HSC plans to increase its charter capital by issuing shares to existing shareholders with a 50% offering ratio, equivalent to a subscription ratio of 2:1. Specifically, shareholders owning 1 share as of the record date will receive 1 subscription right, and those with 2 subscription rights will be able to purchase 1 new share at a price of VND 10,000 per share. The offering is expected to take place in 2025. If the issuance is successful, HSC will raise VND 3,600 billion, increasing its charter capital from VND 7,200 billion to VND 10,800 billion.

The proceeds from the capital raise are expected to be allocated to margin lending and proprietary trading activities. Approximately 70% (equivalent to VND 2,500 billion) will be used to expand margin lending activities, while the remaining 30% (VND 1,100 billion) will be allocated to proprietary trading.

This capital increase will enhance HSC’s financial capacity and strengthen its competitiveness in the market. With the new capital, the company can expand its margin lending activities, increase the NPF limit for foreign institutional investors, and participate more actively in capital arrangement for investment banking deals. A solid capital foundation will enable the company to develop an effective proprietary trading strategy, adapt flexibly to market changes, and increase profitability in the future.

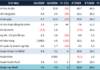

According to the report at the General Meeting, HSC expects to achieve positive business results in 2024. The company forecasts revenue of VND 3,287 billion for 2024, a 46% increase from 2023; and pre-tax profit of VND 1,303 billion, a 55% rise from the previous year. Return on equity (ROE) is projected at 11.2%, higher than the previous year’s 8.3%, and earnings per share (EPS) is estimated at VND 1,771, a 20% increase.

Mr. Trinh Hoai Giang, CEO of HSC, speaking at the General Meeting

The CEO of HSC shared that in the future, HSC aims to continue being a leading enterprise in attracting foreign investment into the Vietnamese capital market. The company will also focus on diversifying its products based on the philosophy of “Seeing through the Customer’s Lens” to enhance customer service experiences. HSC is currently implementing technological solutions in governance and operational management to optimize costs and improve employee productivity. Additionally, HSC attaches great importance to human resource development, enhancing the skills and flexibility of its personnel to better meet the demands of the dynamic securities market.

With a clear strategic orientation, HSC is confident in remaining the top choice for investors and maintaining its position as a trusted financial institution in Vietnam’s capital market.

“Eximbank Receives Approval from State Bank of Vietnam to Amend Chartered Capital to Over VND 18,688 Billion”

On November 25, 2024, the State Bank of Vietnam approved a change in the charter capital of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB). As a result, Eximbank’s charter capital has been adjusted to VND 18,688,106,070,000 (eighteen thousand six hundred and eighty-eight billion one hundred and six million seventy thousand dong).

“Vietbank’s Endeavor for Capital Increase: A Commitment to Sustainable Growth”

The State Securities Commission (SSC) has confirmed receiving the necessary documents for Vietbank’s (VBB on UPCoM) stock dividend issuance, aiming to boost its charter capital by VND 1,428 billion. With this capital increase, Vietbank’s charter capital will rise to VND 7,139 billion. This crucial step of finalizing the procedures with the SSC empowers Vietbank to strengthen its financial capabilities and lay the groundwork for expanding its nationwide network.