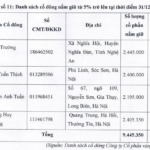

The FLC GAB Board of Directors (BoD) has announced the resignation of Mr. Luu Van Thinh as Chairman, effective November 28th. In his resignation letter, Mr. Thinh cited personal reasons and stated that he would be unable to dedicate the necessary time and attention to his role as Chairman and legal representative of the company.

On the same day, the BoD appointed Mr. Vu Anh Tuan, a current board member, as the new Chairman. Mr. Tuan, who joined the FLC GAB board in January 2023, brings a wealth of experience to his new role.

This follows another recent change in the company’s leadership, with the resignation of Mr. Lam Duc Toan as CEO on November 18th and the subsequent appointment of Mr. Trinh Quoc Thi (born in 1990) as his replacement. In addition to his new role at FLC GAB, Mr. Thi also serves as Deputy General Director of FLC Faros Construction JSC and FLC Stone JSC.

FLC Investment and Asset Management JSC, formerly known as GAB JSC, made a strategic decision to expand its business areas in Q1/2020. Alongside its traditional business in mining and construction materials production, the company ventured into new sectors, including resort real estate, asset management, renewable energy, and air transportation.

In terms of financial performance, FLC Gab reported impressive results for Q3/2024, with a revenue of VND 1.88 billion, reflecting a significant 2,102.6% increase compared to the same period in 2023. The company attributed this surge in revenue to the aftermath of Storm No. 3, which led to increased demand for home and warehouse repairs.

However, due to rising production costs, the company still reported a net loss of VND 1.4 billion in after-tax profit, representing a 76.7% increase. For the first nine months of 2024, FLC Gab’s revenue reached nearly VND 3.68 billion, a decrease of 65.56%. After deducting taxes and fees, the company reported a net profit of nearly VND 4.8 billion, compared to a loss of over VND 4.5 billion in the same period last year.

The Golden Exodus: A Mining Company’s Leadership Transition

Despite a challenging economic landscape, Vàng Lào Cai has persevered through difficult times. From 2020 onwards, the company experienced a hiatus in sales and service revenue, culminating in a challenging year in 2023, with a loss of nearly 14 billion VND. As of the end of 2023, the cumulative loss exceeded 113 billion VND.

The Thuduc House CEO Steps Down

Mr. Nguyen Hai Long was appointed as the new CEO of Thuduc House JSC in mid-April 2024, succeeding Mr. Dam Manh Cuong.

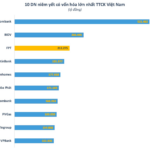

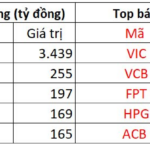

The FPT Market Cap Matches the Combined Value of Five Major Banks; Truong Gia Binh’s Stock Holdings Near VND 15,000 Billion

FPT shares surge to new heights, with a market capitalization surpassing 212,000 billion VND, an impressive feat that even surpasses the combined value of five mid-sized banks: SHB, MSB, VIB, Eximbank, and TPBank.