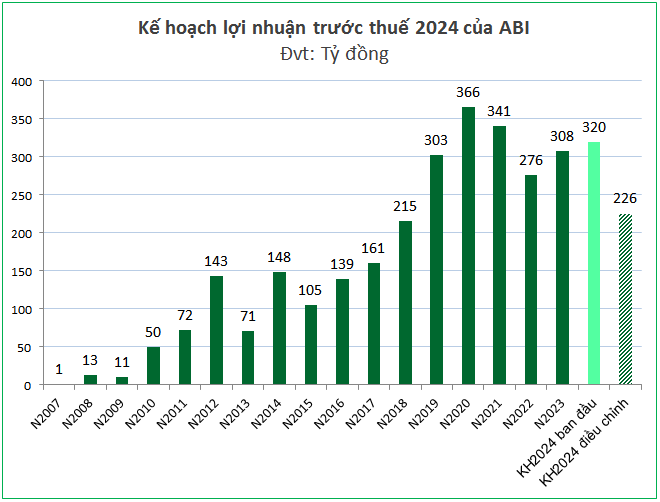

The ABI Board of Directors proposed and received approval from the General Meeting of Shareholders (GMS) via written consent on November 30th to adjust the 2024 business plan.

Specifically, ABI reduced its insurance business revenue target by 9% compared to the plan approved by the 2024 Annual GMS. The new target stands at VND 2,400 billion, a decrease of VND 234 billion from the initial VND 2,634 billion.

Source: VietstockFinance

|

Consequently, the minimum profit before tax target for 2024 was lowered from VND 320 billion to VND 226 billion, a reduction of VND 94 billion or 29.4% from the initial plan. This adjusted profit plan is also 27% lower than the 2023 results.

The target for minimum ROE was adjusted to 11.8%, down from the initially projected 15%. However, the dividend payout ratio for 2024 remains unchanged at a minimum of 14%.

According to the ABI Board of Directors, 2024 has been a challenging year for the insurance industry in general and the company in particular.

Specifically, the public crisis surrounding the insurance sector since 2023 shows no signs of abating, dampening society’s demand for insurance. Many insurance products have shown low growth or even declined compared to 2023. The amended Law on Credit Institutions (LCI) in 2024 has also created difficulties in selling insurance products at the branches of credit institutions.

Furthermore, in early September 2024, Super Typhoon Yagi, considered the strongest storm in the past 70 years, caused extensive damage to lives and property in most northern provinces from Thanh Hoa province onwards (contributing up to 40% of the country’s GDP). It also disrupted and almost completely paralyzed production activities of enterprises, households, and individuals in a vast area. The recovery process is expected to be challenging and may take a minimum of six months to several years.

The losses from Super Typhoon Yagi directly impacted ABI‘s business operations, making it difficult to achieve the revenue and profit targets for 2024.

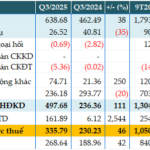

| ABI’s Net Profit by Quarter |

Looking back at Q3 2024 – the quarter affected by Typhoon Yagi, ABI‘s insurance compensation expenses surged by 93% year-on-year to nearly VND 294 billion. This pushed total insurance business expenses up to VND 466 billion, a 56% increase compared to the same period last year. This was the main reason for ABI‘s net loss of over VND 16 billion in Q3 2024.

| ABI’s 9-Month Net Profit Over the Years |

The setback in Q3 caused ABI‘s cumulative net profit for the first nine months of 2024 to decrease by 39% year-on-year to VND 130 billion. Compared to the initial minimum profit before tax target, ABI has achieved only 51% of the profit target after nine months. In comparison to the adjusted plan, ABI has accomplished 72%.

Record Date for the Remaining 2023 Dividend Payout

Also in the resolution to obtain shareholder consent in writing, the ABI GMS approved the plan to pay the remaining 2023 dividend in cash at a rate of 10%.

After obtaining the GMS’s approval, ABI announced that the ex-dividend date for this cash dividend is December 12, 2024. The payment will be made starting from December 24, 2024.

With a payout ratio of 10% and 71.2 million shares currently in circulation, ABI is estimated to pay out more than VND 71 billion for this final dividend installment, completing the 20% dividend payout ratio approved by the 2024 Annual GMS. With the first installment of 10% paid on August 02, 2024, the total dividend payout for 2023 amounts to over VND 142 billion.

Source: VietstockFinance

|

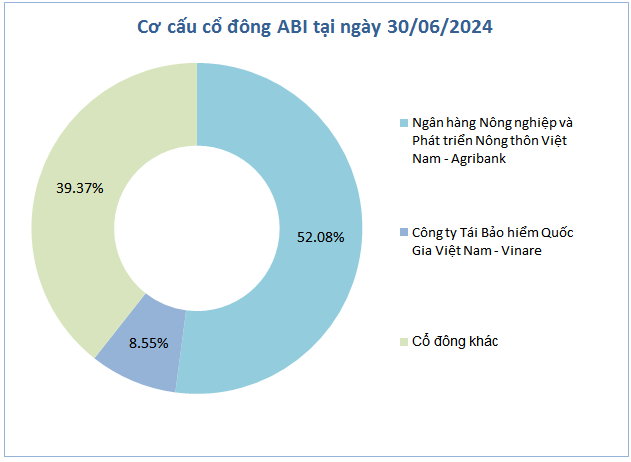

As of June 30, 2024, ABI had two major shareholders holding 60.63% of its charter capital. The Vietnam Bank for Agriculture and Rural Development – Agribank held 52.08% of the capital, while the Vietnam National Reinsurance Corporation – Vinare owned 8.55%. They are expected to receive approximately VND 74 billion and VND 12 billion, respectively, in dividends for 2023.