On December 1st, JSC Lao Cai Gold (GLC) announced that it had received resignation letters from its Board of Management members, including Mr. Nguyen Tien Duc (Chairman), Ms. Hoang Thi Que (Board member, Director, and Legal Representative), and Mr. Nguyen Tien Hai (Board member).

Mr. Nguyen Tien Hai was just elected to the Board of Directors of Lao Cai Gold in July 2024. Mr. Duc served as the company’s vice director from March 2019 to June 2022 and as Chairman from June 2022 onwards. Ms. Que has been the director of the company since March 2019.

Mr. Duc cited personal reasons for his resignation, while Mr. Hai mentioned a change in residence, and Ms. Que also cited a change in residence and career orientation as her reasons.

On December 2nd, the Board of Directors of Lao Cai Gold passed a resolution discharging the duties of the aforementioned individuals and electing three new members: Mr. Tran Quang Dang as Chairman, and Ms. Nguyen Thi Huyen and Ms. Pham Thi Thu Nguyet as Board members. Ms. Huyen was also appointed as the company’s Director and Legal Representative.

Lao Cai Gold was established on September 18, 2007, in Ban 3, Minh Ha, Minh Luong commune, Van Ban district, Lao Cai province. The initial chartered capital was 45 billion VND, contributed by five founding shareholders: Mineral Corporation – Vinacomin (now Mineral Corporation TKV JSC – 33%), Mineral One-Member LLC 3 (now Vimico Mineral Joint Stock Company – 27%), Lao Cai Mineral Company (15%), Thai Nguyen Company Limited (15%), and Dong Bac Company (10%).

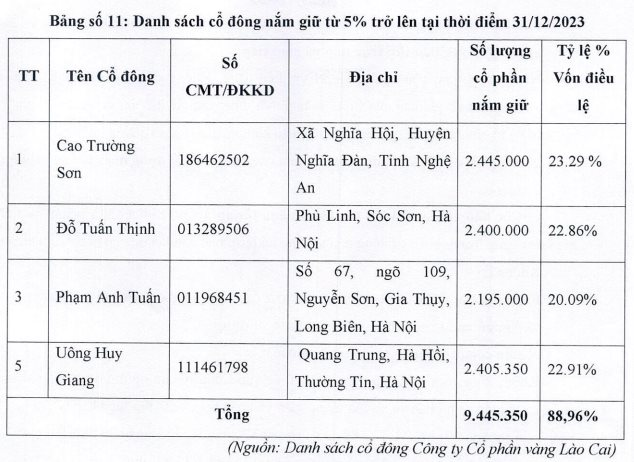

Currently, the company’s chartered capital is 105 billion VND. It has four major shareholders: Mr. Cao Truong Son (23.29%), Mr. Do Tuan Thinh (22.86%), Mr. Pham Anh Tuan (20.09%), and Mr. Uong Huy Giang (22.91%).

Since its establishment, Lao Cai Gold’s primary function and mission have been to implement the Investment Project for Mining and Processing of Primary Gold Ore at the Minh Luong Gold Mine in Minh Luong commune, Van Ban district, Lao Cai province.

The project’s output is gold ore concentrate with a grade of 82 g Au/ton. The maximum designed output is 7,450 tons/year, equivalent to a mining output of approximately 100,000 tons of raw ore per year. The mining method is room-and-pillar mining, and the gold ore concentrate is recovered by gravity separation combined with flotation. The maximum permitted output of gold metal is 500 kg per year.

In terms of financial performance, Lao Cai Gold has not generated any revenue from sales and services since 2020. In 2023, the company incurred a loss of nearly 14 billion VND, with a cumulative loss of over 113 billion VND by the end of 2023.

The Chairman and CEO’s Unexpected Departure: A Story of Unforeseen Turnovers

Mr. Phan Van Tuong, the newly appointed Chairman of the Board of Directors of VRC Real Estate and Investment Joint Stock Company, has stepped down from his position as of October 31st. Similarly, Ms. Phan Do Hanh, who was elected as the Chairman of the Board of Directors of My Chau Printing and Packaging Joint Stock Company for the term 2022-2027, resigned less than a month into her role, effective November 1st, citing personal reasons.

The Elusive Interest Payment: Novaland’s Slow Dance with Bondholders

On November 25, 2024, the company will make interest payments for two bond lots, NVL2020-03-190 and NVL2020-03-140, amounting to VND 10.4 billion and VND 7.6 billion, respectively.