At the Extraordinary General Meeting of Shareholders of Vietnam Maritime Transport Joint Stock Company – Vosco (code: VOS) in 2024, shareholders approved adjustments and supplements to the 2024 ship investment plan, including 10 vessels.

Specifically, Vosco plans to purchase two second-hand Supramax bulk carriers with a deadweight tonnage (dwt) of 56,000-58,000, built in Japan/South Korea/China/Vietnam/Philippines, for a maximum price of $23 million per ship. The company will also invest in building four new Ultramax vessels with a dwt of 62,000-66,000, constructed in the aforementioned countries, for a maximum price of $40 million each.

Additionally, they will invest in building four new MR product tankers with an approximate dwt of 50,000, at a maximum cost of $52 million per vessel. The investment capital for these endeavors will come from a combination of loans and the company’s own capital, with the ratio depending on the specific project.

The company’s management shared that they have successfully arranged counter-capital and have been in talks with various financial institutions, both domestic and foreign, to secure suitable loans. They have also received commitments for financial support from several local banks.

Addressing shareholder concerns, the management assured that the decision to invest in second-hand bulk carriers is based on the current reasonable market prices and the relatively stable long-term market outlook. As for the product tankers, the company intends to invest in newly built resale ships with early delivery dates to take advantage of the favorable market conditions.

Vosco remains committed to maintaining and stably operating its container ship fleet, mainly deployed on domestic routes. Given the high prices of container ships, the company has no immediate plans to purchase new ones but is instead negotiating to lease additional container ships from partners to expand their operational capacity while ensuring profitability.

Currently, Vosco’s managed and operated fleet comprises 13 vessels with a total dwt of approximately 420,000, including nine owned ships (seven dry bulk/bulk carriers and two container ships) and four chartered vessels (two product tankers and two chemical tankers). The most recent addition to their fleet, Vosco Sunrise, was acquired on May 15, 2013.

Since then, the company has only disposed of older vessels without investing in new ones due to financial constraints before the COVID-19 pandemic and persistently high ship prices. Additionally, Vosco faced challenges due to mechanisms for purchasing/building new ships.

When compared to 2013, Vosco’s current fleet has significantly decreased in both size and carrying capacity. In terms of scale, Vosco’s fleet is comparable to that of a small regional shipping company. Moreover, the advanced age of their vessels poses a challenge in maintaining competitiveness.

Therefore, investing in new ships is essential to enhance the company’s transport capacity and competitiveness. It will also provide Vosco with the means to implement flexible and efficient operational strategies, enabling them to venture into more profitable routes that demand higher technical standards and vessel quality.

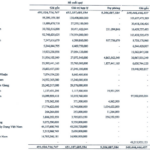

Regarding financial performance, Vosco recorded consolidated net revenue of VND 4,239 billion in the first nine months of 2024, an 86% increase year-on-year, along with a net profit after tax of VND 344 billion, a remarkable 6.8-fold growth compared to the same period last year.

The Golden Exodus: A Mining Company’s Leadership Transition

Despite a challenging economic landscape, Vàng Lào Cai has persevered through difficult times. From 2020 onwards, the company experienced a hiatus in sales and service revenue, culminating in a challenging year in 2023, with a loss of nearly 14 billion VND. As of the end of 2023, the cumulative loss exceeded 113 billion VND.

The Thuduc House CEO Steps Down

Mr. Nguyen Hai Long was appointed as the new CEO of Thuduc House JSC in mid-April 2024, succeeding Mr. Dam Manh Cuong.