This assessment is outlined in the latest report on Vietnam’s economic forecast for Q4 2024, recently published by UOB.

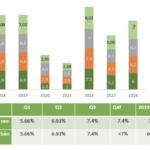

According to the report, Vietnam’s actual GDP growth outperformed expectations in Q3 2024, surging to 7.4% year-on-year, surpassing the market average forecast of 6.1% and our projection of 5.7%. This growth rate is the highest since Q3 2022, when economic activities robustly recovered from the pandemic trough.

“This latest outcome has contributed to widening the previously adjusted 7.09% growth in Q2 2024, resulting in a cumulative increase of 6.82% year-on-year for the first nine months of 2024,” the report said. “The surprising Q3 2024 results reflect the economy’s resilience despite the devastation caused by Storm Yagi (Storm No. 3).”

UOB also noted that while key sectors were impacted by the storm, the agricultural, forestry, and fisheries production in Q3 2024 still managed to increase by 2.6% year-on-year (slower than the 3.6% in Q2 2024). Manufacturing output continued to accelerate, reaching 11.4% year-on-year, up from 10.4% in Q2 2024. The services sector grew by 7.5% year-on-year, a slight improvement from the 7.1% growth recorded in Q2 2024.

In Q3 2024, the services sector was the primary driver of GDP growth, contributing 3.24 percentage points, followed by industry and construction with 3.37 percentage points. Together, these two sectors accounted for 89% of the overall 7.4% increase.

Based on the latest published data, UOB maintains that “Vietnam’s growth trajectory remains on track.”

Specifically, as of October 2024, Vietnam’s exports grew by 14.9% year-on-year, sustaining double-digit growth so far. For the full year of 2024, UOB forecasts Vietnam’s exports to increase by 18%, making it the strongest year since 2021. Imports rose by 16.8% year-on-year during the January-October period, resulting in a trade surplus of $22.3 billion in the first ten months of 2024, the second-highest surplus recorded after $28 billion in 2023. In relation to this, FDI inflows continued to expand, with registered FDI capital reaching $27.3 billion in the first ten months of 2024, up 2% compared to the same period in 2023. Actual FDI inflows as of October 2024 stood at $19.6 billion and are on track to make 2024 the third consecutive record year for FDI inflows.

Domestically, the growth trajectory of retail sales in 2024 has largely remained stable so far, with a 7.1% increase in October 2024 and an average growth of 8.5% year-on-year from the beginning of the year. This is partly supported by a 41% increase in tourist arrivals, totaling 14.1 million visitors from the start of the year to October 2024.

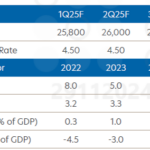

“Considering these factors, we maintain our forecast for Vietnam’s full-year growth at 6.4%, with a projected Q4 2024 growth outcome of 5.2% year-on-year,” UOB stated. “For 2025, we predict a growth rate of 6.6%.”

Explaining this forecast, the UOB report mentioned that the National Assembly has set a GDP growth target of 6.5-7.0% for 2024 and 6.5-7.0% for 2025, while “endeavoring” to achieve 7.0-7.5%. However, with the US entering the second term of President Donald Trump (Trump 2.0), there is a possibility of heightened global trade tensions and risks emerging.

In this context, UOB noted that a significant risk to consider is the potential trade restrictions on Vietnam, as the US trade deficit with Vietnam has more than doubled from $39.5 billion in 2018 to nearly $105 billion in 2023. Overall, the US trade deficit with ASEAN has nearly doubled from below $100 billion in 2018 to $200 billion in 2023.

“With the economy remaining robust in 2024 and extending into 2025, the State Bank of Vietnam (SBV) is not under significant pressure to hastily loosen its policies,” UOB experts predicted. “Inflation has remained below the 4.5% target since June 2023, thus alleviating much of the pressure on the SBV.”

However, with the anticipated increase in global trade tensions under Trump 2.0 and the growing concern about the strength of the US dollar, the SBV is expected to pay attention to the depreciation pressure on the VND. Therefore, UOB anticipates that the refinancing rate will be maintained at its current level of 4.50%.

In this context, UOB experts forecast that despite its solid fundamentals, the VND will remain constrained by external factors, such as a recovering US dollar as the market prices in a scenario of fewer Federal Reserve rate cuts during the Trump 2.0 term.

The Vietnamese Dong’s Devaluation: A Tricky Tightrope for Vietnam’s Central Bank

The HSC predicts a slight increase in the policy rate to 4.75% and 5% by the end of 2025 and 2026, respectively. This forecast is based on a thorough analysis of economic indicators and market trends. With inflationary pressures mounting and a need to curb rising prices, a gradual increase in interest rates is expected to stabilize the economy and encourage sustainable growth.

The Great Chinese Demand: Vietnam’s Surplus to the Rescue as Purchase Increases by 621%

China must ramp up imports from countries such as Vietnam and Indonesia to make up for the shortfall.

Why You Shouldn’t Buy Gold Right Now

This morning (October 25th), gold ring prices remain at a staggering high of 89 million VND per tael, on par with the SJC gold bullion price. Several experts advise against investing in gold at this time due to the high price point and the volatile nature of the market, which could see prices fluctuate dramatically.