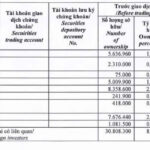

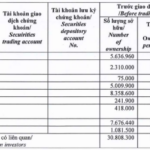

The Dragon Capital foreign fund group, represented by Ms. Truong Ngoc Phuong, has just sent a written report to the State Securities Commission of Vietnam, the Ho Chi Minh City Stock Exchange (HoSE), and the Vietnam Oil and Gas Technical Services Corporation (PVS: MCK, HNX floor) regarding changes in ownership of the related foreign investor group, which is a major shareholder holding 5% or more of the shares.

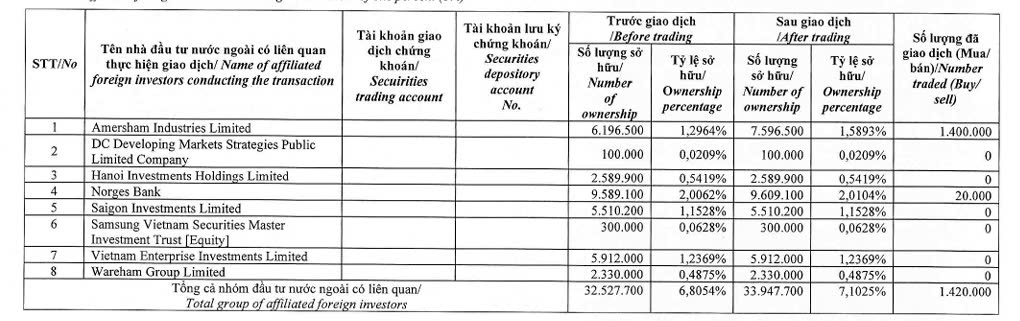

Accordingly, on November 25, 2024, Dragon Capital, through two member funds, purchased a total of 1.42 million PVS shares.

Source: PVS

Specifically, Amersham Industries Limited fund bought 1.4 million PVS shares, while Norges Bank fund purchased 20,000 shares.

After the transaction, the number of PVS shares held by this foreign fund group increased from nearly 32.53 million to over 33.95 million, equivalent to an increase in ownership ratio from 6.8054% to 7.1025%.

Based on the closing price of PVS shares on November 25, 2024, of VND 34,200 per share, Dragon Capital is estimated to have spent more than VND 48.56 billion on the above purchase.

The date of change in the ownership ratio of the entire related foreign investment group exceeding the 1% threshold was November 27, 2024.

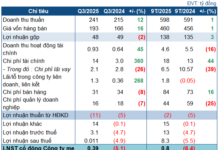

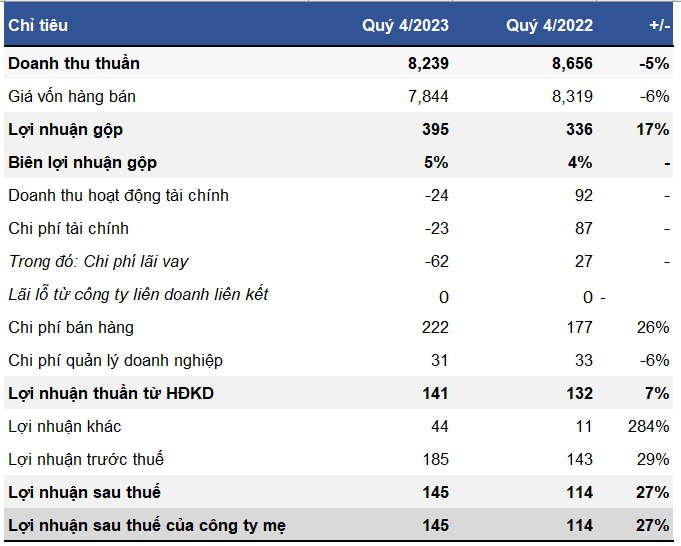

In terms of business results, according to the consolidated financial statements for Q3 2024, PVS recorded net revenue of over VND 4,820 billion, a 15% increase compared to the same period last year. After deducting taxes and fees, the company reported a net profit of over VND 192.7 billion, an increase of 34.32%.

According to PVS’s explanation, the increase in after-tax profit was due to the company recognizing a decrease in deferred income tax expense for unrealized foreign exchange differences and provisions for payables as stipulated by the law during the quarter.

For the first nine months of 2024, PVS achieved net revenue of over VND 14,101 billion, an increase of nearly 12% compared to the same period in 2023, with after-tax profit reaching VND 706.7 billion, up nearly 16.6%.

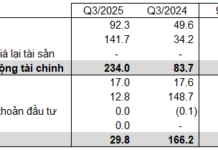

As of September 30, 2024, PVS’s total assets were at nearly VND 27,342.5 billion, up 3.51% from the beginning of the year, and total liabilities were at nearly VND 13,400.8 billion, an increase of 4.11%.

“Unleashing Dragon Capital’s Secrets: The 740,000 Đức Giang Chemical Shares Sale”

Dragon Capital, a prominent foreign investment fund, has recently offloaded 740,000 DGC shares through four of its member funds. This strategic move has resulted in a decrease in their ownership stake, now falling below the 8% threshold in Duc Giang Chemicals, a notable player in the chemical industry.

“Dragon Capital Divests 5.5 Million DXG Shares of Dat Xanh Group”

Dragon Capital has offloaded 5.5 million DXG shares, reducing its ownership stake in Dat Xanh Group from 10.0833% to 9.3201%.