Prior to the ticket sales launch on November 12th, the event had already broken records, outpacing the sell-out speed of the first concert in Ho Chi Minh City, which sold out in 90 minutes. All tickets for the Hung Yen concert were snapped up just 40 minutes after going on sale, setting a new record for the fastest sell-out time.

As of now, fans of the show, affectionately known as “Gai,” are still on the hunt for tickets, scouring internal ticket sales, sponsored tickets, invitations, and even the black market.

Riding on the show’s popularity, the stock of the production company, YEG (Yeah1 Group Joint Stock Company), is also soaring to new heights on the stock market. On December 4th, YEG shares surged to their upper limit, reaching 12,750 VND/share, the highest price in over two years (since September 2022). Notably, the liquidity of this stock continues to break records, with more than 6.2 million shares traded. This was the second consecutive session where the production company’s stock set a new liquidity record.

Chart: YEG stock price movement (Source: CafeF)

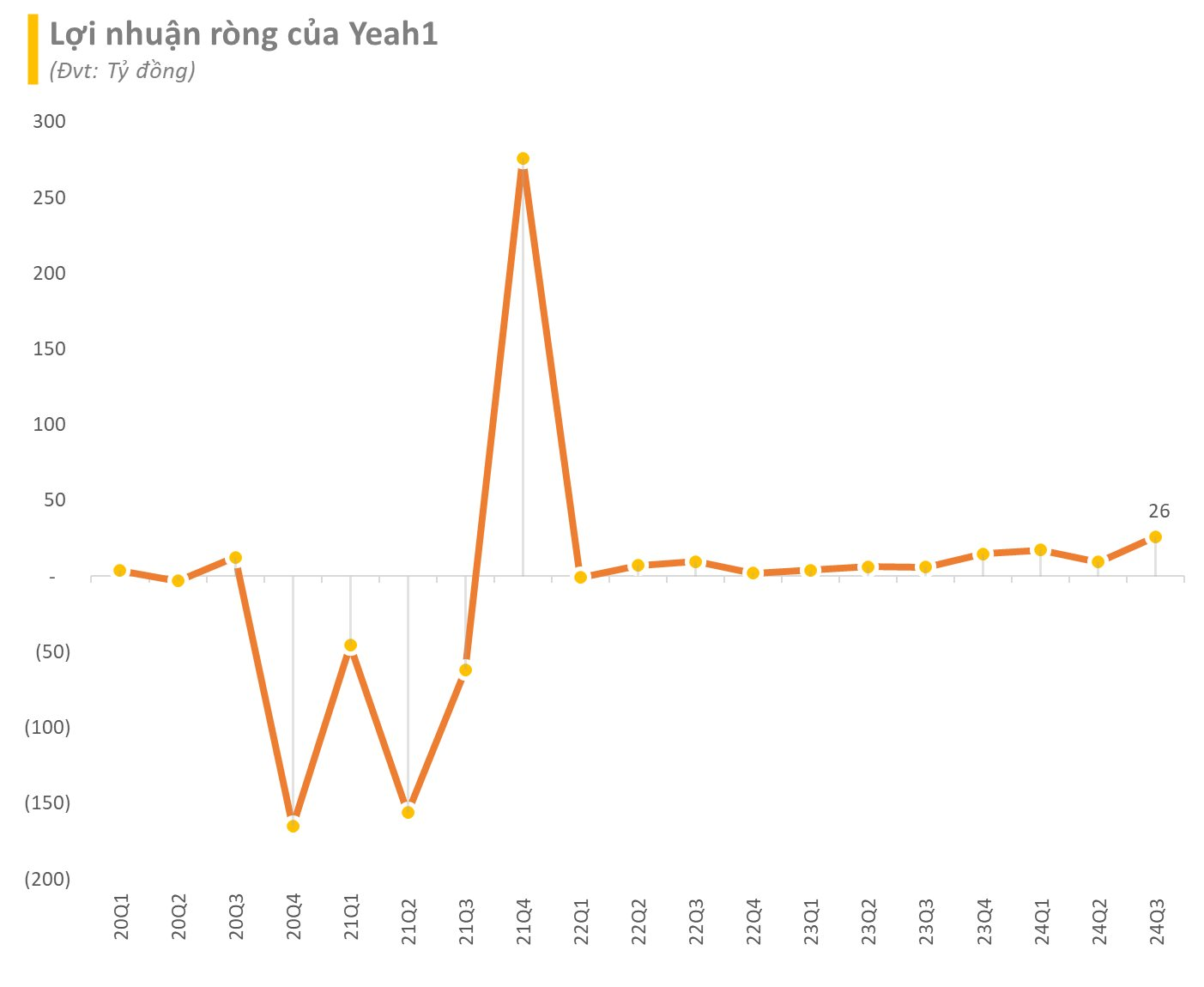

Moreover, the momentum of YEG shares is significantly bolstered by Yeah1’s impressive financial results.

The entertainment company recently revealed that its third-quarter revenue reached over VND 345 billion, a threefold increase compared to the same period last year, and the highest since the fourth quarter of 2020. After deducting related expenses, Yeah1 reported a quarterly profit ten times higher than the previous year, amounting to over VND 34 billion.

In addition to revenue from advertising and media, Yeah1 also generated VND 25 billion from financial activities in the third quarter, including gains from fair value changes in investments in associates, as well as interest income from deposits and loans.

For the first nine months of 2024, Yeah1 recorded a revenue of over VND 629 billion, more than 2.4 times higher, and a net profit of nearly VND 56 billion, 4.5 times higher than the same period in 2023.

Yeah1’s financial report for the third quarter of 2024 (Source: CafeF)

In recent times, Yeah1 has made its mark as the producer of the TV show “Anh Trai Vượt Ngàn Chông Gai,” following the success of last year’s “Chị Đẹp Đạp Gió.” The show features renowned artists such as Tu Long, Bang Kieu, Tuan Hung, and Soobin Hoang Son. “Anh Trai Vượt Ngàn Chông Gai” has resonated strongly with the community and attracted a host of prominent brands as sponsors.

According to Yeah1, beyond the business success, “Anh Trai Vượt Ngàn Chông Gai” and its concert are also their contributions to the development of the cultural industry, in response to the Prime Minister’s call at the beginning of the year.

The show’s popularity has undoubtedly added fuel to the fire for Yeah1’s stock price on the stock market, as it promises to continue generating significant revenue for the company.

Unlocking Vietnam’s Economic Potential: Vietstock LIVE #14: Vietnam 2025 – Opportunities and Challenges

Vietstock LIVE #14, themed ‘The Vietnamese Economy in 2025: Opportunities and Challenges’, will offer investors a comprehensive overview of the prospects and potential pitfalls facing the nation’s economy in the coming year. The show will be streamed live at 3 PM on Friday, December 6, 2024.

A Pause in the Uptrend

The VN-Index’s upward momentum stalled with a slight dip in the latest trading session as volume remained below the 20-day average. This indicates a continued cautious approach from investors. However, the MACD indicator still holds a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would provide a more optimistic outlook for the market, suggesting that the dip may be short-lived.

Market Beat: VN-Index Retreats to 1,240-Point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.