VN-Index Falls as Strong Selling Pressure Takes Hold in the Afternoon Session

HAH Share Price Surges to a New 52-Week High

The Vietnamese stock market witnessed a strong selling pressure in the afternoon session, causing the VN-Index to plunge. The index closed the session on December 4th, 2024, at 1,240, a decrease of 9.42 points. While the trading value on HOSE improved, it still remained low, with a turnover of nearly VND 14,000 billion.

Amid this backdrop, shares of HAH, owned by Hai An Transport and Stevedoring Joint Stock Company, surged 4.49% compared to the previous session’s closing price, settling at VND 50,000 per share. This marked the highest price for the year 2024 and the highest price since June 2022.

Compared to the beginning of 2024, HAH’s share price has climbed by approximately 50%, and liquidity in the past few months has also become more vibrant, with millions of units traded each session.

Hai An’s Fleet of Container Ships

Hai An primarily operates in the fields of cargo handling, freight forwarding, port services, inland and coastal water transportation, and other logistics activities.

Presently, the company owns a fleet of 16 container ships with a capacity ranging from 800 to 3,500 TEU, operating on domestic and intra-Asian routes. Hai An is the largest maritime transport company in Vietnam. According to Alphaliner’s ranking released in July 2024, the company’s fleet is also among the top 100 largest container ship fleets globally.

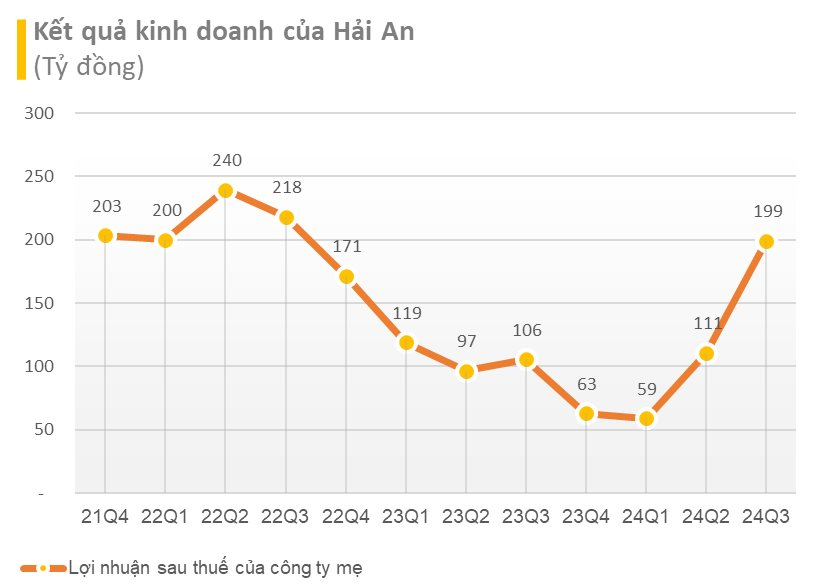

In terms of business performance, in the third quarter of 2024, HAH recorded consolidated net revenue of nearly VND 1,129 billion, a 66% increase compared to the same period last year. The company’s net profit after tax was over VND 199 billion, an increase of nearly 89%. For the first nine months of the year, HAH achieved net revenue of VND 2,781 billion and a net profit after tax of VND 370 billion, representing a 43% and 15% year-over-year increase, respectively.

According to a recent analysis report by BIDV Securities (BSC), they maintain a positive outlook for HAH’s business performance in 2024. They anticipate a significant recovery in the company’s results compared to the previous year, attributed to the growth in self-operated transportation and improved cargo volume and freight rates. Additionally, the report estimates a substantial increase in fixed-term leasing activities in 2024 due to enhanced freight rates and an increase in the number of months and vessels operating on fixed-term leases compared to the previous year.

BSC expects HAH’s self-operated cargo volume to rise by 39% year-over-year in 2024, as evidenced by a cumulative nine-month performance of 432,658 TEUs, reflecting a 40% increase. They believe that this recovery trend will persist into the fourth quarter of 2024 and extend into 2025, driven by sustained demand for transportation as export orders rebound and seasonal factors come into play.

The redirection of goods from China to Vietnam and other Southeast Asian countries to avoid import taxes imposed by the US and the EU, particularly after Donald Trump’s reelection as the US President, has contributed to this positive outlook. HAH estimates that this trend will result in an annual increase of 10% to 15% in container volume.

Another factor is the trend of cargo consolidation at CMTV as shipping lines diversify their service routes, now that mother vessels can directly call at CMTV to pick up cargo.

Regarding freight rates for self-operated transportation, BSC predicts that HAH’s rates will remain stable in 2025 due to excess supply and price competition in the domestic market. Additionally, they anticipate that international freight rates will stabilize in 2025 as ship supply improves.

BSC highlights that the acquisition of the Haian Gama vessel will bolster HAH’s growth in 2025. Based on the vessel’s market value (VND 625 billion), BSC estimates the break-even lease rate for the Haian Gama to be similar to that of other newly invested vessels in 2024, approximately USD 12,000-13,000 per day. The availability of a fixed-term lease contract at USD 30,000 per day until June 2025 ensures a boost in HAH’s business performance during the first half of 2025.

For the second half of 2025, BSC believes that HAH will continue to lease the Haian Gama on fixed-term charters at rates no lower than the current level, as demand for vessel leasing is expected to improve with the forecasted economic recovery in the latter half of 2025, following the Fed’s interest rate cut. Additionally, the Haian Gama, currently flying the Liberian flag, is anticipated to have smoother access to international fixed-term charter markets.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.

A Pause in the Uptrend

The VN-Index’s upward momentum stalled with a slight dip in the latest trading session as volume remained below the 20-day average. This indicates a continued cautious approach from investors. However, the MACD indicator still holds a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would provide a more optimistic outlook for the market, suggesting that the dip may be short-lived.

The Technical Analysis of the Afternoon Session: Investors Remain Hesitant

The VN-Index and HNX-Index rose in tandem, but with no significant improvement in liquidity, indicating investors’ cautious sentiment.

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.