The Vietnamese stock market opened the first trading session of December with a predominantly tug-of-war stance. Despite opening with a gap up at the start of the session, investor caution caused the index to retreat to reference.

At the close of the December 2 session, the VN-Index edged up 0.75 points to 1,251.21. Liquidity still fell short, with the matching value on HoSE reaching a meager VND9,519 billion.

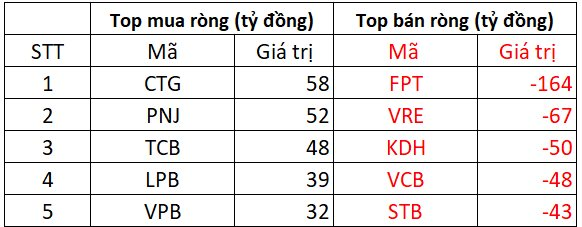

In terms of foreign trading, after a streak of six consecutive net buying sessions, foreign investors returned to net sell over VND 412 billion in today’s session. Specifically:

On HoSE, foreign investors net sold approximately VND 305 billion

On the selling side, FPT stock faced the strongest selling pressure from foreign investors, with a net selling value of VND 164 billion. In addition, a series of blue-chip stocks were heavily “dumped,” including: VRE (-VND67 billion); KDH (-VND50 billion), and VCB (-VND48 billion), etc.

In contrast, CTG, PNJ, TCB, LPB,… were the stocks that foreign investors net bought the most, but the value was only a few dozen billion VND each.

On HNX, foreign investors net sold about VND 400 million

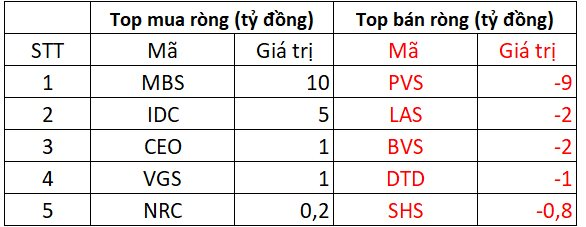

On the buying side, MBS stock was the most net bought with a value of VND 10 billion. Following were IDC, CEO, and VGS, which were bought in the range of a few billion VND each.

On the opposite side, PVS was the most sold stock, with a value of VND 9 billion; LAS, BVS, and DTD also topped the net selling list, with values of only a few billion VND each.

On UPCOM, foreign investors net sold about VND 107 billion

In terms of net bought stocks, OIL led with a value of VND 1 billion. In addition, the codes that were net bought below VND 1 billion included VGR, CNC, VTK, and ND2.

Conversely, ACV stock experienced a sudden net sell-off of VND 106 billion, while MCH and MPC were net sold in the range of VND 1-2 billion each. The group of foreign investors also net sold small amounts of CSI and ABI.

A Slumping Steel Stock Surges, With Share Prices Soaring to 15-Month Highs: What’s Behind the Revival?

However, the business landscape remained bleak as this enterprise reported losses in the third quarter of 2024.

The FDI Magnetism Rankings for the First 11 Months of 2024: Bac Ninh Sustains its Top Spot, with a Dark Horse Province Surpassing Ho Chi Minh City to Claim Second Place.

The Foreign Investment Agency (Ministry of Planning and Investment) noted that in the first eleven months of 2024, registered FDI capital continued to rise slightly (1%) compared to the same period last year, albeit at a slower pace, down by 0.9 percentage points from the ten-month period. Notably, November witnessed a substantial surge in investment volume compared to previous months, attracting nearly USD 4.12 billion, accounting for 13.1% of the country’s total investment in the eleven-month period.

Net Profit Soars by 90% in Q3, Sending Shares of Vietnam’s Largest Container Ship Company to a 29-Month High

As of mid-2024, HAH’s share price has surged by approximately 50% since the beginning of the year, and liquidity has also been robust in recent months, with millions of units traded daily.