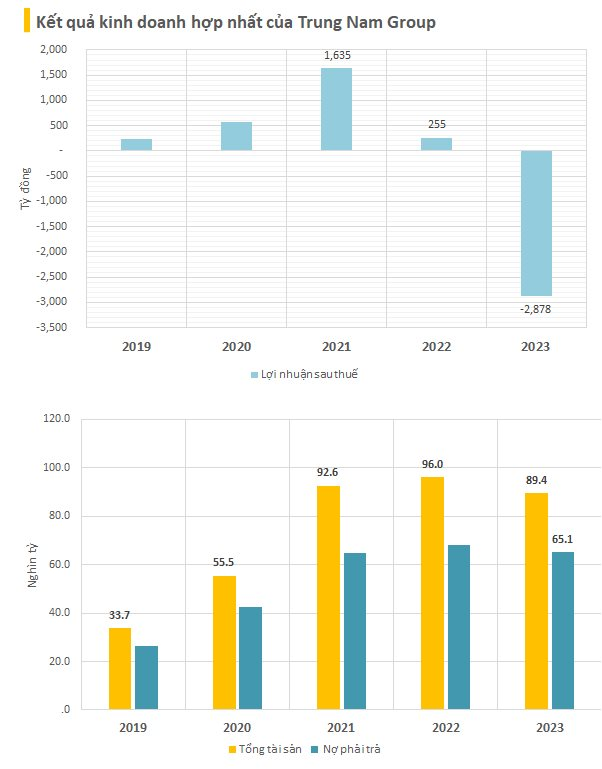

Trung Nam Group, a prominent Vietnamese construction and investment company, has recently announced its financial targets for 2023, projecting a consolidated after-tax loss of VND 2,878 billion, a significant shift from the profits of VND 252 billion in 2022 and VND 1,635 billion in 2021.

As of December 31, 2023, the company’s owner’s equity stood at VND 24,290 billion, a decrease of VND 3,624 billion from the previous year. The debt-to-equity ratio increased to 2.68, indicating total debts of over VND 65,000 billion, with bond debts accounting for approximately VND 18,218 billion. The enterprise’s total assets amounted to VND 89,300 billion.

Established in 2004, Trung Nam Group has its roots in the construction industry, founded by the well-known entrepreneur brothers, Mr. Nguyen Tam Thinh (born in 1973) and Mr. Nguyen Tam Tien (born in 1967). Over the past two decades, they have successfully diversified the company into a multi-sector conglomerate with a focus on five key areas: energy, infrastructure and construction, real estate, and industrial information electronics.

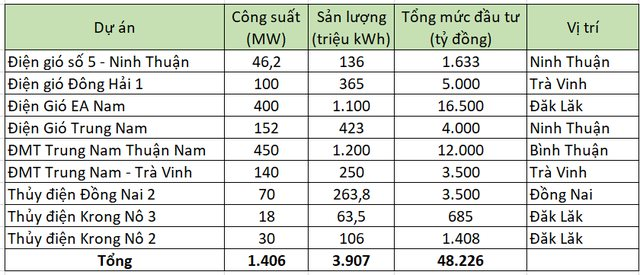

The group’s claim to fame is its significant presence in the renewable energy sector. According to statistics, Trung Nam Group boasts nine power projects with a combined designed capacity of 1,406 MW and an output of nearly 4 billion kWh. The company has invested over VND 48,200 billion in these projects, showcasing its commitment to this field.

VNDirect Research ranks Trung Nam Group as the largest developer of renewable energy in Vietnam. Their flagship projects include the Trung Nam Thuan Nam Solar Power Plant, with an output of 1.2 billion kWh and an investment of VND 12,000 billion, and the Ea Nam Wind Power Project, generating 1.1 billion kWh with an investment of VND 16,500 billion.

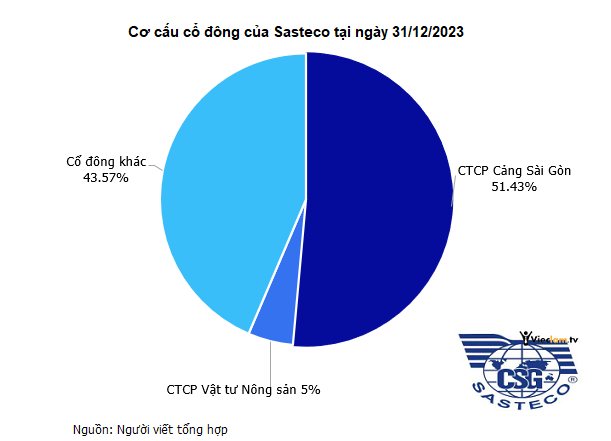

In July 2024, Trung Nam Renewable Energy JSC transferred 19.9 million shares of Trung Nam Solar Power JSC in a bond-related transaction. The transferees included Asia Renewable Energy Investment and Development Co., Ltd. (18 million shares) and Mr. Nguyen Thanh Binh (1.9 million shares).

Among the transferees of Trung Nam Solar Power JSC’s shares was Asia Renewable Energy Investment and Development Co., Ltd., a subsidiary of Asia Industrial Technical JSC (ACIT). Additionally, Mr. Nguyen Dang Khoa, who acquired 100,000 shares of Trung Nam Solar Power JSC, is also affiliated with ACIT as its Deputy General Director.

ACIT has held a 49% stake in the Trung Nam Solar Power Plant since 2021, while the solar power company has a charter capital of VND 1,000 billion. With the acquisition of an additional 18 million shares (equivalent to 18% capital) by ACIT’s subsidiary, ACIT may now consider the solar power company as its subsidiary, potentially shifting control away from the Trung Nam Group.

The Future of Electricity Pricing: A Market-Driven Approach

According to the Ministry of Industry and Trade and industry experts, the newly amended Power Law, passed by the National Assembly, will bring about significant changes in legal regulations. This will untie the knots hindering the development of the electricity industry, particularly in terms of capital mechanisms and investment incentives to attract resources for electricity development and operation.

Unlocking New Frontiers in Energy: The Amended Power Law Lights the Way for Innovative Electricity Ventures

On November 30, the National Assembly passed the amended Power Law with an overwhelming majority of 439 out of 463 delegates voting in favor, accounting for 91.65%. This pivotal piece of legislation carries significant weight, impacting the economy and ensuring the nation’s growth, development, and energy security.