Hanoi South Urban Development and Investment Corporation (code: NHA) has just announced the resolution of its Board of Directors to temporarily halt the plan to offer shares to the public in 2024. The reason for this change is to adjust the offering plan to align with the current production and business activities, as well as the capital mobilization and utilization plan for the upcoming period.

The Company’s Board of Directors will reconsider, decide, and implement the offering at a later date to ensure the best interests of the Company and its shareholders. The Board will report to the General Meeting of Shareholders at the nearest session.

Previously, NHA’s Board of Directors approved the registration dossier for offering additional shares to the public in 2024. The company planned to offer more than 8.8 million shares (ratio 5:1) at a price of VND 10,000/share, raising over VND 88 billion. The offering was expected to take place in Q4 2024 and Q1 2025, subject to SSC approval. If successful, the company’s charter capital would have increased to VND 530 billion.

In terms of capital usage, NHA planned to use VND 30 billion to repay debts, VND 50 billion for investment in projects, and the remaining over VND 8 billion to supplement capital.

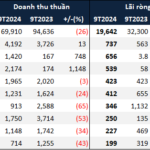

Regarding the Q3 2024 business results, NHA recorded VND 25 billion in net revenue, more than three times the figure of the same period last year. After deducting expenses, the company’s net profit was VND 12 billion, a 197-fold increase compared to the previous year. In the first nine months of the year, this real estate enterprise made a net profit of over VND 53 billion, exceeding 6% of the yearly plan.

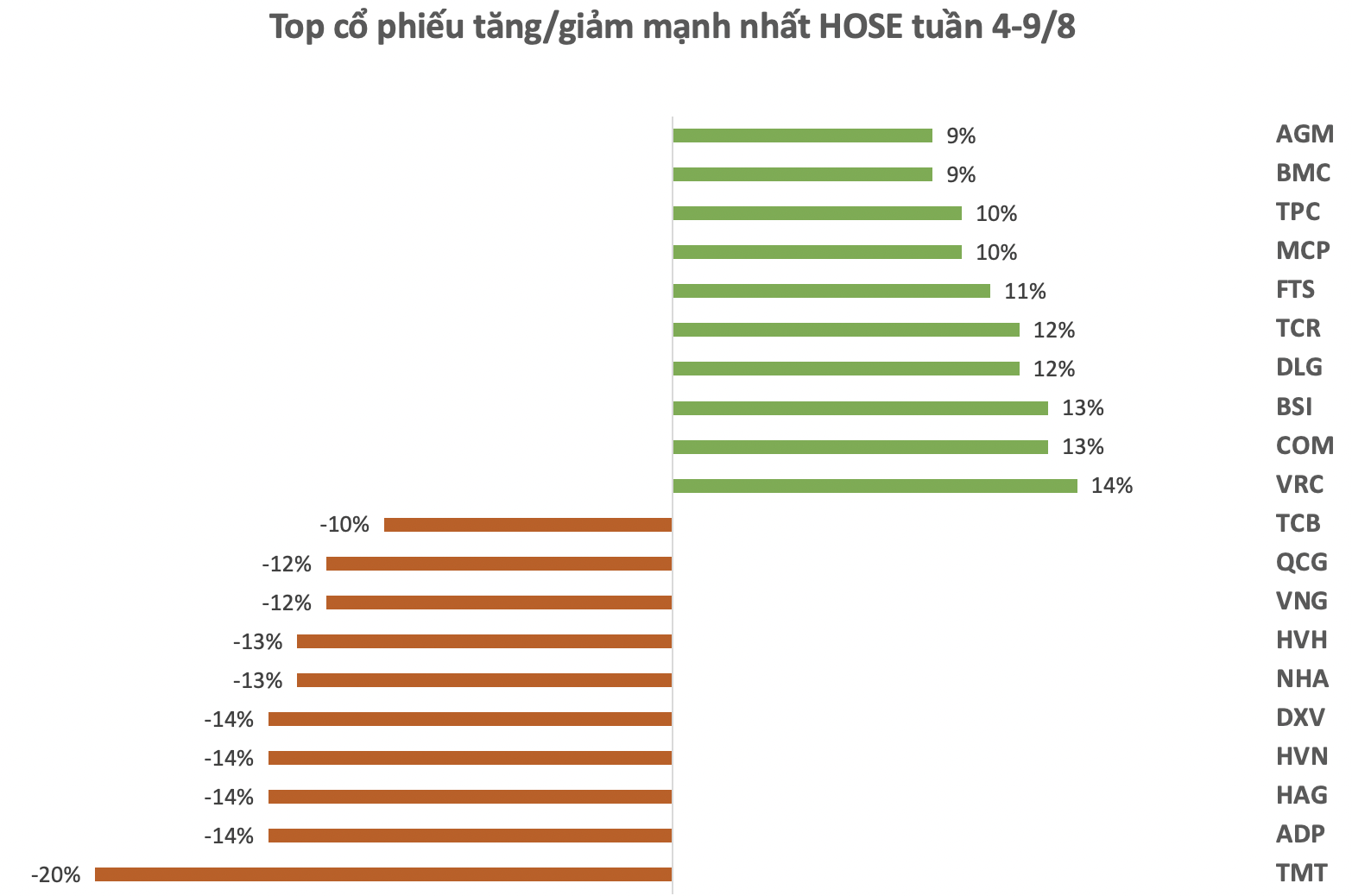

In the market, NHA shares are currently trading at VND 27,600/share, up 62% compared to the beginning of the year. The corresponding market capitalization is over VND 1,200 billion.

Stock Market Pre-Trading Session, September 26: Truong Thanh Wood Receives Another Warning

The Ho Chi Minh City Stock Exchange (HoSE) has issued a warning to Truong Thanh Wood Industry Corporation (TTF) for delayed disclosure of explanations regarding the discrepancy in post-tax profits on the reviewed semi-annual financial statement for 2024.