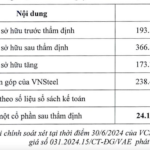

State shareholder VNSteel’s announcement of its plan to divest from RedstarCera (TRT) sent the company’s share price soaring by nearly 74% in four consecutive ceiling-hitting sessions, surging from VND 15,700 to VND 27,300 per share.

Specifically, on December 2nd, TRT shares closed at the ceiling price of VND 27,300 per share, marking the fourth consecutive session of upward momentum. With UPCoM’s trading margin of 15%, TRT witnessed a remarkable surge of almost 74% from November 26th to December 2nd.

This upward trend for TRT followed the announcement by Vietnam Steel Corporation (VNSteel, UPCoM: TVN), a major shareholder in RedstarCera, regarding their intention to offload their entire stake of 2.2 million shares, representing 20.05% of the charter capital.

VNSteel assessed the value of these shares as of June 30, 2024, at over VND 126.5 billion, corresponding to a post-appraisal value of VND 57,358 per share. This appraised value is more than triple the market price of TRT shares at the time of the divestment announcement.

Figure 1: TRT Trading Chart

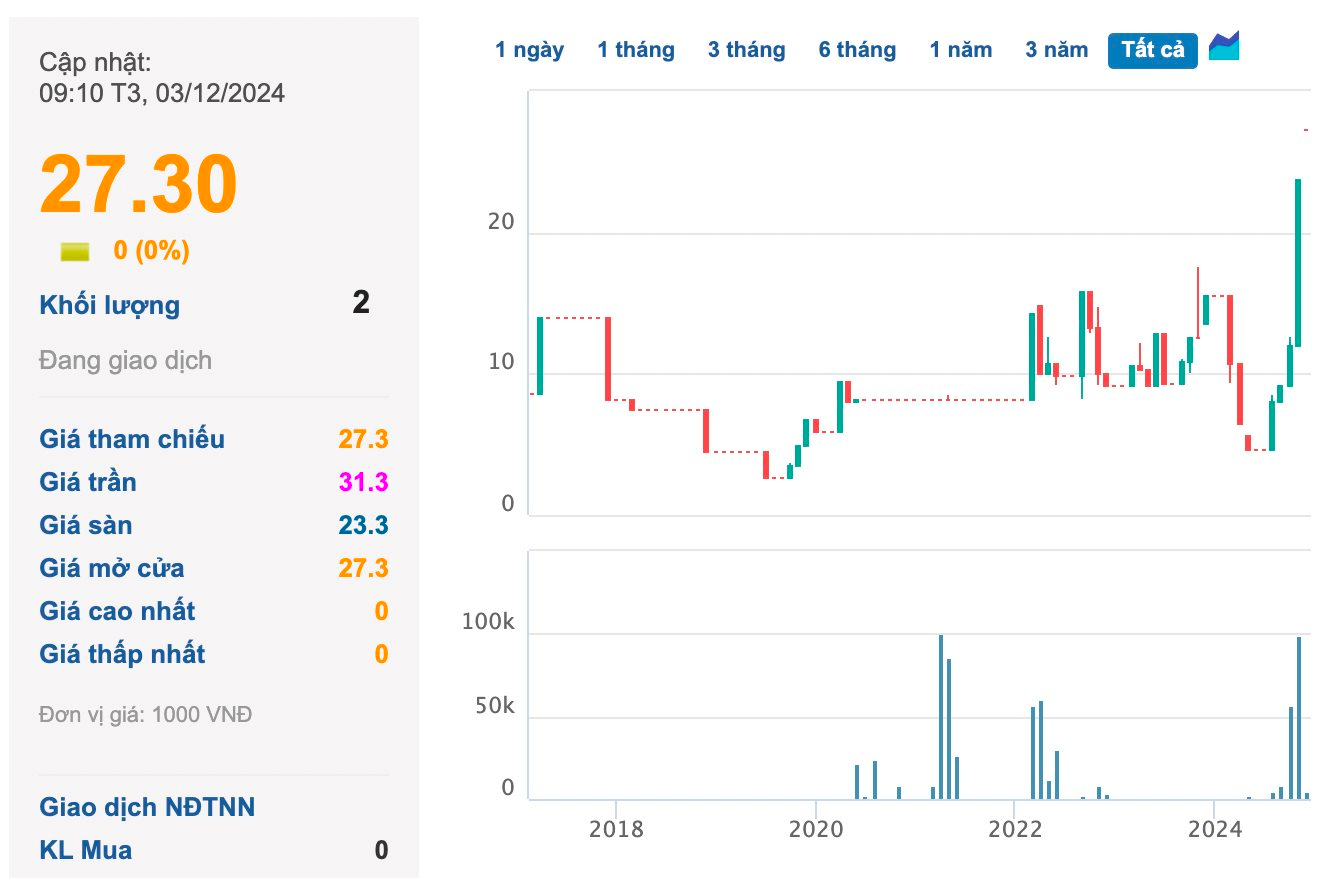

VNSteel also disclosed plans to divest from another company, VICASA Joint Stock Company – VNSTEEL (stock code VCA). Similarly, VCA witnessed a sharp upward trend following the divestment announcement, soaring to the ceiling price of VND 10,400 per share on December 2nd, marking a 22% increase in just three sessions.

Currently, VNSteel holds over 9.8 million shares in Thép VICASA, equivalent to 65% of its charter capital. As per the valuation on June 30, 2024, VNSteel’s contribution to VICASA is valued at VND 238.5 billion, translating to VND 24,158 per share, which is 2.7 times higher than the market price at the time of the divestment announcement.

The news of VNSteel’s divestment plans has significantly boosted the appeal of TRT and VCA shares. Should the divestment plans be realized, VNSteel is expected to retrieve a total of VND 365 billion.

Figure 2: VCA Trading Chart

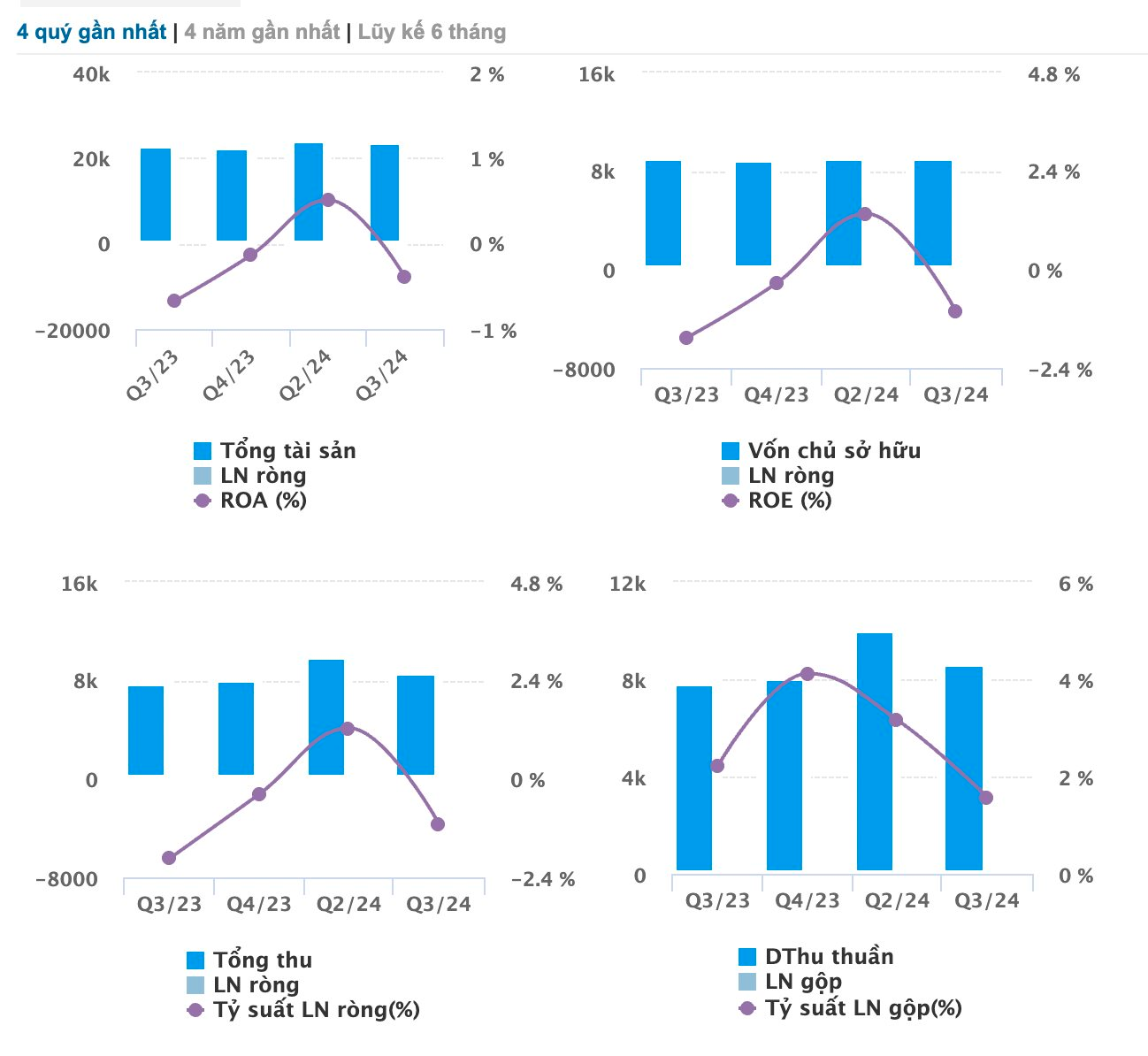

Turning to VNSteel’s financial performance, the company has consistently incurred losses since late 2021. In 2022 and 2023, VNSteel posted losses of VND 760 billion and VND 288 billion, respectively. However, the first half of 2024 witnessed a turnaround, with the company recording a profit of nearly VND 239 billion. Unfortunately, VNSteel slipped back into the red in Q3 2024, mainly due to elevated operating expenses, resulting in a loss of VND 123 billion.

Figure 3: VNSteel’s Financial Performance

“Steel Giant Offloads VICASA Shares at Premium: Starting Bid over 2.5 Times Market Price, Stock Soars”

The share price of VICASA Steel Joint Stock Company – VNSTEEL (HOSE: VCA) surged to the ceiling after the news of the capital sale was announced. Shares of Vietnam Steel Corporation (UPCoM: TVN) also gained 2.8% on a stagnant market day.

The Power of Collaboration: SHB and Vietnam Steel Corporation Join Forces

“The partnership between SHB and VNSTEEL marks a significant step forward in their bilateral relationship. Together, they are committed to mutual growth and dedicated to contributing to the development of the Vietnamese economy.”