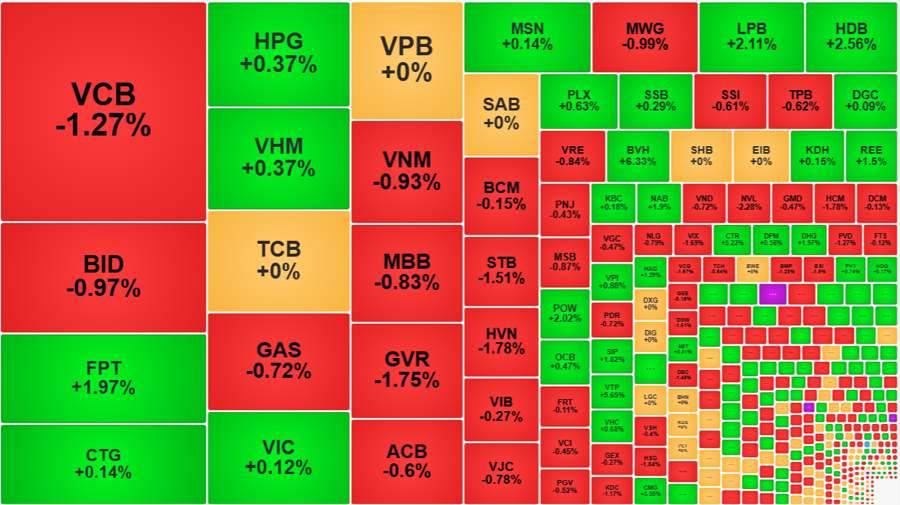

Recovery efforts this afternoon were unsuccessful, as the pressure from the “super pillar” VCB was too strong, while other blue-chips struggled to keep up. The VN-Index ended the session 1.38 points lower, with VCB down 1.27%, costing the index more than 1.6 points. However, bottom-fishing activities were robust, pushing many stocks higher, especially in the insurance sector.

In the first 30 minutes of the afternoon session, the VN-Index rebounded above the reference level, reaching its intraday high of 1253.83. VCB also pared some losses, falling by only 1.17%. FPT, the strongest pillar on the upside, returned to near its morning high, gaining 2.25%. Subsequently, the pillars weakened, and the breadth of the market narrowed. The VN-Index closed at 1249.83, a modest decline, but the index fell below the psychological threshold.

Afternoon trading volume increased by 16.7% on the two exchanges, reaching 6,599 billion VND. HoSE rose by approximately 14.7% to 6,127 billion VND. Buying and selling were significantly more open than on Monday, partly due to the widespread red across the market.

The VN-Index closed with 153 gainers and 222 losers, a weaker ratio than in the morning session, while the price level also showed signs of weakness. Specifically, out of the 222 red codes, 76 fell by more than 1%, compared to 36 at the morning close. There were more stocks that were aggressively sold off, driving up liquidity and deepening the price decline, such as STB, down 1.51%, with a turnover of 285.4 billion; HCM, down 1.78% with 243.6 billion; VIX, down 1.69% with 205.2 billion; HSG, down 1.84% with 95.7 billion; and DGW, down 1.51% with 93.9 billion. Together, this group of deep decliners accounted for 18% of the total matched value on the HoSE floor, a more significant proportion than in the morning session.

Nonetheless, there was still some differentiation within stock groups. For instance, while some small-cap securities firms rose robustly, such as BMS, APS, HAC, VFS, and VIG, larger caps like SSI, VND, HCM, VCI, VIX, and BVS remained in the red. In the real estate sector, NVL, VCG, KHG, and HQC declined, but DXS, SJS, NBB, and IDJ posted gains. Banks also saw mixed performance, with smaller caps leading the upside while VCB and BID, the two largest pillars in the VN-Index, fell.

The insurance sector surprised with several standout performers. BVH, which had risen a modest 0.05% by the morning session close, suddenly surged at the start of the afternoon session. Within the first 30 minutes, it hit its daily limit. Although the price retreated slightly afterward, it still ended the day 6.33% higher than the reference price. Two sessions ago, BVH also posted a daily limit gain. This performance made BVH the strongest gainer in the current recovery phase, with a gain of about 21.7% in just 12 sessions. In the last three sessions, BVH’s liquidity has also been three times higher than its 20-session average. In addition to BVH, the insurance sector saw gains in PRE (up 5.06%), MIG (up 3.76%), BMI (up 3.12%), PTI (up 1.6%), and VNR (up 0.85%)…

While the group of stocks that declined by more than 1% expanded in the afternoon session compared to the morning, the group of gainers also strengthened. Specifically, out of the 153 gainers, 66 rose by more than 1% (compared to 56 in the morning). This group accounted for 25.6% of the total matched value on the HoSE floor, significantly outperforming the decliners (18%). In addition to insurance, real estate, and securities stocks, there were also strong performers like FPT, CMG, POW, VTP, SIP, YEG, REE, VOS, and IMP. This development aligns with the market’s differentiation and lack of clear sector themes.

Foreign investors also reversed course in the afternoon session, net buying approximately 115.2 billion VND compared to net selling 341.2 billion VND in the morning. The selling volume remained similar to the morning session, but new buying surged 2.2 times to 959.9 billion VND. Stocks that saw strong net buying included MSN (+80.3 billion VND), TCB (+28.4 billion VND), CTR (+31.3 billion VND), and DXG (+20.4 billion VND). On the selling side, VCB (-121 billion VND), MWG (-58.4 billion VND), FPT (+55.8 billion VND), HDB (-44.5 billion VND), VRE (-39.4 billion VND), HCM (-27.1 billion VND), and VIC (-21.5 billion VND) saw net outflows.

A Pause in the Uptrend

The VN-Index’s upward momentum stalled with a slight dip in the latest trading session as volume remained below the 20-day average. This indicates a continued cautious approach from investors. However, the MACD indicator still holds a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would provide a more optimistic outlook for the market, suggesting that the dip may be short-lived.

The Technical Analysis of the Afternoon Session: Investors Remain Hesitant

The VN-Index and HNX-Index rose in tandem, but with no significant improvement in liquidity, indicating investors’ cautious sentiment.

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.