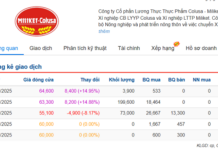

Vietnam’s stock market has recently witnessed a surprising surge in the shares of the Bao Viet Group (code BVH). In just three sessions, the stock soared by over 17%, climbing to 52,100 VND per share—the highest level in over two years. As a result, the market capitalization also surged to nearly 39,000 billion VND, a 35% increase compared to the beginning of 2024.

The significant stock surge brought great joy to shareholders, especially as the dividend payout was announced just days before this acceleration. On November 19, Bao Viet finalized the list of shareholders eligible for a 2023 cash dividend payout of 10.037%. With over 742.3 million shares in circulation, the company expects to spend approximately 745 billion VND on this dividend, which is scheduled to be paid out on December 20.

Undoubtedly, the dividend news had a positive impact on the stock’s performance. However, the dividend amount is not exceptionally high, and it is unlikely to be the sole catalyst for BVH’s recent robust performance. Investors are anticipating more significant catalysts, such as the long-discussed state capital divestment.

During the 2024 Annual General Meeting of Shareholders, Bao Viet’s management revealed that the group would develop a plan and present it to shareholders regarding reducing state ownership from 2026 onwards. Currently, the Ministry of Finance holds over 482.5 million BVH shares, equivalent to a 65% stake in Bao Viet. The State Capital Investment Corporation (SCIC) holds 22.1 million shares, representing a 3% stake.

The plan to divest state capital was also mentioned at the 2023 Annual General Meeting of Shareholders. According to the management, they would consider reducing state ownership to 51% by increasing the contribution ratio of other shareholders and/or through private placements. The Ministry of Finance would remain the largest shareholder of the group.

A report from Vietcap following the 2023 Annual General Meeting of Shareholders revealed that the group’s management might consider reducing state ownership to 51% from 2026 by (1) increasing the contribution ratio of other shareholders and/or (2) private placements. According to Vietcap, during 2023-2025, BVH plans to propose to shareholders a reduction in state ownership and an increase in charter capital to enhance flexibility in capital mobilization.

After the reduction in state ownership, the Ministry of Finance will remain Bao Viet’s largest shareholder, and the new capital will strengthen the company’s capital position and support its insurance business to meet the requirements of the new Insurance Law’s risk-based capital management model. Additionally, the strategic shareholder from Japan, Sumitomo Life (holding 22% of the shares), has expressed its intention to actively consider increasing its investment in Bao Viet in the future.

Aside from these internal factors, Bao Viet’s stock also benefits from the overall growth of the life insurance industry. According to a report by the Vietnam Insurance Association (IAV), in Q3/2024, the total new business premium income of the entire market exceeded 5,934 billion VND, a slight increase compared to the same period last year.

“This growth demonstrates the gradual recovery of trust, although there is still a long way to go,” said Mr. Ngo Trung Dung, Vice Secretary-General of IAV. “Insurance companies have been improving their services and enhancing customer experience through simplified processes, product diversification, and improved benefits. This not only helps the market overcome difficulties but also builds sustainable trust within the community.”

In the first nine months of 2024, Bao Viet recorded consolidated revenue of 42,122 billion VND. Consolidated pre-tax and after-tax profits reached 1,965 billion VND and 1,619 billion VND, respectively, increasing by 14.7% and 13.4% compared to the same period in 2023. Consolidated total assets as of September 30 reached 238,219 billion VND, up 7.7% from the beginning of the year.

Vinhomes Slashes Registered Capital Following the Largest Treasury Stock Purchase in History

After the reduction in charter capital, Vinhomes remains the largest real estate company in Vietnam with a market capitalization of nearly VND 165,000 billion. A formidable force in the industry, Vinhomes continues to shape the landscape of the nation with its innovative and grand-scale developments.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

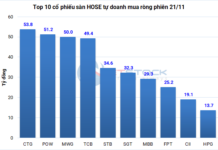

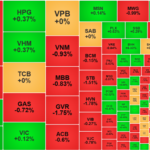

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

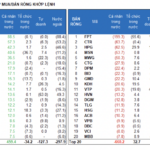

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.

Quarterly Review: Which Sector Will the 18,000 Billion NAV ETF Funds Buy Aggressively?

According to the latest report from BSC Research, the portfolios of two prominent ETFs are set to undergo notable changes during the upcoming Q4 2024 reconstitution. Viettel Post’s VTP is anticipated to feature in both ETF portfolios, while Nam A Bank’s NAB is likely to be added to the VNM ETF.