Vinhomes (ticker: VHM) has announced changes to its business registration certificate, including an adjustment to its chartered capital. The company has reduced its capital from VND 43,544 billion to VND 41,074 billion due to a share buyback program. These changes will officially take effect on December 3, 2024.

Prior to this announcement, between October 23 and November 21, Vinhomes repurchased nearly 247 million of its own shares at an average price of VND 42,444.36 per share, amounting to a transaction value of up to VND 10,500 billion, the largest in the history of Vietnam’s stock market. This share buyback program helps reduce the number of circulating shares, protecting the interests of the company and its shareholders.

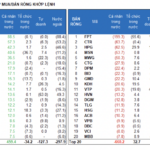

On the stock exchange, VHM shares are currently trading at VND 40,100 per share, a 17% decrease from its one-year high but still 16% higher than its all-time low in early August when the share buyback plan was first hinted at. With a market capitalization of approximately VND 165,000 billion (USD 6.6 billion), Vinhomes ranks 7th among the most valuable listed companies in Vietnam and maintains its top position in the real estate industry.

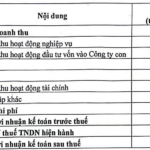

As of Q3 2024, Vinhomes reported total assets and equity of VND 524,684 billion and VND 215,966 billion, respectively, an increase of 18% and 18.3% compared to the end of 2023. Among their assets, cash, cash equivalents, and bank deposits amounted to VND 22,055 billion (~USD 1 billion). This cash balance is expected to fluctuate significantly following the recent historic transaction.

In terms of financial performance for Q3 2024, Vinhomes recorded a slight increase of nearly 2% in revenue, amounting to VND 33,323 billion compared to the same period last year. After expenses, their after-tax profit exceeded VND 8,980 billion. For the first nine months of the year, Vinhomes achieved consolidated revenue of VND 69,910 billion and after-tax profit of VND 20,600 billion.

Market Beat: VN-Index Surges Past Challenges, Up Over 6 Points

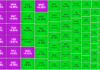

The VN-Index faced significant pressure in the first half of the morning session, even briefly dipping below the 1,240-point mark. However, a swift turnaround saw the index overcome these challenges and close 6.41 points higher at 1,246.82.

The Unbelievable “Shock”: MBS Offers a Whopping 100% Margin Interest Gift to Traders in December

Belief in Vietnam’s ability to achieve or surpass its 7% growth target by the end of 2024 is fueling a stock market surge. In this context, MBS is rolling out its “Margin Shock” program for the first time, offering a market-leading 100% interest repayment to empower investors and boost the overall market.