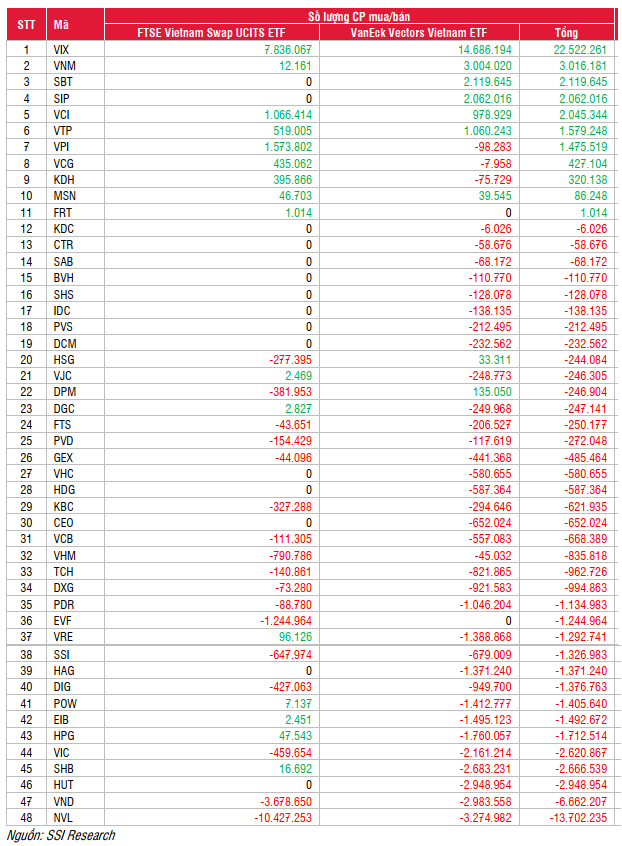

For the FTSE Vietnam Index, VTP and VPI are likely to be added to the basket. Specifically, VTP stock price has increased by 77% compared to the end of August 2024, helping the stock meet the capitalization criteria, and VPI has also satisfied the criteria. Meanwhile, EVF and NVL may be excluded due to failing to meet the free-float ratio and capitalization conditions or being under warning.

SSI Research estimates that the FTSE Vietnam Swap UCITS ETF (total assets of VND 6,558 billion) will purchase 519,000 VTP shares (weight of 1.04%) and 1.57 million VPI shares (weight of 1.4%). On the other hand, the fund will sell about 1.2 million EVF shares and 10.4 million NVL shares.

For the MarketVector Vietnam Local Index, SIP and VTP are expected to be added as they are in the top 85% of free-float capitalization, but no stocks are expected to be removed.

According to SSI Research’s predictions, the VanEck Vectors Vietnam ETF (total assets of VND 11,000 billion) is expected to purchase approximately 2 million SIP shares and 1 million VTP shares. In addition, the fund will also buy VIX (14 million shares), VNM (3 million shares), and SBT (2 million shares).

Aggregating the transactions of both ETFs, VIX is the most heavily bought stock with 22.5 million shares, followed by VNM with 3 million shares and SBT with 2.1 million shares. In contrast, selling pressure is concentrated on NVL (13.7 million shares), VND (6.6 million shares), HUT (2.9 million shares), SHB (2.6 million shares), and VIC (2.6 million shares)

According to the schedule, FTSE will announce the basket on December 6, while MarketVector will announce on December 14. The entire restructuring process is expected to be completed by December 20, 2024.

The Hunt for the Top Stock Picks: Unveiling the Two Most Formidable “Sharks” in the Market

According to DSC Securities, a retail stock is set to be the focal point of foreign ETF fund inflows.