ending the session with a 1% decline. A few small bright spots, such as AGG, L14, HDC, NTC, NHA, CEO, etc., could not help the industry recover as stocks with large capitalization were all in the red, typically VHM (-1.96%), VRE (-2.26%), VIC (-0.99%), BCM (-1.81%), NVL (-1.87%), IDC (-1.82%), and PDR (-1.45%).

The financial group also exerted significant pressure on the overall market with the strong selling of a series of stocks such as BID (-1.95%), CTG (-1.67%), VPB (-1.04%), LPB (-1.47%), TPB (-1.25%), SSI (-1.03%), VND (-3.64%), HCM (-1.63%), FTS (-2.03%), MIG (-3.11%), BIC (-1.58%), BMI (-1.63%),…

Energy and utilities were the only two groups that managed to stay in the weak green in today’s fiery red session, thanks to the main contributions of BSR (+1.04%), HLC (+1.67%), PSB (+1.85%); DNH (+14.99%), TDM (+1%), and PPC (+1.81%). Most of the remaining stocks could not escape the general downward trend.

The sharp fall of the VN-Index with trading volume surpassing the 20-day average indicates a rather negative investor sentiment. If, in the coming sessions, the index continues to hold above the Middle line of the Bollinger Bands, the situation will not be too pessimistic. Currently, the MACD indicator is still maintaining a buy signal and is likely to cut above the 0 threshold. If the indicator cuts above this threshold in the future, the risk will be reduced.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Above the Middle Bollinger Band

The VN-Index fell sharply with trading volume exceeding the 20-day average, indicating a rather negative investor sentiment. If, in the coming sessions, the index continues to hold above the Middle Bollinger Band, the situation may not be too pessimistic.

At present, the MACD indicator still maintains a buy signal and is likely to cut above the zero line. If the indicator cuts above this line in the future, the risk will be reduced.

HNX-Index – Stochastic Oscillator and MACD Indicators Maintain Buy Signals

The HNX-Index fell with trading volume above the 20-day average. However, the index remained above the Middle Bollinger Band, while the MACD indicator maintained a buy signal since crossing above the Signal Line.

Additionally, the Stochastic Oscillator continued to rise after giving a buy signal. If this state persists, the situation may not be too pessimistic.

Money Flow Analysis

Changes in Smart Money Flow: The Negative Volume Index indicator of the VN-Index has crossed above the EMA 20-day moving average. If this state continues in the next session, the risk of a sudden drop (thrust down) will be limited.

Changes in Foreign Investor Flow: Foreign investors continued to net sell during the trading session on 04/12/2024. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON 04/12/2024

Economic and Market Strategy Analysis Department, Vietstock Consulting

This Week’s Market: Will Liquidity Continue to Decline, but Can VN-Index Sustain Its Uptrend?

Despite the uncertain recovery pace, with liquidity continuing to decline, the Vn-Index is expected to extend its upward trajectory, buoyed by supportive domestic news.

Drip Feed Selling, VN-Index Turns Green at the Last Minute, Foreigners Dump Again

Selling pressure mounted slightly in the afternoon session, pushing the VN-Index briefly into negative territory with a sea of red on the screen. However, the extremely low trading volume indicated that buyers were mostly sitting on the sidelines, and the market was quick to rebound as bottom-fishers jumped in.

Stock Market Outlook for the Week of December 2nd to 6th: Will the VN-Index’s Robust Recovery Finally Bring Relief to Investors?

The stock market soared this week, bolstered by a strong showing from foreign investors who bought net for several consecutive sessions.