The VN-Index shifted to a trading range around the 1,240 threshold in the December 4 session and closed at 1,240.41, a loss of more than nine points from the previous session. While liquidity improved, it remained low with trading value on HOSE reaching nearly VND14 trillion.

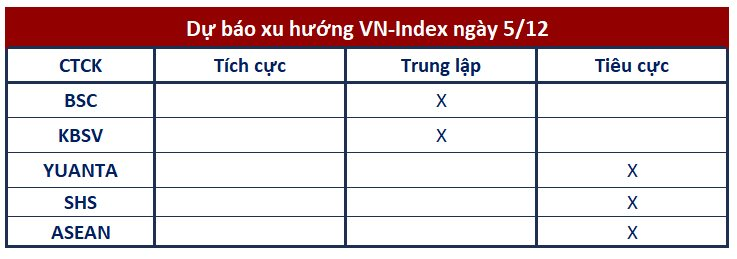

Looking ahead to the next trading session, most securities companies forecast continued volatility and advised investors to trade with caution.

Waiting for Bottom-fishing Cash Flow

BSC Securities

The recovery momentum of the VN-Index has stalled at the resistance threshold of 1,260. The index’s future movement depends on bottom-fishing cash flow at 1,240.

KBSV Securities

Despite recovery efforts in the session, the increasing signal of selling pressure at low prices, which caused the VN-Index to close at the lowest level at the end of the session, somewhat showed the impatience of stock holders. The formation of a long red candlestick also leaves open the possibility of further correction. However, when the index fell deeply into the nearby support area, low-price demand is expected to increase and bring recovery opportunities in the coming sessions.

VN-Index continues to fluctuate

Yuanta Securities

The market is likely to continue adjusting in the next session and the VN-Index is expected to fluctuate around the 20-session average (i.e. 1,238 points). At the same time, the market returned to an accumulation status, indicating that the price chart could fluctuate narrowly with low liquidity and cash flow differentiation among stock groups in the coming sessions.

SHS Securities

The short-term trend of VN30 is under pressure to retest the area around 1,295 points, corresponding to the 20-session average as well as the 200-session average. To improve the market trend, VN30 needs to recover well in this support area in the next few sessions. The VN-Index trend can only be positive and grow again when it surpasses this price area with improved liquidity after trading below the 200-session average since January 2024.

Asean Securities

The weak trend creates price expansion and needs to accumulate demand to maintain the range of 1,240-1,243 points. Thus, the market is under selling pressure in the short term and needs a longer accumulation process. Accordingly, the market tends to fluctuate around the range of 1,238-1,240 points.

Stock Market Pre-Trading Session on November 5th: PXM Hit With a Hefty Fine

PXM is currently trading on the UpCOM exchange at just VND 500 per share, but there has been little to no trading activity for months.

A Slumping Steel Stock Surges, With Share Prices Soaring to 15-Month Highs: What’s Behind the Revival?

However, the business landscape remained bleak as this enterprise reported losses in the third quarter of 2024.